News Blast

Your daily dose of trending news and updates.

Why Term Life Insurance is the Least Boring Adulting Decision You'll Make

Discover why term life insurance isn't just smart—it's the most exciting adulting choice you'll ever make! Find out how to protect your future now!

Top 5 Myths About Term Life Insurance Debunked

Term life insurance is often shrouded in misconceptions that can lead to confusion and hesitancy when considering this essential financial product. One common myth is that term life insurance is only necessary for those with dependents. In reality, even individuals without dependents can benefit from a term policy, as it can cover debts, funeral expenses, and provide peace of mind for loved ones left behind. Furthermore, many believe that once the term ends, the benefits are lost, but numerous policies offer options for renewal or conversion to permanent life insurance, ensuring protection continues as needed.

Another prevalent myth is that term life insurance is overly complicated and difficult to understand. However, term policies are among the simplest forms of life insurance available. They provide a straightforward death benefit for a set period, making it easier to grasp compared to other products. Additionally, many people think that term life insurance is prohibitively expensive, when in fact, it can be one of the most affordable options on the market. By debunking these myths, individuals can make informed decisions that align with their financial goals and family protection needs.

How Term Life Insurance Can Be Your Safety Net: A Fun Guide

Term life insurance serves as an essential safety net for individuals and families, providing financial security during challenging times. Unlike permanent life insurance, term life offers coverage for a specified period—typically ranging from 10 to 30 years. This makes it an excellent option for those seeking affordable premiums without the complicated investment aspects of whole life policies. With a straightforward approach, term life insurance allows you to ensure that your loved ones are financially protected in case the unexpected occurs.

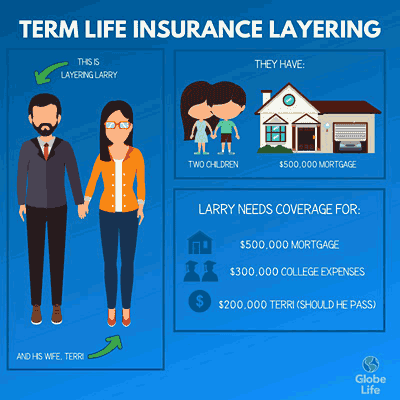

Imagine this scenario: you’re the primary breadwinner in your household, and your family relies on your income for daily living expenses. In the event of your untimely passing, a term life insurance policy can provide peace of mind, knowing that your loved ones won't face financial hardships. Not only does it cover outstanding debts and mortgaged property, but it can also support future expenses such as college tuition for your children. With the right coverage, you can rest assured that your family is safeguarded against life's uncertainties, allowing you to live with confidence. So, why not consider term life insurance as your protective umbrella?

What Makes Term Life Insurance an Exciting Investment for Your Future?

Term life insurance has emerged as a compelling investment option for those looking to secure their family's financial future. Unlike permanent life insurance, term life policies offer coverage for a specified period, typically 10, 20, or 30 years, making it an affordable choice for individuals on a budget. This affordability allows policyholders to invest the difference in premium costs into other financial vehicles, such as retirement accounts or mutual funds, potentially leading to greater long-term gains. By choosing the right term length and coverage amount, you can ensure that your loved ones are protected during the most financially critical years of your life.

Moreover, the benefits of term life insurance extend beyond just financial protection. Many policies come with options to convert to permanent coverage in the future, offering flexibility as your needs evolve. Additionally, the straightforward nature of term policies makes them easier to understand and compare, empowering you to make informed decisions. As a risk management tool, it can provide peace of mind knowing that in the event of unforeseen circumstances, your family will not face financial hardships, thus making term life insurance an exciting and strategic addition to your overall investment portfolio.