News Blast

Your daily source for the latest news and insights.

Insurance Showdown: Who's Got Your Back?

Uncover the ultimate insurance showdown! Discover which provider truly has your back in times of need. Don't miss out!

Understanding Coverage Options: What Every Policyholder Should Know

When it comes to choosing the right insurance coverage, policyholders often face a myriad of options that can be overwhelming. Understanding coverage options is crucial for ensuring that you select a policy that meets your specific needs. It typically involves clauses that define what is included or excluded from your coverage, such as liability, property damage, and personal injury. Knowledge of these terms can empower policyholders to make informed decisions while avoiding gaps in their coverage. Here are some key types of coverage you should be familiar with:

- Liability Coverage: Protects against legal claims.

- Collision Coverage: Covers damage to your vehicle in the event of an accident.

- Comprehensive Coverage: Offers protection against non-collision events, like theft or natural disasters.

Another important aspect to consider is the deductible and premium relationship. A lower premium may mean a higher deductible, which is the amount you pay out-of-pocket before your insurance kicks in. As a policyholder, it’s essential to find a balance that fits your budget and risk tolerance. Additionally, regularly reviewing your policy and any optional add-ons can help ensure that you are not underinsured or overpaying for unnecessary coverage. Remember, understanding your coverage options not only enhances your financial security but also contributes to peace of mind in knowing that you are adequately protected.

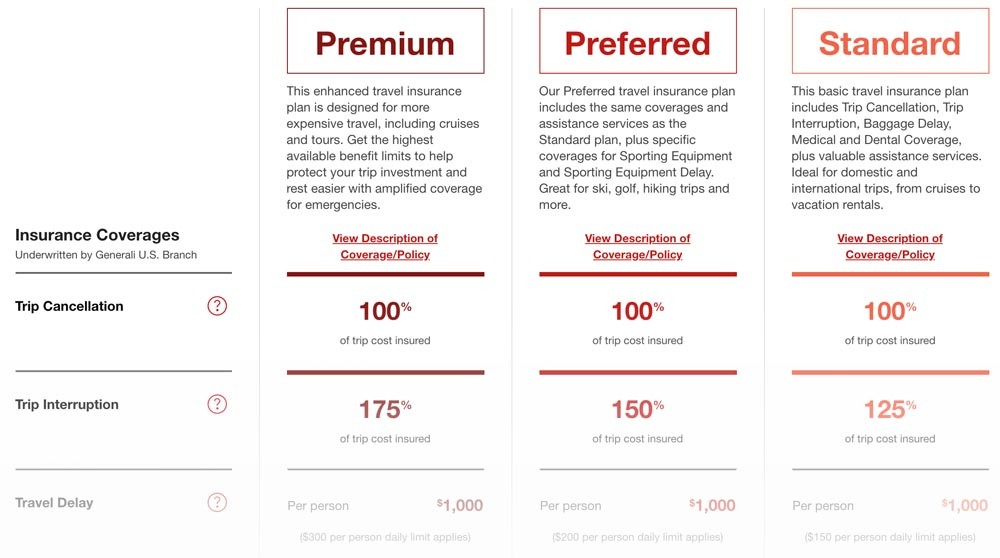

The Great Insurance Debate: Comparing Providers and Their Benefits

The insurance landscape is vast and complex, making it crucial for consumers to engage in the great insurance debate. When comparing providers, one must take into account a multitude of factors that can significantly impact both coverage and cost. For instance, consider the variety of plans available; some providers may offer essential coverage at competitive rates, while others might provide more comprehensive packages that come with increased premiums. It’s not just about the price; it’s about evaluating which benefits matter most to you. Factors such as policy flexibility, customer service quality, and claim processing efficiency can vastly influence your overall satisfaction. Therefore, understanding the benefits offered by different insurance providers is pivotal in making an informed decision.

Another vital aspect of the great insurance debate is the importance of personal needs in the selection process. Each provider tends to excel in different areas, which can be determined by examining customer reviews and feedback. For example, one provider might be lauded for its quick claims turnaround, while another could stand out for its extensive network of healthcare providers. To make the comparison easier, consider creating a simple checklist that includes the following criteria:

- Coverage Options

- Premium Costs

- Deductible Rates

- Customer Service Ratings

- Claims Process Efficiency

Are You Fully Covered? Common Insurance Misconceptions Explained

When it comes to insurance, a multitude of misconceptions can lead to inadequate coverage and unexpected financial consequences. One common belief is that simply having insurance means you are fully protected. However, insurance policies often come with exclusions, limits, and deductibles that can leave you vulnerable. For instance, many people think that their home insurance covers all types of natural disasters; unfortunately, this is not always the case. It is crucial to review your policy in detail and understand any specific conditions or limitations that may apply.

Another prevalent misconception is that insurance agents will always have your best interests in mind. While many agents are trustworthy professionals, not all are obligated to provide impartial advice. Always remember to conduct your own research and ask questions when selecting insurance coverage. Furthermore, the belief that higher premiums guarantee better coverage is misleading; it’s essential to compare different policies and identify what truly meets your needs. Educating yourself about the intricacies of insurance will empower you to make informed decisions about your coverage.