News Blast Hub

Stay updated with the latest news and insights.

Gold Fever: Why Everyone is Chasing the Glitter

Uncover the allure of gold! Dive into the frenzy behind gold fever and discover why everyone is chasing the glitter. Join the hunt now!

The Allure of Gold: Understanding the Historical Obsession

Gold has captivated human interest for centuries, transcending geographical boundaries and cultural differences. Its allure stems from its rarity, beauty, and durability, making it a symbol of wealth and power. Historically, various civilizations, including the Egyptians, Greeks, and Romans, revered gold not only as a medium of exchange but also as a representation of divine favor and immortality. The famous golden treasures discovered in tombs across Egypt and the intricate gold artifacts from the ancient Americas testify to humanity's enduring obsession with this precious metal.

Beyond material wealth, gold has played a crucial role in global economies and trade dynamics. For instance, the Gold Standard fundamentally changed how economies operated by tying currency value directly to gold reserves. This system fostered trust in monetary transactions but also led to speculation and political conflicts, highlighting the complex relationship between gold and societal stability. As we explore the depths of this historical obsession, it becomes clear that gold signifies far more than mere luxury; it encapsulates human aspiration, survival, and the quest for permanence in a transient world.

Is Gold Still a Safe Haven Investment in Today's Economy?

In today's volatile economy, many investors are questioning whether gold still serves as a reliable safe haven investment. Historically, gold has been sought after during times of economic uncertainty, inflation, and geopolitical tensions. As currencies fluctuate and market conditions become unpredictable, gold often maintains its value, making it an attractive option for those looking to preserve wealth. Recent trends suggest that while the dynamics of investing may evolve, the allure of gold remains strong, particularly as central banks around the world increase their gold reserves.

However, potential investors should consider the current financial landscape when evaluating gold as a safe haven. Factors such as rising interest rates, shifts in monetary policy, and changes in supply and demand dynamics may impact gold's performance. Additionally, the rise of alternative investments like cryptocurrencies has introduced new considerations for those seeking stability. In this context, it is essential to weigh both the historical significance and the modern implications of investing in gold before making a decision.

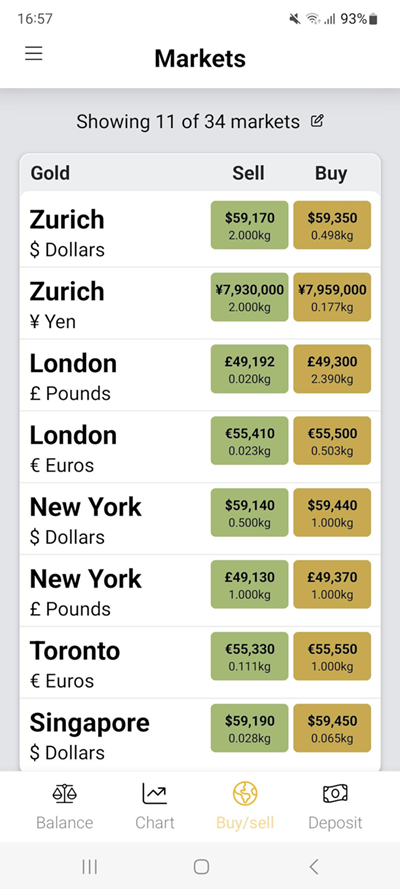

How Gold Impacts Global Economies: A Deep Dive into Market Trends

Gold has always held a prominent position in the global economy due to its intrinsic value and status as a safe-haven asset. When geopolitical tensions rise or market volatility increases, investors often flock to gold as a method of protecting their wealth. This behavior influences not only gold prices but also has a ripple effect on stock markets and currencies worldwide. For instance, during economic downturns, you might observe a sharp increase in gold demand, leading to price surges which in turn impact inflation rates and the purchasing power of various currencies.

Additionally, the impact of gold on global economies can be observed through central bank policies. Many central banks hold significant reserves of gold as part of their monetary policy strategies to stabilize their economies. The dynamics of gold trading also reflect broader market trends. For example, when gold prices reach new highs, it can signal inflationary pressures, while declining prices might indicate a recovering economy. Understanding these market trends is crucial for investors and policymakers alike as they navigate the complex financial landscape shaped by the fluctuating value of gold.