News Blast: Your Daily Dose of Insight

Stay updated with the latest news and insightful articles.

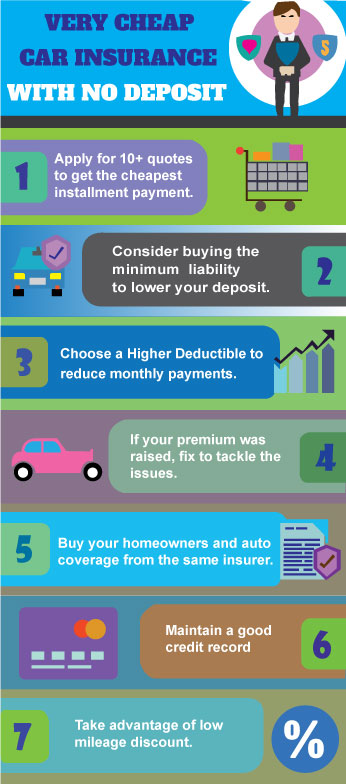

Cheap Insurance That Won't Break the Bank

Discover affordable insurance options that protect your wallet and peace of mind. Get the coverage you need without overspending!

Top 5 Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance without sacrificing coverage can be a daunting task, but it is entirely possible with the right approach. Here are top 5 tips to help you navigate this process:

- Shop Around: Don't settle for the first quote you receive. Take the time to compare policies from multiple providers to ensure you're getting the best price for the coverage you need.

- Understand Your Needs: Before seeking a policy, take stock of your personal needs. Consider what coverage is essential and what you can do without, as this will guide you in choosing a plan that fits your budget.

Continuing with our top 5 tips,:

- Leverage Discounts: Many insurance companies offer a variety of discounts based on factors like bundling policies, maintaining a good driving record, or having a good credit score. Be sure to inquire about these opportunities, as they can significantly lower your premiums.

- Review Your Coverage Regularly: Regularly assess your insurance coverage. As your life changes—such as moving, getting married, or purchasing new assets—you may find that you can adjust your coverage for better rates without compromising your protection.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premiums. Just make sure you have enough savings to cover the deductible in case of an emergency.

Understanding the True Cost of Cheap Insurance: What You Need to Know

When it comes to purchasing insurance, the allure of cheap insurance can be compelling. However, it's essential to understand that the lowest price often comes with significant trade-offs. Many individuals find themselves drawn to policies that promise low premiums but fail to provide adequate coverage or have high deductibles. This can lead to devastating financial consequences when claims are denied or not fully covered. Therefore, understanding the true cost of cheap insurance is crucial for making informed decisions that will protect you and your assets.

One of the biggest risks associated with cheap insurance is the potential for hidden costs and exclusions. Often, policies that seem affordable at first glance may include limitations that can leave you vulnerable in times of need. For instance, you might discover that certain types of damage are not covered or that the coverage limits are insufficient to protect you fully. Therefore, it's vital to read the fine print and ensure you know precisely what you’re paying for before signing any insurance agreement. Understanding these nuances can save you from unexpected out-of-pocket expenses down the line.

Is Cheap Insurance Worth It? Key Questions to Ask Before You Buy

When considering cheap insurance, it's essential to evaluate whether the savings are worth the potential compromises in coverage. One of the first questions to ask is, What does the policy cover? While lower premiums can be attractive, they may come with limited coverage or higher deductibles. Reviewing the policy details thoroughly can help identify any exclusions or limitations that could leave you vulnerable in the event of a claim.

Another critical aspect to consider is the insurance provider's reputation. Questions such as How does the company handle claims? and What are customer reviews like? should be prioritized in your research. A company offering inexpensive policies may save you money upfront, but if they have a history of poor customer service or slow claims processing, it might lead to higher costs when you need assistance the most.