News Blast

Your daily source for breaking news and insightful articles.

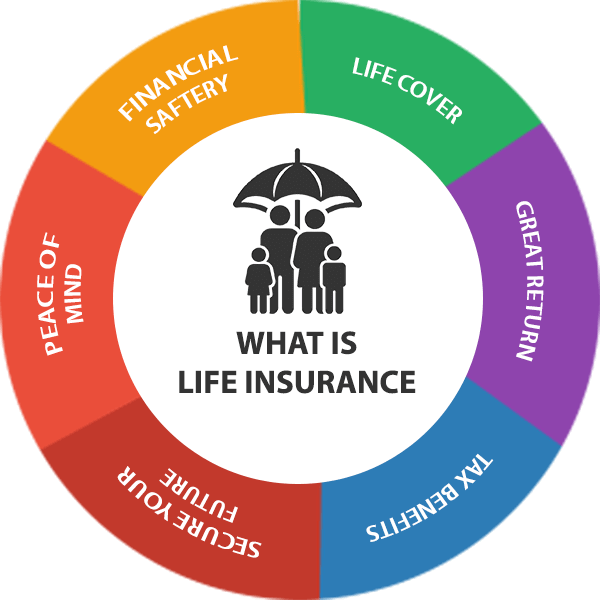

Life Insurance: Because Your Family Deserves a Safety Net

Secure your family’s future with life insurance—because peace of mind is priceless! Discover how to protect what matters most today.

Understanding the Basics of Life Insurance: What You Need to Know

Life insurance is a financial tool that provides protection to your loved ones in the event of your unexpected passing. It ensures that your family can maintain their standard of living and cover essential expenses such as mortgage payments, education costs, and daily living expenses. Understanding the basics of life insurance is crucial for making informed decisions. There are two main types of life insurance: term life insurance, which covers you for a specific period, typically ranging from 10 to 30 years, and whole life insurance, which provides coverage for your entire life and includes a cash value component that can grow over time.

When considering a life insurance policy, it’s essential to evaluate your financial needs and circumstances. Start by calculating the total amount of coverage needed by identifying your liabilities, such as debts, and your dependents' future needs, such as education and living expenses. Additionally, shopping around for the best rates and comparing policies from various insurers can save you money. Remember, purchasing a policy early can lock in lower premiums, as rates typically increase with age and health changes. Understanding the intricacies of life insurance can help secure your family's future and provide peace of mind.

Top 5 Reasons Why Life Insurance is Essential for Your Family's Security

Life insurance is a crucial aspect of financial planning that provides peace of mind for families. It ensures that in the event of an untimely death, loved ones are not left struggling financially. Here are the top 5 reasons why life insurance is essential for your family's security:

- Financial Protection: Life insurance offers a safety net for your family, covering debts, mortgages, and daily living expenses.

- Child's Education: It helps in securing your children's future by ensuring funds are available for their education.

- Peace of Mind: Knowing that your family will be financially secure can alleviate stress and allow you to focus on creating lasting memories.

- Estate Planning: Life insurance can be a valuable tool in estate planning, allowing for a smoother transfer of wealth to your heirs.

- Supplemental Income: Certain policies can provide supplemental income for your family in the long term through cash value accumulation.

How Much Life Insurance Coverage Does Your Family Really Need?

Determining how much life insurance coverage your family really needs is a crucial step in financial planning. Start by evaluating your family's current and future financial obligations. This could include expenses such as your mortgage, children's education, daily living costs, and any outstanding debts. A common guideline is to aim for coverage that is 10 to 15 times your annual income. Additionally, consider any special needs or circumstances, such as caring for elderly parents or a child with a disability, that may increase your required coverage.

Another approach to assess life insurance coverage is the needs analysis method. This involves estimating immediate financial needs, such as funeral expenses and outstanding debts, followed by long-term needs like income replacement and future educational costs. Create a comprehensive list detailing each financial obligation and use this to calculate the total coverage required. Remember that as your family dynamics change—like having a new child or changing jobs—your life insurance needs may also shift, so it's important to regularly reassess your policy.