News Blast Hub

Stay updated with the latest news and insights.

Why Pay More? The Hidden Costs of Skipping Insurance Comparisons

Uncover the shocking hidden costs of skipping insurance comparisons—don’t overpay! Discover how to save money today!

Understanding the True Cost of Skipping Insurance Comparisons

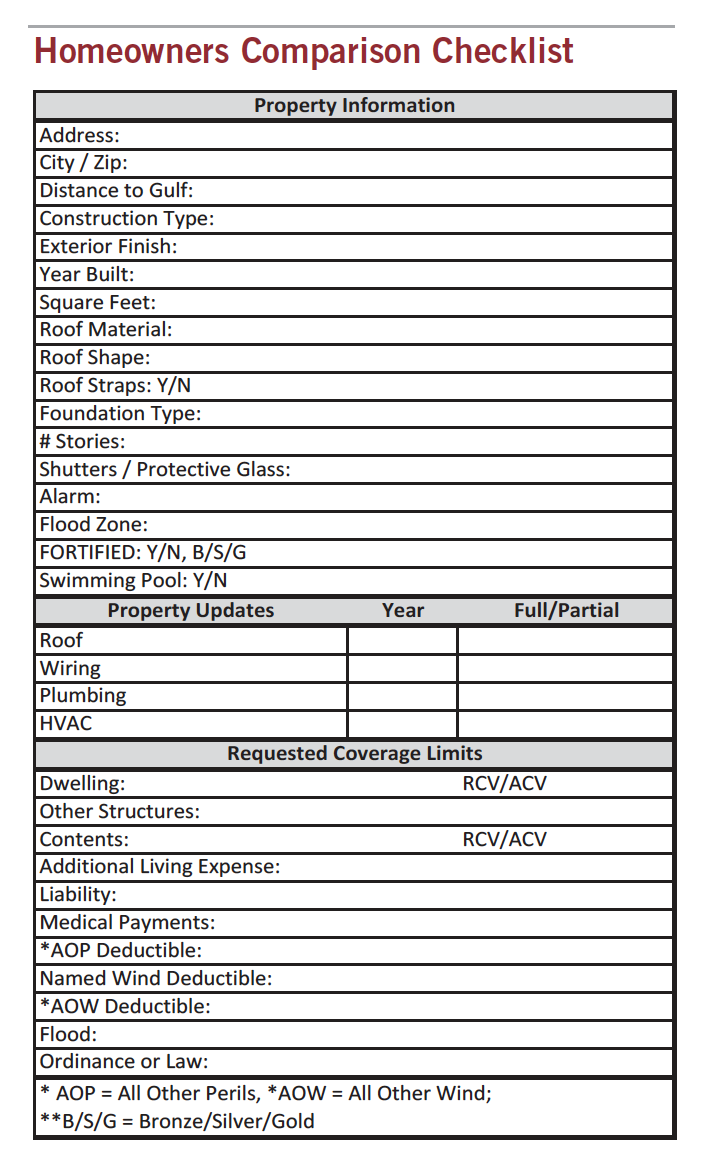

When it comes to purchasing insurance, many individuals and businesses often overlook the vital step of comparing various policies. Skipping insurance comparisons can lead to significant financial consequences that might not be immediately apparent. For instance, by not exploring different options, you could end up paying higher premiums for identical coverage, effectively wasting hundreds, if not thousands, of dollars each year. Additionally, failure to compare can mean missing out on valuable discounts or tailored coverage that could better suit your specific needs.

Beyond just financial implications, neglecting to compare insurance options can also result in inadequate coverage, leaving you vulnerable in the event of a claim. Consider this: according to industry experts, a thorough comparison could reveal essential differences in deductibles, limits, and exclusions that a single policy might not adequately address. Investing time in insurance comparisons not only enhances your peace of mind but also ensures that you are making a well-informed decision that protects both your finances and your assets.

Are You Overpaying? The Financial Pitfalls of Ignoring Insurance Rates

In today's fast-paced world, many individuals and families overlook the critical importance of regularly reviewing their insurance rates. Are you overpaying? This question should be at the forefront of your financial planning, as failing to compare rates can lead to significant financial burdens over time. Ignoring your insurance rates can mean missing out on substantial savings, which could instead be utilized for essential expenses or investments. Regularly monitoring your policies can prevent you from falling into the trap of overpaying for coverage that may not even meet your current needs.

Moreover, it's essential to recognize the long-term financial pitfalls associated with ignoring your insurance rates. Many policyholders simply renew their insurance without questioning the terms or seeking competitive quotes. This complacency can result in increasing premiums that do not align with the level of coverage provided. By taking proactive steps to reassess your policies—such as comparing rates from different providers or consulting with an insurance advisor—you can uncover potential savings and ensure you are not throwing money away unnecessarily.

The Hidden Price Tags: Why Thorough Insurance Comparisons Matter

When it comes to choosing the right insurance policy, many people underestimate the significance of thorough insurance comparisons. Without a comprehensive comparison, consumers may unintentionally overlook crucial aspects of coverage, such as deductibles, limits, and exclusions. For instance, a seemingly affordable policy with a low premium may come with hidden price tags in the form of high deductibles or limited coverage options. By taking the time to compare various insurance providers line by line, individuals can unveil these concealed costs and make informed decisions that truly align with their financial and protection needs.

Moreover, thorough insurance comparisons empower consumers by shedding light on the value of each policy. Different insurers may offer varying levels of customer service, claims processing efficiency, and additional perks that can greatly affect the overall satisfaction of a policyholder. For example, a policy that appears cheap upfront may be associated with long wait times for claims or poor customer feedback. Therefore, as you navigate the complex landscape of insurance options, remember that understanding the hidden price tags through detailed comparisons can save you not only money but also prevent future headaches, ensuring your investment truly serves its intended purpose.