News Blast

Your daily source for the latest news and insights.

Why Comparing Insurance Is Like Shopping for a New Pair of Shoes

Discover why comparing insurance is just like finding the perfect pair of shoes—style, fit, and value matter! Don't miss out!

The Price of Protection: How Comparing Insurance is Like Finding the Perfect Fit

When it comes to securing your future, understanding insurance options is crucial. Just like finding the perfect fit in clothing, comparing insurance policies requires careful consideration of your unique needs and circumstances. Each type of insurance—be it health, auto, or home—has a variety of providers offering different coverage options, deductibles, and premiums. It’s essential to compare insurance policies side by side, much like trying on various outfits, to find the one that provides the best balance between coverage and affordability.

Imagine you're shopping for a pair of shoes: a good fit is essential for comfort and functionality. Similarly, when comparing insurance policies, you must ask critical questions to ensure you find the right match for your specific situation. Consider factors such as coverage limits, customer service quality, and any additional benefits that may be included. By analyzing and contrasting these components, you can make an informed decision that safeguards your assets and provides peace of mind, ultimately making the price of protection feel like a worthwhile investment.

Step into Savings: Key Factors to Consider When Comparing Insurance Policies

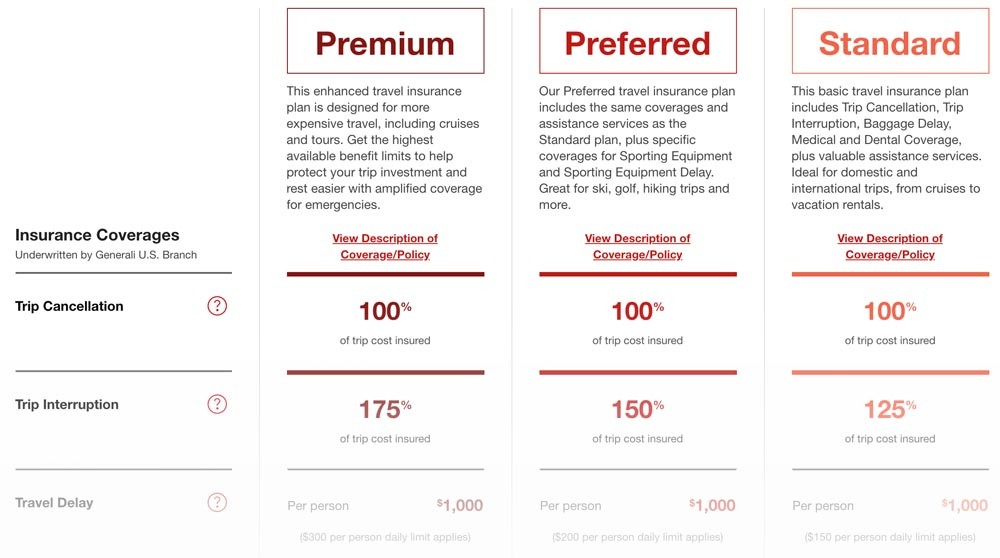

When it comes to comparing insurance policies, there are several key factors to consider that can significantly impact your overall savings. First and foremost, evaluate the coverage options available within each policy. This includes understanding the types of coverage offered, such as liability, collision, and comprehensive, and how they align with your specific needs. Additionally, you should also look into the policy limits and deductibles, as these elements can greatly influence your premium costs and out-of-pocket expenses in the event of a claim.

Another crucial aspect to examine is the premium costs. Be sure to obtain quotes from multiple insurance providers and compare them side by side. While lower premiums may seem appealing, it's vital to assess the overall value of the policy, including customer service ratings and financial stability of the insurer. Don’t hesitate to ask about discounts that may apply to you, such as those for safe driving, bundling policies, or maintaining a good credit score. By carefully considering these factors, you can make informed decisions and ultimately step into savings without compromising on necessary coverage.

Why Choosing Insurance is Like Shoe Shopping: Tips for Finding Your Ideal Coverage

Choosing the right insurance can often feel a lot like shopping for the perfect pair of shoes. Just as you wouldn't settle for a pair that pinches your toes or doesn't fit your lifestyle, the same principles apply when selecting your insurance coverage. Understanding your needs is the first step in this process. Do you need insurance for your home, car, or health? Much like assessing your foot type before shoe shopping, make a list of your requirements and priorities. This will help you narrow down options and focus on policies that truly fit.

Next, consider trying on different options before making your final choice. In shoe shopping, walking around in a few pairs helps you gauge comfort and style. Similarly, you should compare various insurance quotes and coverages. Don't hesitate to ask questions and seek clarity on policy details. Look for hidden fees or exclusions that might not be immediately visible, just as you would check for sizing tags or defects in shoes. By prioritizing these factors, you can find your ideal coverage without compromising on quality or comfort.