News Blast: Your Daily Update

Stay informed with the latest news and trends.

Why Term Life Insurance is Like a Safety Net You Didn’t Know You Needed

Discover why term life insurance is the safety net you never knew you needed—protect your loved ones and secure your future today!

How Term Life Insurance Provides Financial Security for Your Loved Ones

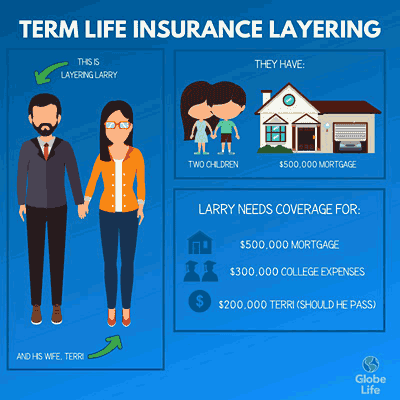

Term life insurance is a crucial financial tool that offers peace of mind to individuals and families, ensuring that loved ones are protected financially in the event of an untimely death. By selecting a specific term length, policyholders can secure a substantial death benefit that can cover essential expenses, such as mortgage payments, college tuition, and daily living costs. This financial cushion not only helps families maintain their standard of living but also alleviates the stress of unexpected financial burdens during a time of grief.

One of the primary advantages of term life insurance is its affordability compared to permanent life insurance policies. With lower premium costs, more individuals can access significant coverage that meets their specific financial needs. Additionally, the simple structure of term life policies allows policyholders to focus on their financial responsibilities without the complexity often associated with other types of insurance. Ultimately, having term life insurance in place means ensuring that your loved ones can continue to thrive, even in your absence.

Is Term Life Insurance the Safety Net You Never Knew You Needed?

Term life insurance offers a financial safeguard that many people overlook until they face unexpected challenges. Unlike permanent life insurance, which builds cash value over time, term life is designed to provide coverage for a specified period, usually ranging from 10 to 30 years. This type of insurance can be particularly beneficial for young families, homeowners, or those with significant financial obligations. In the event of the policyholder's untimely passing, benefits disbursed to beneficiaries can alleviate financial burdens, such as mortgage payments and educational expenses, ensuring that loved ones are not left struggling.

Investing in term life insurance can be seen as a proactive measure to create a financial safety net. Many individuals mistakenly believe they don't need life coverage until they're older or have achieved certain financial milestones. However, life is unpredictable, and securing a policy early can lock in lower premiums while providing peace of mind. Additionally, the simplicity of term life insurance makes it an attractive option—it's straightforward to understand and manage. Overall, considering term life insurance could be the step towards securing your family's future that you never knew you needed.

6 Reasons Why Term Life Insurance is Essential for Your Peace of Mind

When it comes to safeguarding your family's financial future, term life insurance is paramount. Here are six reasons why it is essential for your peace of mind:

- Affordability: Term life insurance generally offers lower premiums compared to whole life policies, making it an attractive option for budget-conscious individuals.

- Temporary Coverage: If you have short-term financial obligations, such as a mortgage or children's education, term life insurance provides coverage for a set period, ensuring that your loved ones are protected during critical years.

- Simple to Understand: With straightforward terms and conditions, term life policies are easier to understand than permanent life insurance, allowing you to make informed decisions quickly.

Moreover, having term life insurance can alleviate stress in challenging times. Consider these additional reasons:

- Peace of Mind: Knowing your family is financially secure if something happens to you brings a significant sense of comfort.

- Financial Legacy: A death benefit can help your beneficiaries pay off debts, such as loans and credit cards, allowing them to maintain their quality of life.

- Flexibility: Many term policies offer conversion options to permanent insurance, granting you flexibility as your financial needs evolve.