News Blast: Your Daily Dose of Insight

Stay updated with the latest news and insightful articles.

Drive Down Costs with These Sneaky Auto Insurance Discounts

Unlock hidden auto insurance savings! Discover sneaky discounts that can drive down your costs and boost your wallet today!

Unlock Hidden Savings: Auto Insurance Discounts You Didn't Know About

When it comes to auto insurance, many drivers are unaware of the numerous discounts available to them that can significantly lower their premiums. Unlock hidden savings by exploring options such as multi-policy discounts, where bundling your auto insurance with home or renters insurance can lead to notable savings. Additionally, many insurance companies offer discounts for being a safe driver, such as accident-free or good student discounts for young drivers. It's essential to communicate with your insurer and inquire about every potential discount that applies to your unique situation.

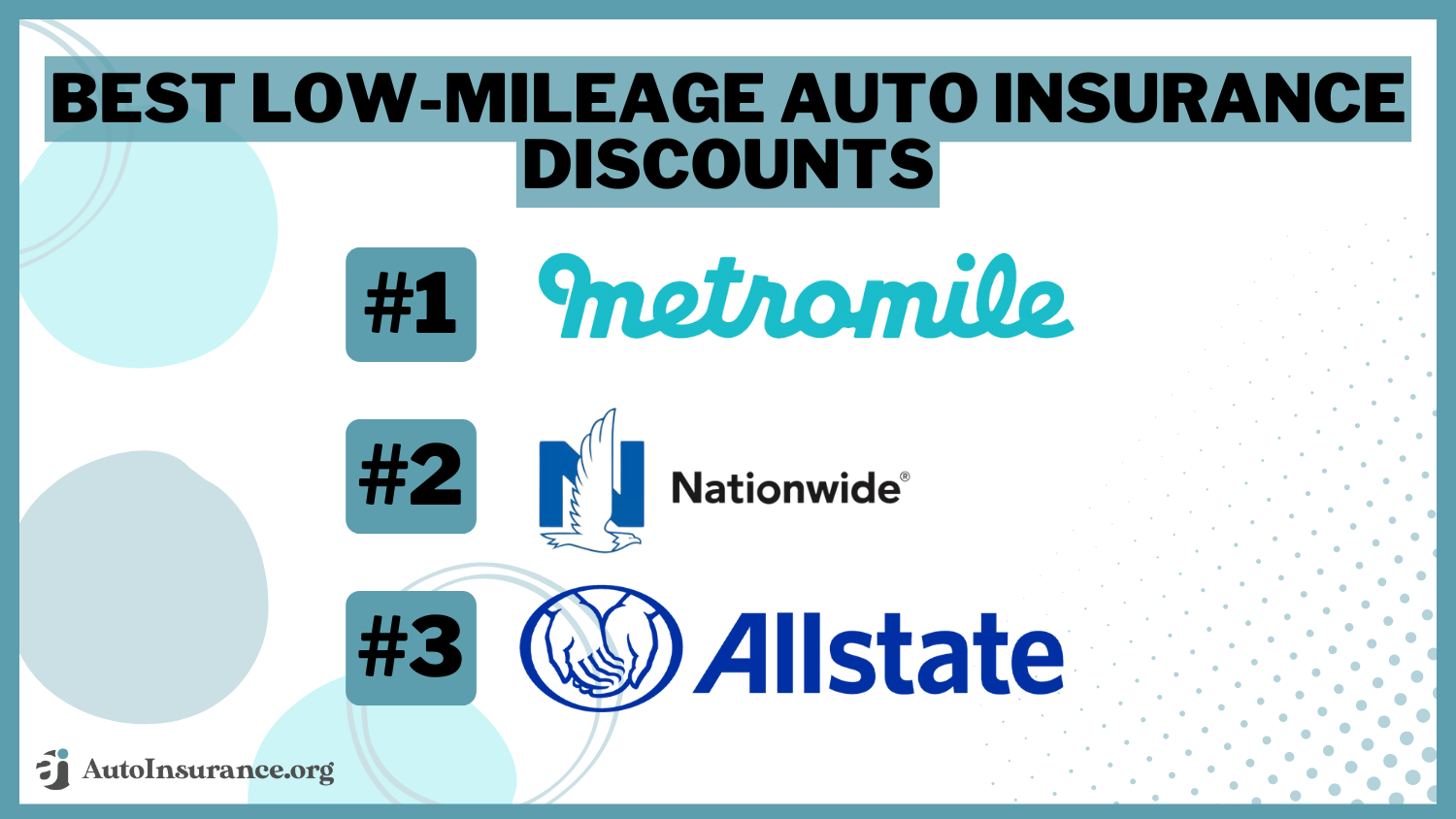

Another way to unlock hidden savings is by taking advantage of low mileage or usage-based insurance programs. If you drive less than the average driver, you might qualify for a reduced rate. Furthermore, signing up for telematics programs could reward you for safe driving habits, such as obeying speed limits and avoiding sudden stops. Don't forget to check for discounts that might be available through affiliations with professional organizations, alumni groups, or even certain employers. Every penny counts when it comes to auto insurance, so be proactive in seeking out these auto insurance discounts.

Are You Missing Out? Top Sneaky Discounts for Your Auto Insurance

When it comes to auto insurance, many drivers may feel they're paying too much without realizing there are numerous sneaky discounts available. First and foremost, did you know that bundling your auto insurance with other types of coverage, like homeowners or renters insurance, can lead to significant savings? Insurers often reward customers for consolidating their policies, as it reduces administrative costs. Furthermore, keeping a clean driving record can also qualify you for a safe driver discount, making it crucial to practice safe driving habits.

In addition, don't overlook the potential benefits of taking a defensive driving course. Many insurance companies offer a discount for drivers who complete these programs, as they reduce the likelihood of accidents. Additionally, some insurers provide discounts for low mileage drivers, so if you work from home or have a short commute, be sure to mention this when inquiring about your auto insurance premium. Finally, always ask about available discounts—it's a simple step that could save you hundreds each year!

How to Slash Your Premiums with These Little-Known Auto Insurance Discounts

Auto insurance can be a significant expense, but many drivers are unaware of the little-known auto insurance discounts that could help them save substantially on their premiums. Insurance companies often offer a myriad of discounts based on various factors, including your driving habits, vehicle safety features, and even your professional affiliations. For example, maintaining a clean driving record can lead to a safe driver discount, while installing advanced safety technology in your car might qualify you for a vehicle safety discount. Be sure to ask your insurer about all available options to ensure you're not leaving money on the table.

Additionally, there are often discounts linked to your lifestyle that you may not even be aware of. Many insurers provide special discounts for things like being a member of certain organizations or having a good credit score. You might also be eligible for discounts if you bundle your auto insurance with other types of coverage, such as home or renters insurance. To maximize your savings, consider the following:

- Ask about discounts for low mileage

- Look for alumni or association discounts

- Inquire about loyalty rewards

By taking the time to explore these little-known auto insurance discounts, you can significantly reduce your overall insurance costs.