News Blast

Your daily source for breaking news and insightful articles.

Barking Up the Right Tree: Why Pet Insurance is a No-Brainer

Discover why pet insurance is a must-have for every pet owner! Protect your furry friends and your wallet today!

The Ultimate Guide to Understanding Pet Insurance: What Every Pet Owner Should Know

As a pet owner, understanding pet insurance is crucial for ensuring the health and well-being of your furry companions. Pet insurance helps cover unexpected veterinary costs, allowing you to make decisions based on your pet's health rather than your budget. Consider these key points when evaluating different policies:

- Types of Coverage: There are various plans available, including accident-only, comprehensive, and wellness coverage.

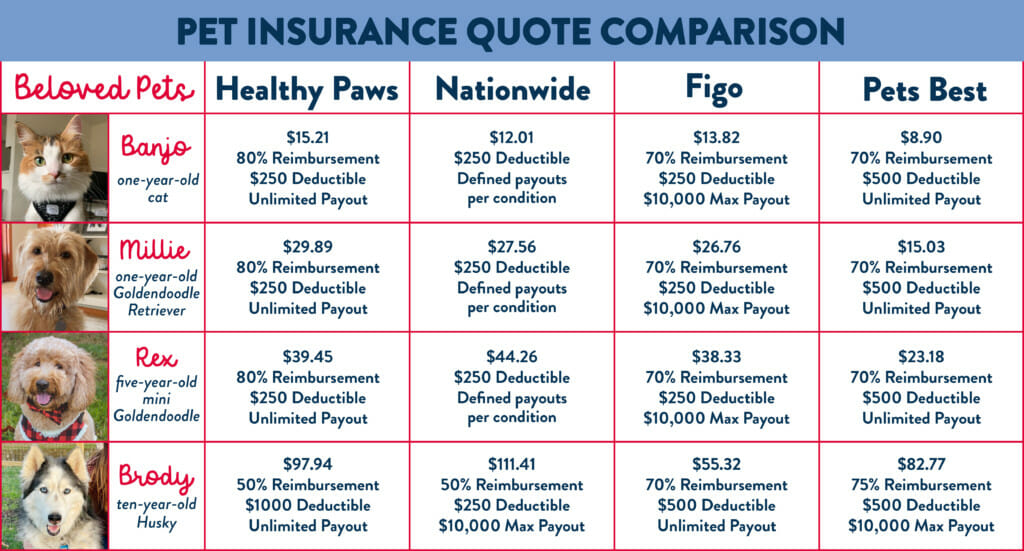

- Premium Costs: Monthly premiums can vary based on your pet’s age, breed, and the level of coverage you select.

- Deductibles and Reimbursement: Understand how much you’ll need to pay out-of-pocket before the insurance kicks in and what percentage of the bill you’ll be reimbursed.

It’s also essential to read the fine print of any pet insurance policy you consider. Look for exclusions, such as pre-existing conditions or breed-specific issues, that might impact your coverage. Additionally, staying proactive about your pet's health can lead to lower premiums over time. Regular check-ups not only help catch health issues early but can also provide peace of mind that your pet is covered in case of unexpected events. Ultimately, investing in pet insurance can provide security and support during difficult times, making it easier for you to focus on what truly matters—your pet's happiness and well-being.

Common Misconceptions About Pet Insurance: Debunking the Myths

When it comes to pet insurance, many pet owners hold onto common misconceptions that can lead to costly decisions. One prevalent myth is that pet insurance is too expensive and not worth the investment. However, the truth is that premiums can vary significantly based on the pet's breed, age, and health history, often making pet insurance a more budget-friendly option than anticipated. Additionally, not having insurance can lead to overwhelming costs during emergencies, making it crucial to weigh the long-term benefits against the upfront costs.

Another common belief is that pet insurance is only beneficial for young or healthy animals. In reality, pets of all ages can face unexpected health issues, and many policies cover conditions that arise later in life. According to industry experts, pet insurance can be a safety net for chronic conditions, helping pet owners avoid financial strain while ensuring their furry friends receive necessary medical care. Debunking these myths is essential in making informed decisions about your pet’s healthcare.

Is Pet Insurance Worth It? Key Factors to Consider for Your Furry Friend

Pet insurance can be a valuable investment for pet owners, but it's essential to assess whether it's worth it for your furry friend. One of the key factors to consider is the age and health of your pet. Young and healthy pets may not require extensive medical care, but unforeseen accidents or illnesses can arise. In contrast, older pets often face more health issues, making insurance a potentially wise choice. Additionally, the cost of veterinary care has been steadily increasing, and a single emergency visit can lead to unexpected expenses that may be difficult to manage without financial support.

Another factor to evaluate is the types of coverage offered by various pet insurance policies. Not all plans are created equal; some cover only accidents and emergencies, while others may include preventive care, vaccinations, and routine check-ups. It's important to compare options and determine what level of coverage suits your pet's specific needs. Furthermore, consider the policy's exclusions, waiting periods, and reimbursement rates to ensure you're making an informed decision. Ultimately, understanding these elements will help you decide if investing in pet insurance is truly worth it for your beloved companion.