News Blast: Your Daily Update

Stay informed with the latest news and trends.

Blockchain: The Digital Gold Rush You Didn't Know About

Uncover the hidden treasure of blockchain technology! Dive into the digital gold rush and discover wealth opportunities awaiting you.

Understanding Blockchain: How It Transforms Our Economy

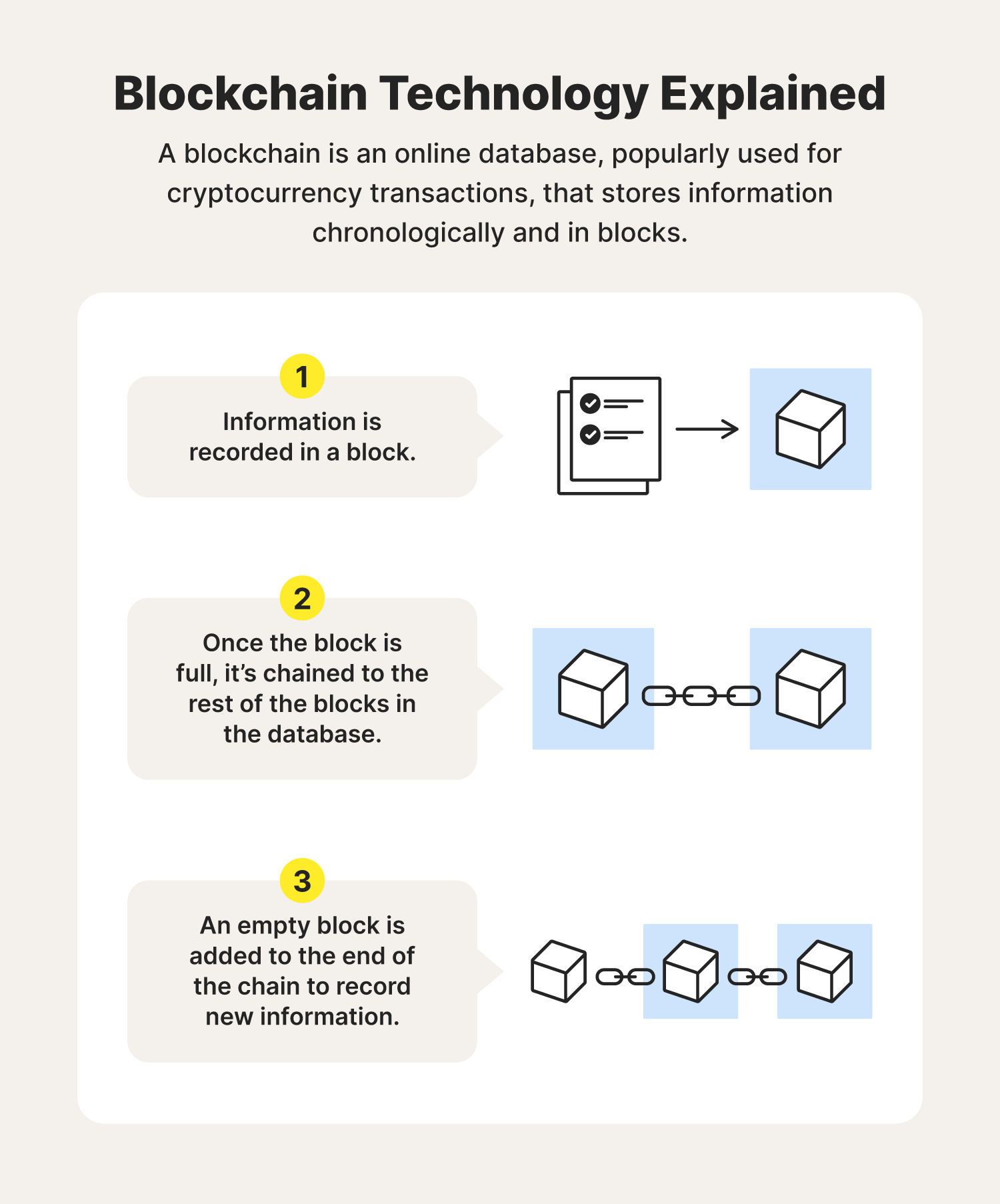

Understanding blockchain is essential for grasping its profound impact on our modern economy. At its core, blockchain is a decentralized ledger technology that facilitates transparent and secure transactions without the need for intermediaries. This innovative approach not only enhances trust among participants but also streamlines traditional processes, leading to increased efficiency. As businesses increasingly adopt blockchain, we are witnessing a shift towards greater autonomy in financial transactions, where users can engage directly, thereby reducing costs associated with traditional banking systems.

The transformational potential of blockchain extends beyond mere transactions. By enabling smart contracts, self-executing agreements without human intervention, this technology can revolutionize industries such as real estate, supply chain management, and even healthcare. For example, in the supply chain, blockchain enhances traceability, allowing consumers to verify the authenticity of products. Moreover, sectors like finance are exploring decentralized finance (DeFi) platforms, which offer traditional financial services in a more accessible and efficient manner, ultimately contributing to a more resilient economy.

Is Blockchain the Future of Finance? Exploring Its Potential

The question of whether Blockchain is the future of finance is gaining momentum as the financial sector undergoes significant transformations. With its decentralized nature, blockchain technology offers enhanced security, transparency, and efficiency compared to traditional financial systems. By eliminating the need for intermediaries, it has the potential to drastically reduce transaction costs and processing times. As more financial institutions and startups experiment with blockchain applications such as smart contracts, cryptocurrencies, and decentralized finance (DeFi), the landscape of finance is poised for a revolution.

However, the adoption of blockchain in finance is not without challenges. Regulatory hurdles, technological scalability, and interoperability among different blockchain networks remain significant obstacles. Furthermore, the volatility of cryptocurrencies has raised concerns among institutions hesitant to fully embrace this technology. Despite these challenges, the potential benefits of blockchain cannot be ignored. As the industry evolves and solutions to these issues are developed, it is quite possible that blockchain will play a pivotal role in shaping the future of finance in ways we are only beginning to understand.

What You Need to Know Before Investing in Blockchain Technology

Investing in blockchain technology can be an exciting opportunity, but it requires a solid understanding of what it entails. Before diving in, it's essential to grasp the fundamental aspects of blockchain, including its decentralized nature and the role of smart contracts. These components not only enhance security but also enable transparency in transactions. Additionally, consider the current market trends and the specific use cases of blockchain across various industries, from finance to supply chain management. Researching these areas will provide insight into the potential benefits and risks associated with your investment.

Moreover, due diligence is crucial when investing in blockchain technology. It's advisable to evaluate the projects you are interested in by looking at the development team, their track record, and the technology's scalability. Avoid projects with vague whitepapers or those lacking a clear business model. Consider the community support surrounding the project, as a vibrant community often indicates viability. Lastly, remember that while blockchain holds great potential, it is also a volatile investment. Prepare yourself for fluctuations in value, and never invest more than you can afford to lose.