News Blast: Your Daily Update

Stay informed with the latest news and trends.

Unlocking Hidden Savings in Your Auto Insurance

Discover secret tricks to slash your auto insurance costs and unlock hidden savings today! Don't miss out on huge discounts!

5 Secrets to Maximize Your Auto Insurance Savings

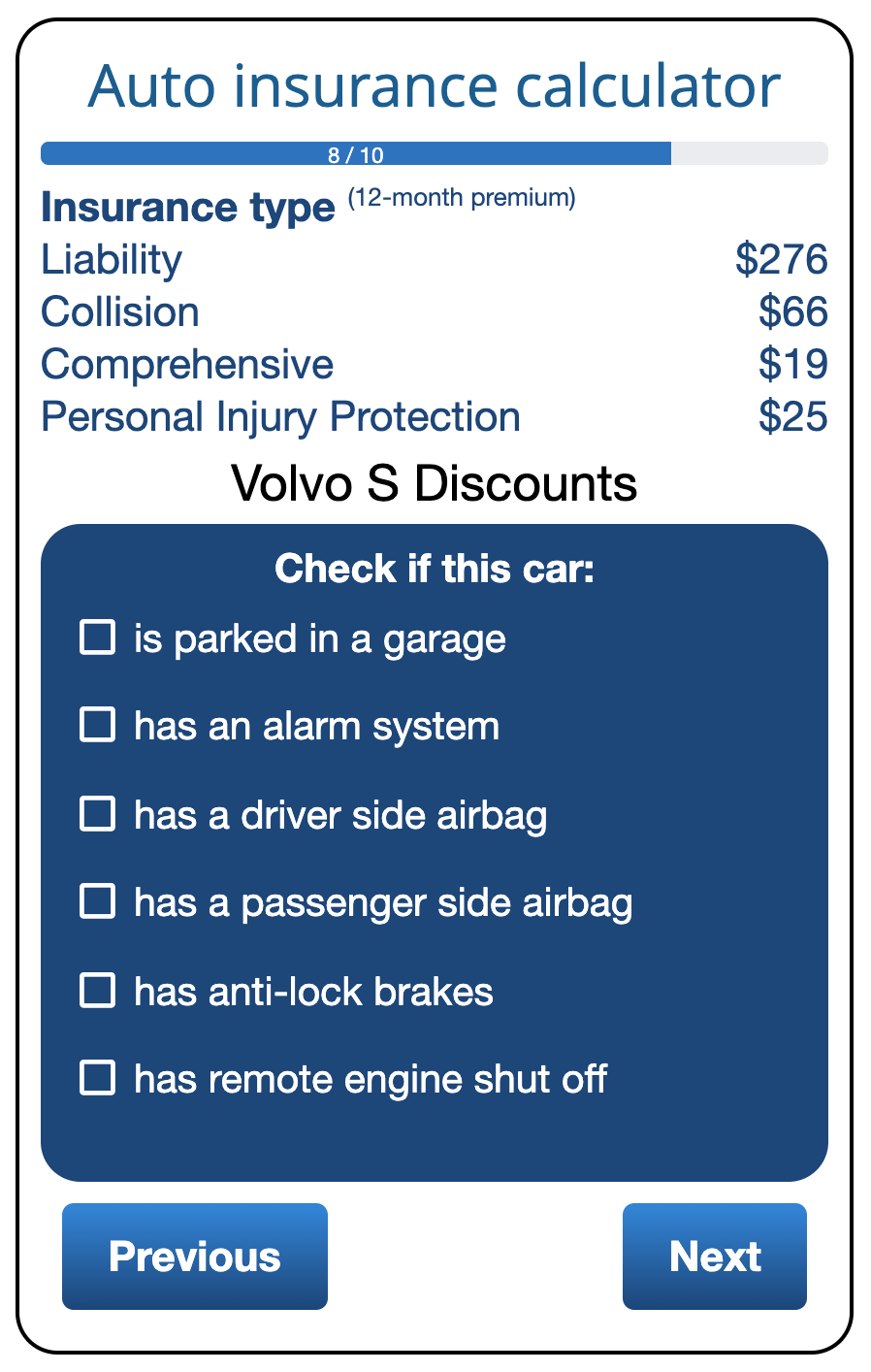

Maximizing your auto insurance savings can be achievable by implementing some strategic measures. First, always compare quotes from multiple insurance providers. Using online comparison tools will allow you to see which companies offer the best rates for your specific coverage needs. Additionally, don’t forget to ask about available discounts. Many insurers offer discounts for safe driving records, bundling policies, or even for having certain safety features in your vehicle.

Second, consider raising your deductible. While this means you'll pay more out of pocket in the event of a claim, it can significantly lower your monthly premium. Moreover, regularly reviewing and updating your coverage can lead to additional savings. If your vehicle is older, you might find that you can drop collision or comprehensive coverage, which could save you a substantial amount over time. Finally, maintaining a good credit score can also be beneficial, as many insurers take credit history into account when determining rates.

Is Your Auto Insurance Policy Overpriced? Discover Hidden Discounts!

Many drivers often feel that their auto insurance policy is more expensive than it should be. In fact, studies show that many policyholders may be missing out on valuable discounts that could significantly lower their premiums. It's essential to review your policy regularly and ask your provider about any available discounts. Some common examples include safe driver discounts, multi-policy discounts, and discounts for vehicles equipped with certain safety features.

In addition to the standard discounts, insurance companies often have hidden offers that can help you save even more money. For instance, did you know that many insurers offer discounts for customers who opt for electronic billing or automatic payments? Another potential source of savings could be through membership organizations or affiliations, as some companies provide special rates for members. Make sure to discover these hidden discounts by reaching out to your insurance agent, as they can guide you through the options tailored to your specific situation.

How to Review Your Auto Insurance for Potential Savings: A Step-by-Step Guide

Reviewing your auto insurance policy is essential for identifying potential savings. Start by gathering your documents, including your current policy, any recent claims, and your driving record. Once you have everything in order, follow these step-by-step guidelines:

- Compare coverage options: Assess whether your current policy aligns with your needs. Look for any unnecessary add-ons that you may not use.

- Check for discounts: Many insurance companies offer discounts for safe driving, bundling policies, or being a member of certain organizations. Don't hesitate to ask your insurer about available savings.

After evaluating your current policy, it's time to shop around. Reach out to at least three different insurance providers for quotes, ensuring that you compare similar coverage levels. Pay close attention to factors such as deductibles and limits, as these can significantly impact your premium. Once you've gathered this information, reassess your coverage and reevaluate potential savings by calculating the difference in premiums. Finally, consider consulting with an insurance agent who can help you navigate your options and potentially save you money in the long run.