News Blast

Your daily source for breaking news and insightful articles.

Discounts That Drive Down Your Premiums

Unlock hidden savings! Discover essential discounts that can slash your premiums and boost your budget today. Don't miss out!

Unlocking Savings: Essential Discounts to Lower Your Insurance Premiums

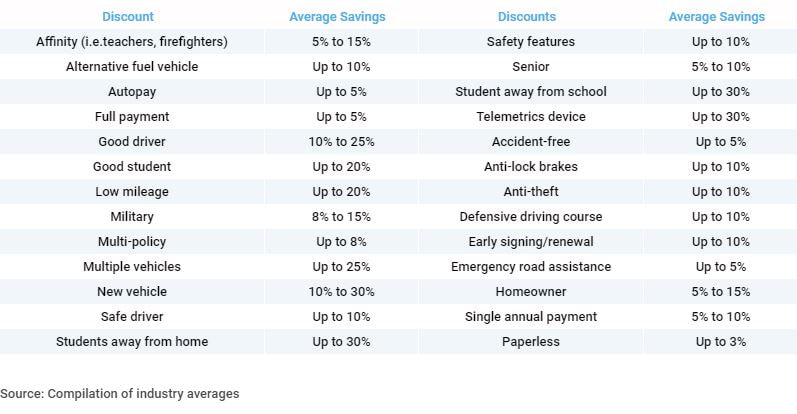

Finding ways to lower your insurance premiums can significantly enhance your financial well-being. Many providers offer a variety of discounts that are often overlooked by policyholders. To unlock these savings, consider taking advantage of the following:

- Multi-Policy Discount: Bundling your home and auto insurance can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record may qualify you for lower rates.

- Good Student Discount: If you’re a student with good grades, you could enjoy reduced premiums.

Additionally, being proactive in your policy management can directly impact your insurance premiums. Simple steps like increasing your deductible, participating in defensive driving courses, and regularly reviewing your coverage can unlock further discounts. Remember to communicate openly with your insurance provider to inquire about any additional savings opportunities that may be available for you. Every little bit counts when it comes to reducing costs and making the most of your insurance policy.

Are You Missing Out? Common Discounts That Can Reduce Your Premium Costs

When it comes to managing your insurance premiums, many consumers overlook common discounts that could significantly reduce their costs. Understanding these discounts can be the key to optimizing your budget. For instance, bundling policies, such as home and auto insurance, can often result in substantial savings. Many insurers offer multi-policy discounts that reward customers for consolidating their coverage. Additionally, maintaining a good credit score can also qualify you for lower rates, as insurers typically view responsible credit behavior as a sign of reliability.

Another frequently missed opportunity relates to age and experience. Many insurance companies provide discounts for safe driving records or for those over a certain age, reflecting a lower risk profile. Additionally, participating in safe driving courses can further enhance these discounts. Don't forget to inquire about loyalty discounts as well; remaining with the same insurer for a number of years can lead to significant perks. By taking the time to explore these options, you may discover you're missing out on vital discounts that can help reduce your premium costs.

Maximize Your Benefits: A Guide to Discounts That Impact Your Premiums

In today's competitive market, understanding how to maximize your benefits can lead to significant savings on your premiums. One effective way to achieve this is by taking advantage of various discounts offered by insurers. These discounts can range from safe driving records, bundling multiple policies, to taking defensive driving courses. It's essential to regularly review your insurance policy and consult with your provider to uncover all available discounts that may apply to you.

Additionally, it’s important to be proactive. Keeping track of changes in your life that might qualify you for new discounts can help you save more. For example, homeownership, maintaining a good credit score, or even being a member of certain organizations can provide additional premium reductions. By staying informed and asking the right questions, you can ensure that you are not leaving any money on the table. Remember, every discount counts towards maximizing your overall benefits!