News Blast: Your Daily Update

Stay informed with the latest news and trends.

Term Life Insurance: Not Just for Your Grandma's Peace of Mind

Discover why term life insurance is a smart choice for everyone, not just Grandma! Secure your future today with affordable peace of mind.

Why Term Life Insurance is a Smart Choice for Young Families

For young families, term life insurance represents a practical and affordable way to secure financial stability for loved ones. In the event of an unexpected tragedy, this type of insurance provides a death benefit that can cover essential expenses such as mortgage payments, child education, and daily living costs. By selecting a term that aligns with their family's financial milestones, young parents can ensure that their loved ones are protected during the most critical years.

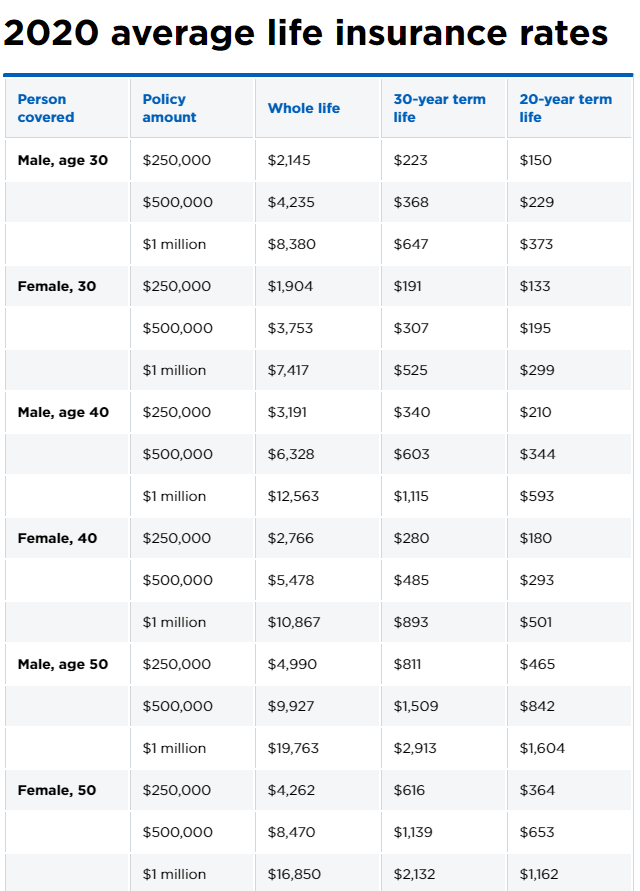

One of the main advantages of term life insurance is its cost-effectiveness. Premiums for term policies are often significantly lower than whole life options, making it easier for young families to stay within their budgets while still obtaining adequate coverage. Additionally, many term life policies offer flexible terms ranging from 10 to 30 years, allowing families to tailor their insurance needs as their circumstances evolve. This combination of affordability and adaptability makes term life insurance a smart choice for ensuring peace of mind.

5 Common Myths About Term Life Insurance Debunked

When it comes to term life insurance, many misunderstandings can cloud the decision-making process. One common myth is that term life insurance is only beneficial for older individuals. This is simply not true; individuals of all ages can gain significant advantages from this type of coverage. Younger policyholders can lock in lower premiums and have peace of mind knowing their loved ones will be financially protected in the event of an unexpected tragedy. Furthermore, term life insurance serves as a strategic financial tool that can align with long-term goals, making it an ideal choice for young families or homeowners.

Another prevalent myth is that term life insurance is not worth the investment because it doesn't build cash value, unlike whole life policies. However, this misconception overlooks the primary purpose of term life insurance: to provide affordable coverage for a specified period. It allows families to secure substantial coverage for lower premiums, which can be particularly crucial during periods of financial vulnerability. While whole life policies have their benefits, many individuals find that the flexibility and affordability of term life better meet their needs during key life stages.

Is Term Life Insurance Right for You? Key Questions to Consider

When considering term life insurance, it's essential to evaluate your personal circumstances and financial goals. Here are some key questions to assess whether this type of insurance suits you:

- What is your primary purpose for obtaining life insurance?

- How long do you anticipate needing coverage?

- What are your current financial obligations, including debts and dependents?

Additionally, think about your budget and the affordability of premiums. Term life insurance can provide significant coverage for a more affordable cost compared to permanent life insurance, but it's crucial to determine if the cost aligns with your financial plans. Consider the following:

- Can you comfortably pay the premiums throughout the term?

- Do you foresee any changes in your financial situation during the term?

- What happens after the term expires—are you prepared for potential increases in premium costs?