News Blast: Your Daily Update

Stay informed with the latest news and trends.

How to Avoid Getting Played by Insurance Comparisons

Discover secret strategies to outsmart insurance comparisons and save big! Don't get played—learn how to protect your wallet today!

Top 5 Insurance Comparison Pitfalls You're Overlooking

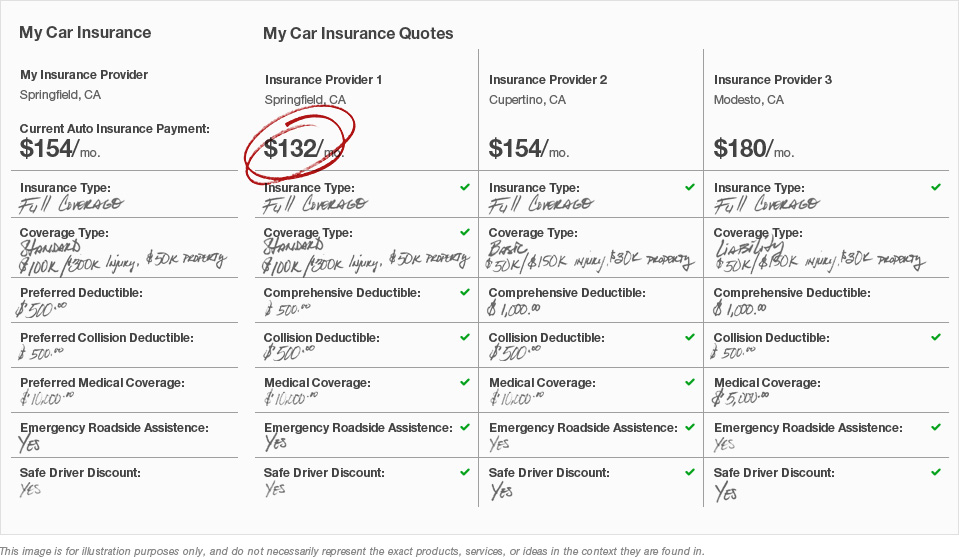

When it comes to insurance comparison, many consumers fall into common traps that can lead to poor decisions. One significant pitfall is focusing solely on price. While affordability is important, it’s crucial to consider the coverage details and limitations associated with each policy. A cheaper policy may come with higher deductibles or less comprehensive coverage, which can ultimately cost you more in the long run. Always assess what you truly need and compare policies on more than just premium costs.

Another overlooked aspect is the impact of ratings and reviews. Many people neglect to check customer feedback on insurance providers, which can be a key indicator of their reliability and service quality. It’s important to understand that a company with a low rate might not always offer the best service when you need to file a claim. Be sure to involve factors such as customer support and claims process efficiency when making your comparison. Remember, a reputable insurer can provide significant peace of mind in your insurance journey.

How to Ensure You're Getting the Best Insurance Deals

When searching for the best insurance deals, it's crucial to compare multiple quotes. Start by gathering quotes from various insurance providers to ensure you have a comprehensive view of the market. Websites that specialize in insurance comparisons can be incredibly helpful, as they allow you to view different policies side by side. Additionally, consider the factors that influence your premium, such as your age, location, and driving record. This knowledge will enable you to negotiate better rates and secure the most advantageous terms.

Another effective strategy is to take advantage of discounts. Many insurance companies offer various discounts for bundled policies, safe driving records, or even for being a member of certain organizations. Don't hesitate to ask your agent about any available discounts that could reduce your premium significantly. Moreover, regularly reviewing your policy can also uncover areas where you may be over-insured or not taking full advantage of potential savings. By staying proactive and informed, you can continuously ensure you're getting the best insurance deals available.

Navigating Insurance Comparison Sites: What You Need to Know

Navigating insurance comparison sites can be overwhelming, but understanding their functionality can simplify the process of choosing the right policy for your needs. These platforms allow you to compare various policies side by side, highlighting differences in coverage, premiums, and deductibles. To get started, gather key information such as your personal details, coverage preferences, and budget. This will help you filter the options effectively and ensure that you’re focusing on plans that best suit your circumstances.

When using insurance comparison sites, it’s crucial to pay attention to the details provided in the comparisons. Look for comprehensive insights and not just the premiums—consider factors like customer satisfaction ratings and claim settlements. Additionally, be wary of hidden fees and policy limitations, which may not always be obvious at first glance. By doing thorough research and understanding the pros and cons of each option, you can make an informed decision that secures the best coverage for your needs.