Breaking News Blast

Stay updated with the latest news and insightful articles.

Pocketing Cash: The Secret World of Auto Insurance Discounts

Unlock hidden savings on your auto insurance! Discover the secret discounts that can put cash back in your pocket today!

Unlocking Savings: How to Find Hidden Auto Insurance Discounts

Finding hidden auto insurance discounts can significantly reduce your premiums and help you save money. Many drivers are unaware that they may qualify for various discounts simply by taking specific actions. For example, bundling your policies can lead to substantial savings, as insurers often provide discounts for combining auto insurance with homeowner's or renter's insurance. Additionally, maintaining a clean driving record is crucial; many providers offer discounts for safe driving habits. Don’t hesitate to ask your insurance agent about potential savings that might be available based on your unique situation.

Another effective way to unlock savings is by exploring discounts tied to your vehicle’s features and your personal affiliations. Safety features such as anti-lock brakes, air bags, and anti-theft systems may qualify you for reductions in your premium. Furthermore, belonging to organizations like AAA or serving in the military often comes with exclusive discounts. Regularly reviewing your policy and remaining in touch with your insurer is essential; you never know when new discounts may be introduced or when you might become eligible for savings based on changes in your circumstances.

Are You Missing Out? Common Auto Insurance Discounts You Should Know About

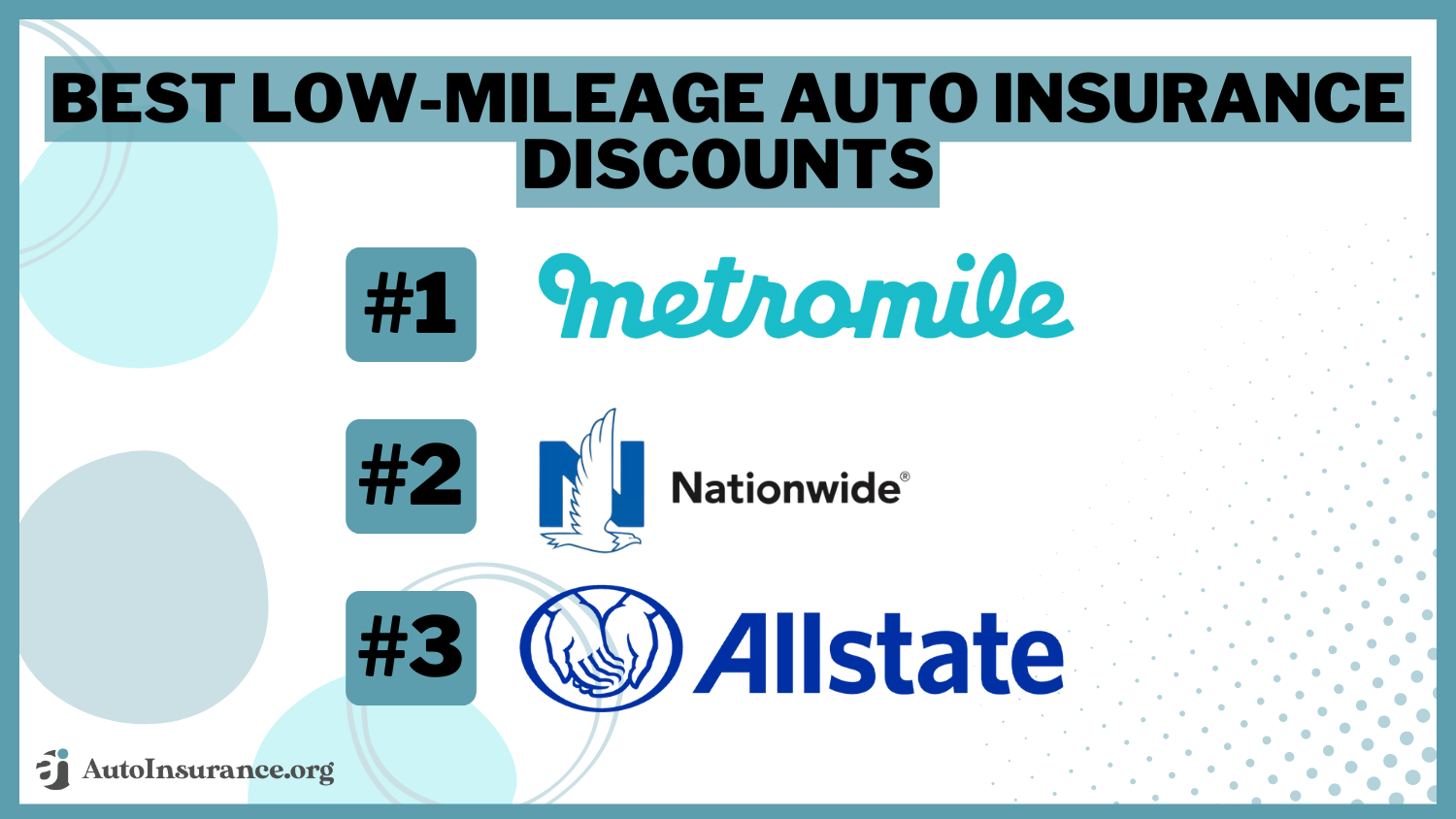

When it comes to auto insurance, many drivers might be missing out on valuable savings by not taking advantage of available discounts. Insurance providers often offer a variety of discounts that can significantly lower your premium. For instance, discounts for safe driving records, multi-policy bundling, and even loyalty discounts can all contribute to more affordable coverage. Additionally, driving less can lead to a low mileage discount, which rewards those who use their vehicles less frequently.

Here are some common auto insurance discounts you should inquire about:

- Good Student Discount: Typically available for drivers under 25 who maintain a strong academic record.

- Military Discount: Offered to active duty members and veterans.

- Safety Features Discount: Vehicles equipped with advanced safety technologies can qualify for lower rates.

- Pay-in-Full Discount: Some insurers provide discounts for paying the annual premium upfront instead of monthly.

The Ultimate Guide to Auto Insurance Discounts: Save More on Your Policy

When it comes to auto insurance discounts, many drivers are unaware of the plethora of opportunities available to them. Insurers often provide various discounts that can significantly reduce your premiums. Common categories of auto insurance discounts include safe driver discounts, which reward drivers with clean driving records, and multi-policy discounts for those who bundle their auto insurance with home or life insurance. Additionally, factor in discounts for low mileage, student drivers with good grades, and even military personnel.

To maximize your savings, it's essential to actively seek out and inquire about auto insurance discounts from your provider. Many insurance companies offer loyalty discounts for long-term customers or discounts for vehicles equipped with safety features like anti-lock brakes and airbags. Don’t hesitate to ask your agent about any lesser-known discounts, such as those offered for memberships in certain professional organizations or associations. By taking the time to understand and leverage these discounts, you can ensure that you are saving as much money as possible on your insurance policy.