News Blast

Your daily source for the latest news and insights.

Insurance Tango: Dancing Through Risks with Small Business Coverage

Discover how to waltz through risks with savvy small business coverage tips. Join the Insurance Tango for insights that can save your business!

Understanding the Basics of Small Business Insurance: A Step-by-Step Guide

Small business insurance is crucial for any entrepreneur looking to safeguard their investment and ensure long-term success. Understanding the basics of small business insurance begins with recognizing the various types of coverage available. Common types include general liability insurance, which protects against claims of bodily injury or property damage, and property insurance, which covers your business’s physical assets. Additionally, consider specialized policies such as professional liability insurance for service-based businesses and workers' compensation insurance for businesses with employees.

To navigate the complexities of small business insurance, follow this step-by-step guide:

- Assess your risks: Determine the unique challenges your business faces in its specific industry.

- Identify necessary coverage: Based on your risk assessment, decide which types of insurance are essential.

- Shop around: Compare quotes from multiple insurance providers to ensure you're getting the best value.

- Review your policies regularly: As your business grows, so will your insurance needs, so it's essential to reevaluate your coverage periodically.

How to Choose the Right Insurance Coverage for Your Small Business

Choosing the right insurance coverage for your small business is a crucial decision that can safeguard your assets and minimize risks. Start by assessing the specific needs of your business, considering factors such as the industry you operate in, the number of employees, and the types of risks you might face. It can be helpful to create a list of potential risks, including natural disasters, liability issues, and employee-related injuries. Once you have a thorough understanding of your exposure, you can explore various options, such as general liability, property, and workers' compensation insurance.

After identifying the necessary coverage, it's essential to compare different policies and providers. Make sure to read the fine print to understand what is included and excluded in each policy. Consult with an insurance expert who can guide you through the specifics of each coverage option and help you tailor them to your business needs. Consider obtaining multiple quotes to find the best balance between coverage and cost, and don't hesitate to ask questions. Remember, the right insurance coverage not only protects your business but also provides peace of mind for you and your employees.

Common Risks Small Businesses Face and How Insurance Can Protect You

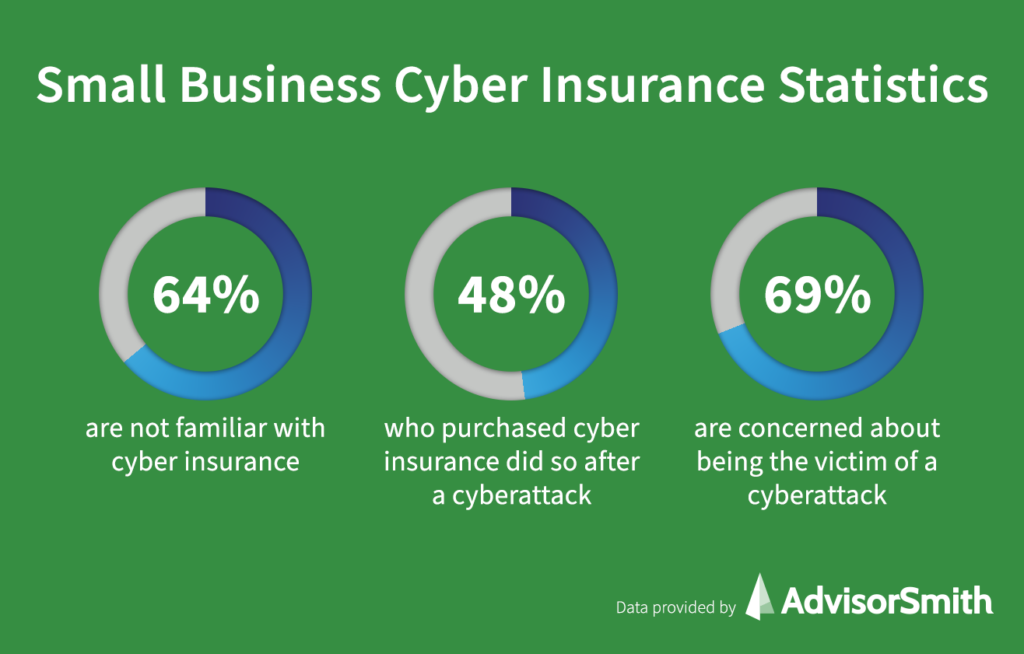

Small businesses encounter a variety of challenges that can pose significant risks to their operations. Common risks small businesses face include property damage, liability claims, and employee injuries. Natural disasters, theft, and cyber attacks can disrupt business operations and result in substantial financial losses. Additionally, the unpredictability of economic downturns can affect revenue streams, making it crucial for small business owners to be proactive in managing these risks.

Insurance plays a vital role in mitigating these risks and providing peace of mind. By investing in comprehensive business insurance policies, small businesses can protect themselves from the financial repercussions of unforeseen events. For instance, general liability insurance can cover legal fees and settlements from lawsuits, while property insurance can safeguard against damages to physical assets. Furthermore, workers' compensation insurance not only protects businesses from employee claims but also promotes a safer workplace. Understanding and utilizing the right insurance options is essential for small businesses to thrive amidst potential challenges.