News Blast: Your Daily Update

Stay informed with the latest news and trends.

Disability Insurance: Your Safety Net in Disguise

Discover how disability insurance can be your ultimate safety net, protecting your finances when you need it most. Don't miss out!

Understanding the Basics: What is Disability Insurance and Why Do You Need It?

Disability insurance is a type of insurance coverage that provides income replacement if you become unable to work due to a disability. Understanding the basics of disability insurance is essential for securing your financial future. This protection typically covers a portion of your lost wages, allowing you to maintain your standard of living while you recover. There are different types of disability insurance, including short-term and long-term coverage, each with specific definitions of disability and varying benefit periods.

So, why do you need disability insurance? Life is unpredictable, and a serious injury or illness can happen to anyone at any time. According to statistics, approximately one in four people will experience a disability lasting longer than 90 days during their working years. This can lead to significant financial strain if you rely solely on savings. Having a policy ensures that you receive financial support when you most need it, providing peace of mind and stability for you and your family.

Top Myths About Disability Insurance Debunked

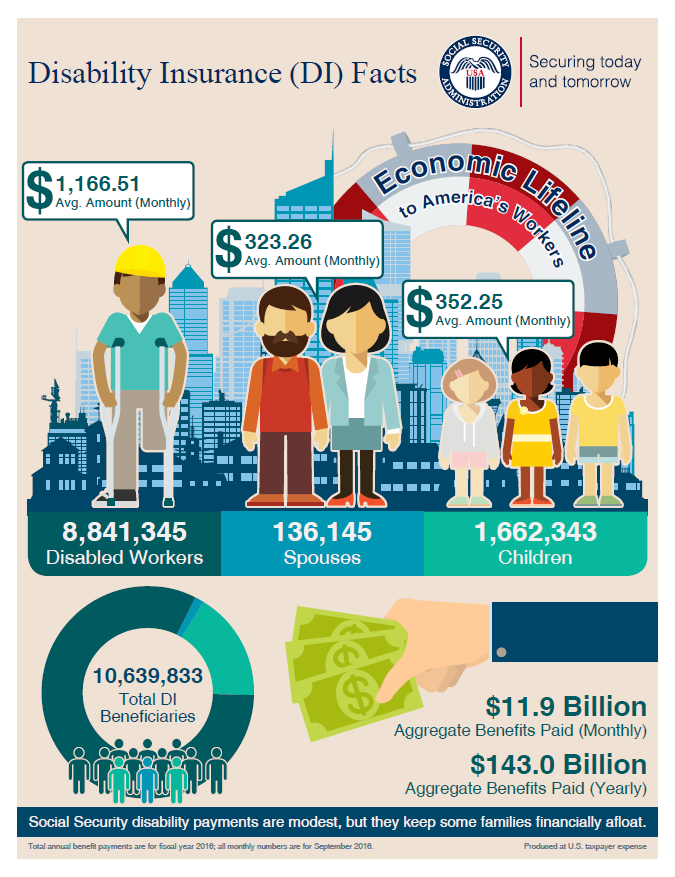

Disability insurance is often surrounded by misunderstandings that can deter individuals from securing their financial future. One common myth is that disability insurance is only for those in high-risk professions, such as construction or law enforcement. In reality, anyone can experience a disabling event, whether it's due to illness or injury. According to statistics, approximately 1 in 4 workers will experience a disability before reaching retirement age, making it essential for everyone to consider this form of protection.

Another prevalent myth is that government assistance will cover all necessary expenses in the event of a disability. While programs like Social Security Disability Insurance (SSDI) exist, they often provide limited financial support and can be challenging to qualify for. The truth is, disability insurance policies can offer significantly higher benefits, providing a safety net during difficult times. Relying solely on government programs can leave individuals vulnerable, which is why obtaining disability coverage should be a priority for prudent financial planning.

How to Choose the Right Disability Insurance Policy for Your Needs

Choosing the right disability insurance policy is crucial to protect your financial future in the event of an unexpected illness or injury. Start by assessing your individual needs, which may vary based on your occupation, health status, and lifestyle. Consider the following factors:

- Coverage Amount: Evaluate your monthly expenses to determine how much coverage you will need to maintain your standard of living.

- Policy Type: Familiarize yourself with the different types of policies available, such as short-term and long-term disability insurance, and assess which aligns with your needs.

It's also important to examine the policy's elimination period, which is the time you must wait before benefits kick in. A shorter elimination period may come with higher premiums but could provide peace of mind during a tough time. Furthermore, review the benefit period under which you'll receive payments, as well as any clauses regarding renewability and portability of the policy. Consulting with an insurance advisor can also provide personalized guidance to ensure you choose a policy that meets your specific needs.