News Blast: Your Daily Update

Stay informed with the latest news and trends.

Term Life Insurance: Because You Can't Predict Life's Plot Twists

Discover how term life insurance can protect your loved ones from life's unexpected twists. Secure their future today!

What is Term Life Insurance and Why Should You Consider It?

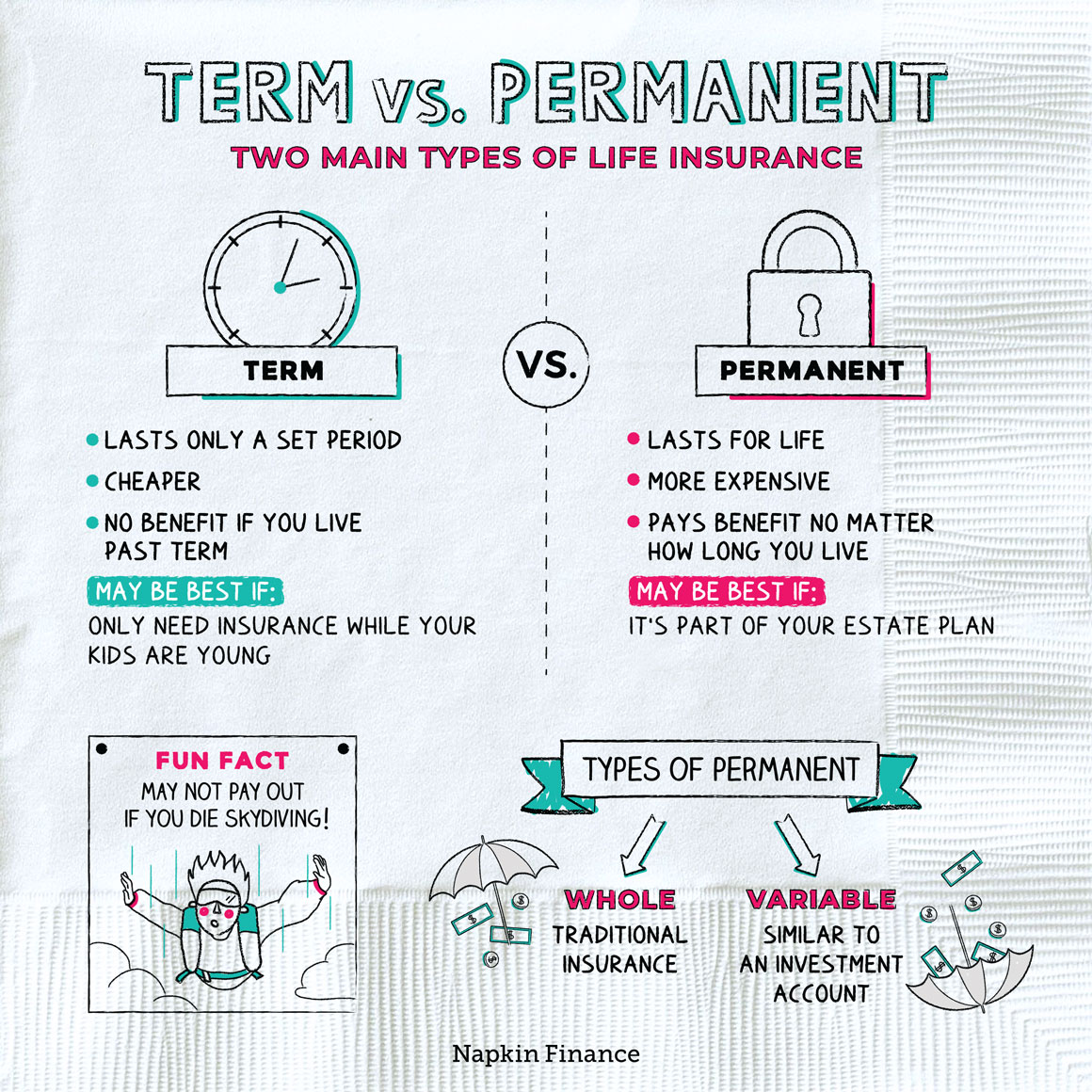

Term Life Insurance is a type of life insurance policy that provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away within the term of the policy. Unlike whole life insurance, which lasts for your entire lifetime and includes a cash value component, term life is more straightforward and often more affordable. This makes it an attractive option for many individuals and families looking to secure their financial future without breaking the bank.

There are several reasons why you should consider Term Life Insurance:

- It offers financial protection for your loved ones, ensuring they can maintain their lifestyle and cover expenses such as mortgages and education.

- Term policies are generally cheaper than permanent life insurance, allowing you to get higher coverage at a lower cost.

- Many policies offer the ability to convert to a permanent policy later on, giving you flexibility as your financial situation changes.

In essence, if you have dependents or financial obligations, Term Life Insurance can provide peace of mind and security for both you and your family.

How Term Life Insurance Can Protect Your Loved Ones from Life's Unexpected Changes

Term life insurance is a financial safety net that provides a crucial layer of protection for your loved ones in the event of unexpected changes in life. This type of insurance offers a death benefit to your beneficiaries if you pass away during the policy term, which can help alleviate the financial burden of essential expenses such as mortgage payments, education costs, and daily living expenses. By securing a term life insurance policy, you ensure that your family's financial needs are met during a challenging time, allowing them to grieve without the added stress of financial uncertainty.

Investing in term life insurance not only provides peace of mind but also encourages responsible financial planning. As life circumstances shift—be it a new job, the arrival of a child, or other significant life events—reviewing and updating your term life insurance policy to match your evolving needs is essential. In doing so, you can rest assured that your loved ones will be protected against the unexpected, giving you the confidence to enjoy life's journey while safeguarding their future.

5 Common Misconceptions About Term Life Insurance Debunked

Term life insurance is often misunderstood, leading to several common misconceptions that can prevent individuals from making informed decisions. One prevailing myth is that term life insurance provides no value if you outlive the policy. In reality, the primary purpose of term life insurance is to offer financial protection for your loved ones during a critical period, such as when children are dependent or when you have significant debts. It is designed to safeguard your family's financial future in the event of your untimely passing.

Another misconception is that term life insurance is only necessary for those with dependents. Many believe that if you are single or have no children, you do not need life insurance. However, this is not entirely true. Even individuals without dependents can benefit from term life insurance, as it can cover outstanding debts, funeral expenses, and provide a financial cushion for family members who might be impacted by your passing. Understanding these common misconceptions can help you choose the right coverage that fits your unique financial situation.