News Blast

Your daily source for the latest news and insights.

Whole Life Insurance: A Love Story Between Savings and Security

Discover how whole life insurance blends savings and security in a heartwarming journey that protects your loved ones and grows your wealth.

Understanding Whole Life Insurance: How It Balances Savings and Security

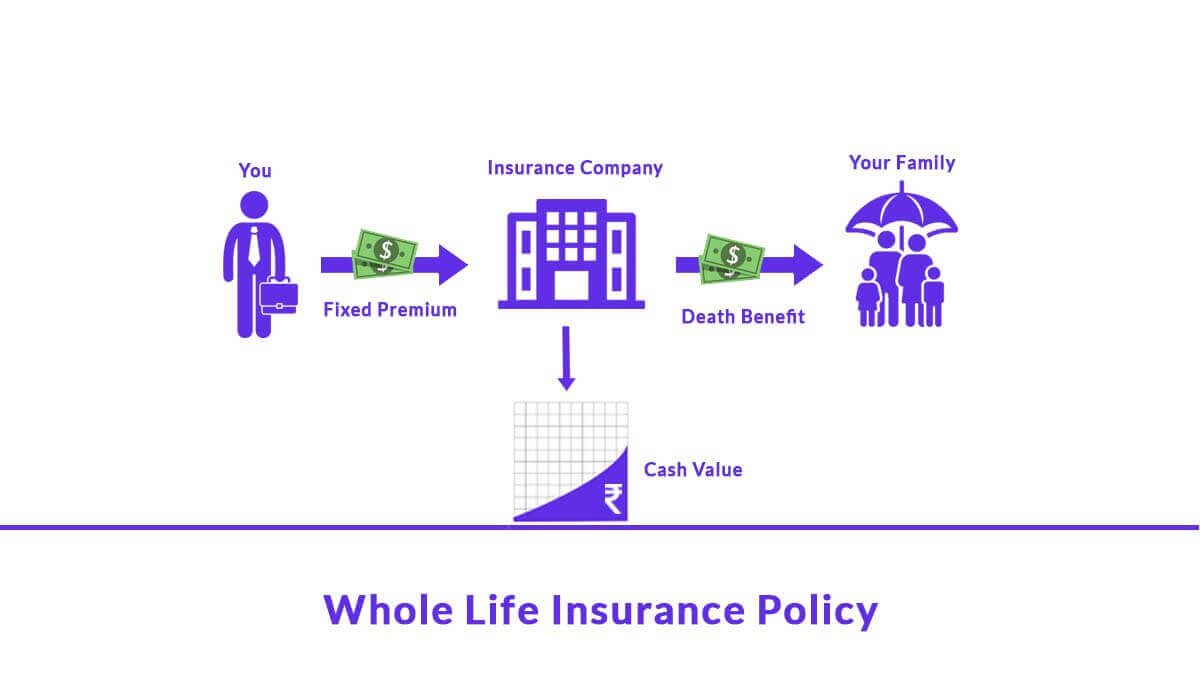

Whole life insurance is a type of permanent life insurance that provides both a death benefit and a savings component, ensuring financial security and growth. Unlike term insurance, which only covers a specific period, whole life policies are designed to last a lifetime, as long as the premiums are paid. This dual benefit of coverage and cash value accumulation appeals to individuals seeking a stable financial foundation for their families. With the cash value portion growing at a guaranteed rate, policyholders can use these funds for essential needs, emergencies, or even as collateral for loans.

Investing in whole life insurance allows policyholders to enjoy the peace of mind that comes with a guaranteed payout upon their passing, coupled with the ability to access the accumulated cash value during their lifetime. This balance of savings and security makes it an attractive option for those who desire both life coverage and a means to build wealth. Additionally, the predictable growth of the cash value, which is often enhanced by dividends from mutual insurance companies, sets this product apart as a reliable financial tool.

Is Whole Life Insurance Right for You? Key Questions to Consider

When considering whether whole life insurance is right for you, it's essential to evaluate your financial goals and obligations. Whole life insurance provides coverage for your entire life, offering a guaranteed death benefit and a cash value component that grows over time. Ask yourself the following questions:

- Do you have dependents who rely on your income?

- Are you looking for a way to accumulate savings while ensuring financial security for your loved ones?

- Can you commit to paying premiums throughout your lifetime?

Another crucial aspect to consider is the cost associated with whole life insurance. Premiums tend to be significantly higher than term life insurance, which can affect your overall budget. Reflect on these points:

- Do you have a steady income that allows for the additional expense?

- Have you explored other life insurance options that might better fit your needs?

- Is the potential for cash value growth something that appeals to you as part of your long-term financial strategy?

The Benefits of Whole Life Insurance: A Long-Term Love Affair with Financial Stability

Whole life insurance offers a unique blend of protection and savings, making it a vital component of a solid financial strategy. Unlike term insurance, which provides coverage for a specified period, whole life insurance remains in effect for the insured's entire lifetime, as long as premiums are paid. This means that as you grow older, your policy accumulates cash value, which can serve as a financial resource during your lifetime. Additionally, the death benefit ensures that your loved ones are financially stable even in your absence, making whole life insurance a true gift of security.

One of the most significant benefits of whole life insurance is its ability to provide predictable financial stability. The premiums remain constant throughout the life of the policy, allowing for easier budgeting and planning. Furthermore, the cash value growth is typically steady and tax-deferred, which can be advantageous for long-term financial planning. By choosing whole life insurance, you're not just purchasing a policy—you're committing to a lifelong financial companion that can serve various purposes, from funding your children's education to supplementing retirement income.