News Blast: Your Daily Dose of Information

Stay updated with the latest happenings across the globe.

Why Paying Less for Auto Insurance is Just Smart Money Sense

Discover smart money-saving tips on auto insurance and learn why paying less is a clever choice for your wallet!

10 Tips for Finding Affordable Auto Insurance Without Sacrificing Coverage

Finding affordable auto insurance can seem challenging, but by following a few essential tips, you can secure a policy that meets your needs without compromising on coverage. Start by comparing quotes from multiple insurance providers. Websites that aggregate quotes can save you time and help identify the best deals available in your area. Additionally, consider adjusting your deductibles; opting for a higher deductible can considerably lower your premium, but make sure you can afford the out-of-pocket costs in case of an accident.

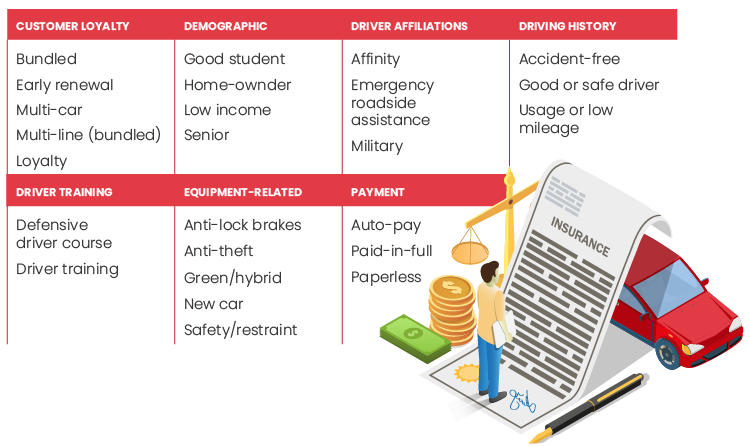

Another important tip is to take advantage of discounts. Many insurers offer various discounts for factors like safe driving records, membership in certain organizations, or bundling multiple policies. Also, periodically review your policy to ensure you're not paying for coverage you no longer need. Finally, maintaining a good credit score can greatly influence your premiums, as insurers often view higher credit scores as indicative of lower risk. By implementing these strategies, you can find affordable auto insurance without sacrificing the protection you need.

Is Cheaper Auto Insurance Really a Smart Move? Here’s What You Need to Know

When searching for cheaper auto insurance, it's natural to want to save money. However, before you jump at the lowest premium, it's crucial to understand what you're sacrificing in terms of coverage. Cheaper auto insurance often means less comprehensive protection, which can leave you vulnerable in the event of an accident. To make an informed decision, consider evaluating the coverage options offered, the deductibles involved, and any exclusions listed in the policy. Reading reviews and understanding the insurer's claim-handling abilities can also guide you in choosing wisely.

Additionally, the potential drawbacks of cheaper auto insurance can manifest in various ways that may cost you more in the long run. For instance, while the upfront cost might seem favorable, low-cost policies might have lower limits on liability or lack essential perks like roadside assistance. Furthermore, if you encounter an accident and find out your coverage is insufficient, the financial strain could outweigh any initial savings. To prevent surprises, always compare multiple quotes and delve into the fine print to ensure that your cheaper auto insurance makes sense for your unique driving needs.

How to Save Money on Auto Insurance: Myths vs. Reality

When it comes to saving money on auto insurance, many people are misled by common myths that can hinder their efforts. One prevalent myth is that all insurance companies offer the same rates. In reality, auto insurance premiums can vary significantly from one provider to another based on factors like your driving history, location, and even your credit score. It’s essential to shop around and compare quotes to find the coverage that best fits your needs and budget. Additionally, some believe opting for the minimum required coverage will always save them money, but this can lead to costly out-of-pocket expenses in the event of an accident.

The reality is that there are several legitimate strategies you can use to lower your auto insurance costs. Taking a defensive driving course or having a clean driving record can earn you discounts from many insurers. Furthermore, bundling your auto insurance with other policies, such as home or renter’s insurance, often yields significant savings. It’s also important to regularly review your policy and update it as your circumstances change, such as adding new drivers or vehicles. By debunking these myths and understanding the realities of auto insurance, you can make informed choices that ultimately save you money.