News Blast

Your daily source for breaking news and insightful articles.

Pet Insurance: A Pawsitive Investment for Your Furry Friend

Discover why pet insurance is the ultimate safeguard for your furry friend—protect their health and your wallet today!

Why Pet Insurance is Essential for Your Furry Friend: A Comprehensive Guide

As a responsible pet owner, ensuring the health and well-being of your furry friend is a top priority. Pet insurance is essential for safeguarding your pet’s health against unforeseen circumstances. Just like humans, animals can face medical emergencies, chronic illnesses, or accidents that can lead to significant veterinary bills. By investing in a comprehensive pet insurance plan, you can relieve the financial burden and make informed decisions about your pet’s healthcare without the added stress of costs in times of crisis.

Furthermore, pet insurance not only helps with immediate health expenses but also encourages routine veterinary visits, which can lead to early detection of health issues. Many plans offer coverage for preventative care, including vaccinations and check-ups. This proactive approach to your pet's health can potentially extend their life and improve their quality of living. In essence, having pet insurance is a critical step in being a responsible pet parent, ensuring your furry companion receives the best possible care when they need it the most.

5 Key Benefits of Having Pet Insurance for Your Beloved Companion

One of the most significant benefits of having pet insurance is the financial protection it provides during unexpected veterinary emergencies. Pets can require extensive medical care due to accidents or illnesses, and the costs can add up quickly. With pet insurance, you can ensure that your furry friend receives the necessary treatment without the burden of exorbitant out-of-pocket expenses. This peace of mind allows you to focus more on your pet's recovery rather than worrying about the financial implications.

Another key advantage is the flexibility pet insurance provides in choosing veterinary care. Many pet insurance plans allow you to visit any licensed veterinarian, so you're not limited to specific clinics or providers. This flexibility means you can receive care from specialists and top-rated facilities, ensuring your pet gets the best medical advice and treatment. Additionally, with insurance covering a portion of the costs, you can pursue more comprehensive treatment options that might otherwise be unaffordable.

Is Pet Insurance Worth It? Common Questions Answered

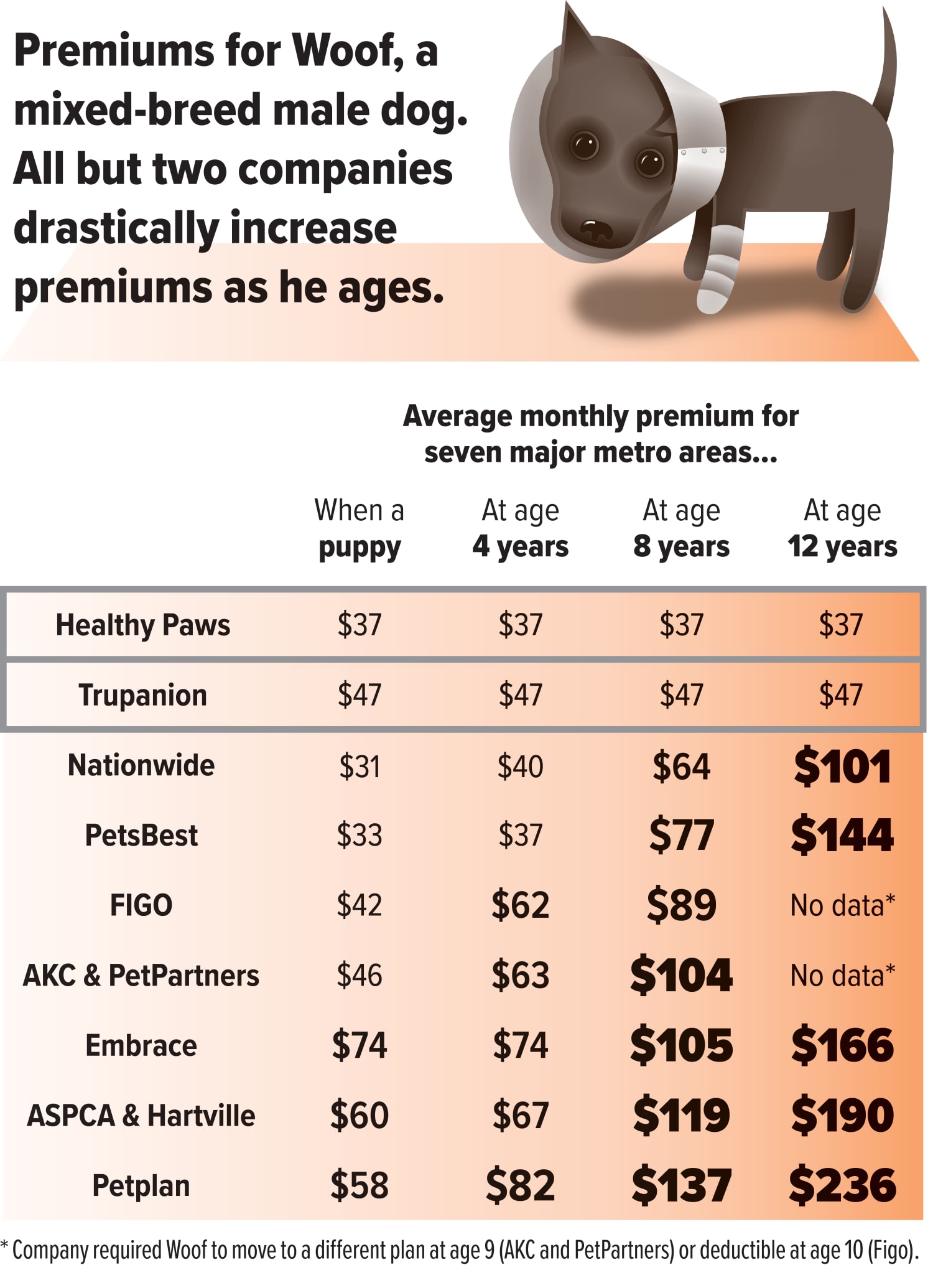

When considering pet insurance, many pet owners ask themselves if it's truly worth the investment. The answer largely depends on your pet’s health, age, and lifestyle. For instance, younger pets may have fewer health issues, making insurance less critical, while older pets or those with pre-existing conditions can face expensive vet bills that insurance could help mitigate. It’s essential to evaluate your financial situation and potential risks. If you’re prepared for unforeseen medical costs, spending on insurance might seem unnecessary; however, knowing that you can afford treatments for sudden illnesses or accidents can provide peace of mind.

Another common question is, what does pet insurance cover? Most pet insurance plans cover a variety of health care services, including accidents, illnesses, and some preventive care. The specifics can vary widely among providers, so reading the fine print is crucial. Additionally, pet owners should consider factors such as deductibles, co-pays, and coverage limits when selecting a policy. It’s wise to compare different policies and find one that suits your needs, ensuring that you are not caught off guard when your pet needs medical attention.