News Blast: Your Daily Update

Stay informed with the latest news and trends.

Term Life Insurance: Protecting Your Wallet and Your Loved Ones

Discover how term life insurance can secure your family's future and save you money. Protect what matters most without breaking the bank!

Understanding Term Life Insurance: What You Need to Know

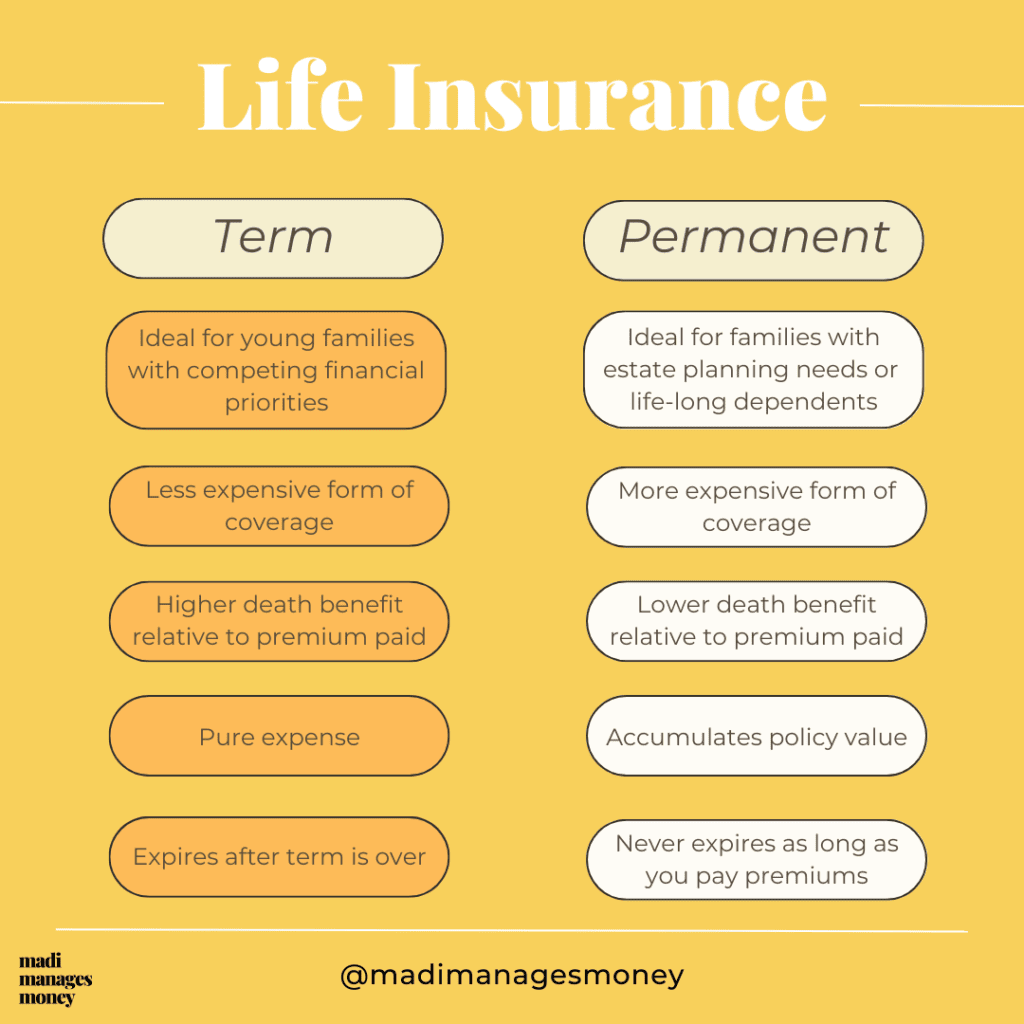

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, if the insured person passes away, the beneficiaries receive a death benefit. This makes term life insurance an attractive option for individuals seeking affordable coverage to protect their loved ones, particularly during crucial life stages such as raising children or paying off a mortgage. It's important to compare plans and rates from different providers to ensure you find the best coverage for your needs.

One key feature of term life insurance is that it is generally less expensive than permanent life insurance policies, such as whole life or universal life, because it does not accumulate cash value. However, once the term expires, the coverage ends, and you may need to apply for a new policy, which can be at a higher premium due to your older age or any health changes. To make an informed decision, consider factors like the length of coverage you need, your current financial obligations, and your overall financial goals.

Is Term Life Insurance Right for You? Key Factors to Consider

When considering whether term life insurance is right for you, it's essential to evaluate your specific needs and circumstances. Term life insurance provides coverage for a predetermined period, typically ranging from 10 to 30 years, making it an appealing option for those looking for affordable premiums and straightforward benefits. Key factors to consider include your current financial situation, dependents who rely on your income, and any outstanding debts that may need to be settled in the event of your passing. Additionally, think about how long your loved ones would need financial support.

Another crucial aspect to assess is your long-term financial goals. If you anticipate significant life changes, such as buying a home, starting a family, or planning for retirement, term life insurance can provide peace of mind during those crucial years. It's also worth noting that, unlike whole life insurance, term policies do not accumulate cash value, so your decision should align with your broader financial strategy. To help guide your decision, you may want to ask yourself these key questions:

- How many years of coverage do I need?

- What is my budget for premium payments?

- Do I have other assets to protect my family?

How Term Life Insurance Can Provide Financial Security for Your Family

Term life insurance is a vital financial tool that provides peace of mind and security for families. It offers a death benefit that can be instrumental in covering living expenses, outstanding debts, and future financial obligations such as children's education costs. When the unexpected happens, having a term life insurance policy in place ensures that your loved ones are not left in a difficult financial situation. This safety net allows families to maintain their standard of living during a challenging time, ensuring that they can focus on healing rather than financial burdens.

Choosing the right term life insurance policy can make all the difference for your family's financial future. Here are a few key benefits of this insurance option:

- Affordability: Term life insurance typically has lower premiums compared to whole life insurance, making it accessible for families on any budget.

- Flexibility: Policies can be tailored for varying term lengths, usually ranging from 10 to 30 years, allowing families to choose what best fits their needs.

- Peace of Mind: Knowing that your family will have financial support in the event of your passing brings invaluable psychological and emotional comfort.