News Blast Today

Stay updated with the latest trends and breaking news.

Disability Insurance: The Quiet Protector You Never Knew You Needed

Unlock peace of mind with disability insurance—the essential safeguard you didn’t know you needed. Discover how it protects you today!

What You Need to Know About Disability Insurance: Coverage Explained

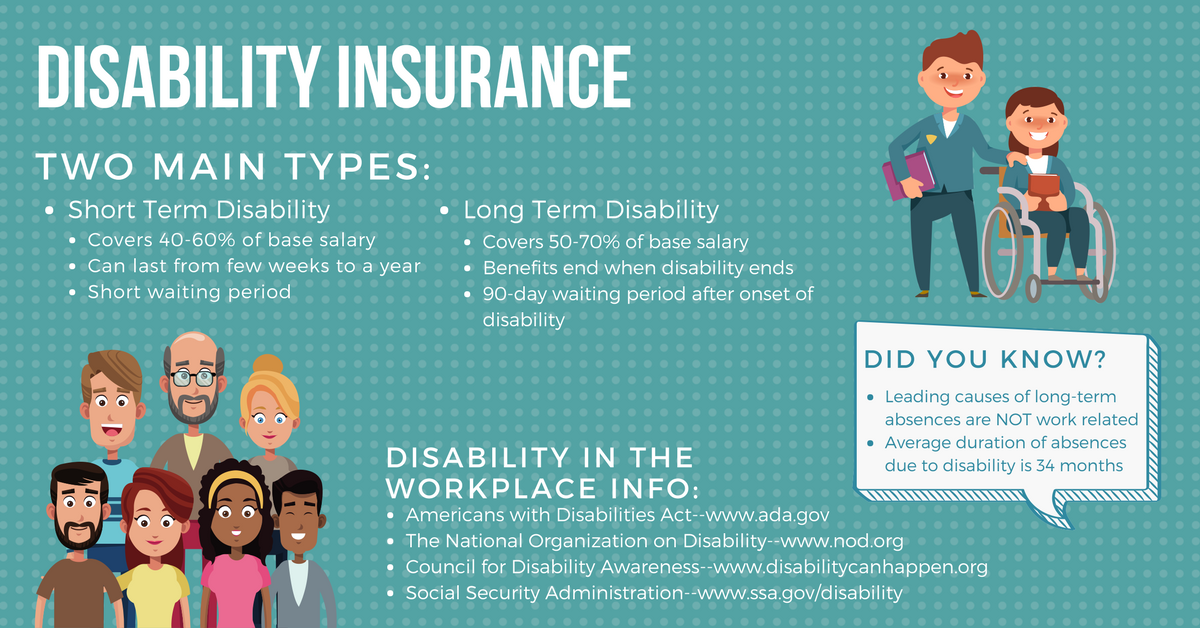

Disability insurance is a vital financial safety net designed to protect your income in the event of a disability that prevents you from working. It typically replaces a portion of your salary, ensuring that you can maintain your standard of living while you recover. There are two primary types of disability insurance: short-term and long-term. Short-term disability insurance usually covers you for a few months after the onset of a disability, while long-term disability insurance can provide coverage for several years or even until retirement age, depending on the policy terms.

When considering disability insurance, it's crucial to understand the key components of coverage. This includes the elimination period, which is the time you must wait after a disability before benefits kick in, and the benefit period, or how long you will receive payments. Additionally, policies may differ in their definitions of disability—some may require you to be unable to work in any occupation, while others only require you to be unable to perform your specific job. Reviewing these details carefully will ensure you select the right coverage that meets your needs.

5 Common Misconceptions About Disability Insurance Debunked

Disability insurance often comes with a plethora of myths that can lead to misunderstanding its true benefits. One common misconception is that disability insurance is only for those in high-risk professions. In reality, anyone can experience a disabling condition, whether due to an accident, illness, or chronic health issue. Statistically, nearly one in four workers will experience a disability at some point in their careers. This underscores the importance of having disability insurance as part of a robust financial safety net.

Another prevalent myth is that disability insurance will cover any and all types of disabilities. However, policies vary significantly, and many only cover total disabilities that prevent you from performing your job. It’s crucial to carefully read the fine print and understand the specifics of your policy, including the definitions of 'disability' and any exclusions that may apply. To avoid **misconceptions**, always consult with a professional to ensure you select a plan that aligns with your unique needs.

How Disability Insurance Can Safeguard Your Financial Future

Disability insurance is a crucial element of financial planning that many people overlook. By providing a safety net in the event of an unexpected illness or injury, disability insurance can replace a portion of your income, ensuring that you can meet your financial obligations. This type of insurance not only covers daily living expenses but can also help protect your savings and investments. Without it, a sudden loss of income could lead to significant financial strain, affecting everything from mortgage payments to retirement savings.

When considering how disability insurance can safeguard your financial future, it's important to recognize the various types of policies available. Long-term disability insurance typically lasts for years or until retirement, while short-term policies may cover only a few months of lost income. Evaluating your individual needs and circumstances can help determine the right coverage. Additionally, many employers offer group policies that can be a great starting point, but it's essential to assess whether this coverage is adequate for your long-term needs.