News Blast

Your daily source for breaking news and insightful articles.

The Sneaky Truth About Car Deals

Uncover hidden tricks and insider secrets behind car deals that dealers don't want you to know. Get the best price today!

Unveiling the Hidden Costs: What Car Dealerships Don't Want You to Know

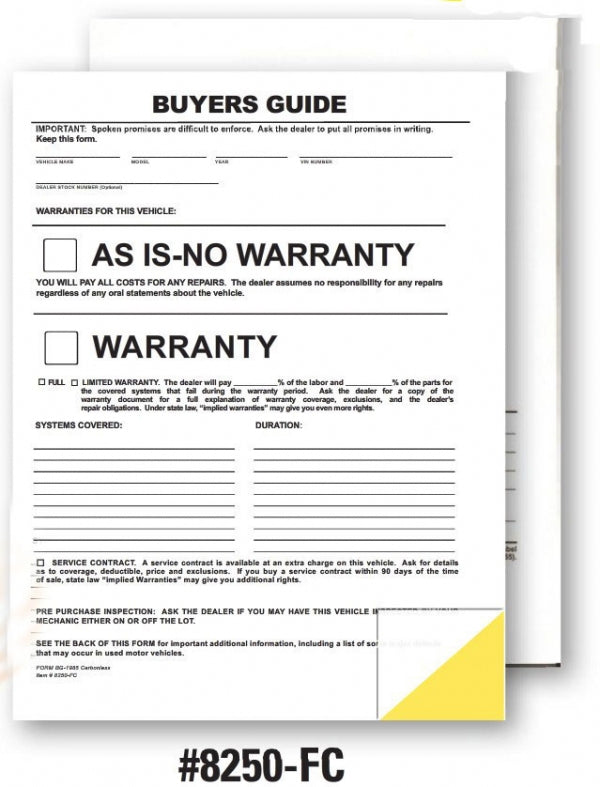

When it comes to buying a car, the price on the sticker is just the beginning. Unveiling the hidden costs that car dealerships often conceal can save you thousands. One of the biggest traps is the range of add-on fees, which can include documentation fees, dealer preparation fees, and even destination charges. These fees are often not disclosed upfront, leaving buyers shocked when the final total exceeds their budget.

Another aspect to consider is the financing options available at dealerships. Many dealerships offer enticing promotional interest rates that can lure you in, but these offers may come with higher fees or less favorable loan terms. Additionally, dealerships often push extended warranties and other insurance products that can drastically increase the overall cost of your vehicle purchase. Always remember to read the fine print and be informed about any hidden costs before signing on the dotted line.

Are You Overpaying? The Secrets Behind Car Financing Deals

Understanding the ins and outs of car financing can save you a significant amount of money. Many consumers find themselves asking, Are you overpaying? A common pitfall is not understanding the total cost of financing, which includes interest rates, loan terms, and any hidden fees. To avoid being caught off guard, it's essential to compare financing offers from various lenders. Start by obtaining quotes from multiple sources and reviewing the details carefully. Look for the annual percentage rate (APR) and ensure you understand the overall cost of the loan over time.

Additionally, consider the impact of your credit score on your financing deal. A higher credit score can help secure a lower interest rate, reducing your overall payment. If your credit isn’t stellar, you might be paying a premium without realizing it. According to industry experts, you should regularly check your credit report and dispute any inaccuracies. By following these steps, you’ll not only answer the question of Are you overpaying? but also put yourself in a better financial position when negotiating your next car purchase.

Negotiation Tactics: How to Spot a Good Deal and Avoid Pitfalls

Negotiation tactics are essential skills for anyone looking to secure a good deal. One effective tactic is to recognize the value of research; this means gathering data on market prices, alternative offers, and the specific needs of both parties involved. Prioritize understanding your own limits while simultaneously gauging the other party's motivations. Use this knowledge to prepare for the negotiation process and make informed decisions that align with your goals. Additionally, being aware of common triggers that signal a potential pitfall, such as high-pressure sales tactics or vague terms, will help you navigate through the negotiation more effectively.

Once you are engaged in the negotiation, maintain a balanced approach. Listen actively and ask clarifying questions to ensure you grasp the full context of the deal. It's important to identify red flags that may indicate a bad deal, such as unwillingness from the other party to provide necessary information or hidden fees that are not disclosed upfront. Trust your instincts; if something feels off, don’t hesitate to walk away. By combining strategic negotiation tactics with careful observation, you'll be better equipped to spot a good deal while avoiding common pitfalls in the process.