News Blast: Your Daily Update

Stay informed with the latest news and trends.

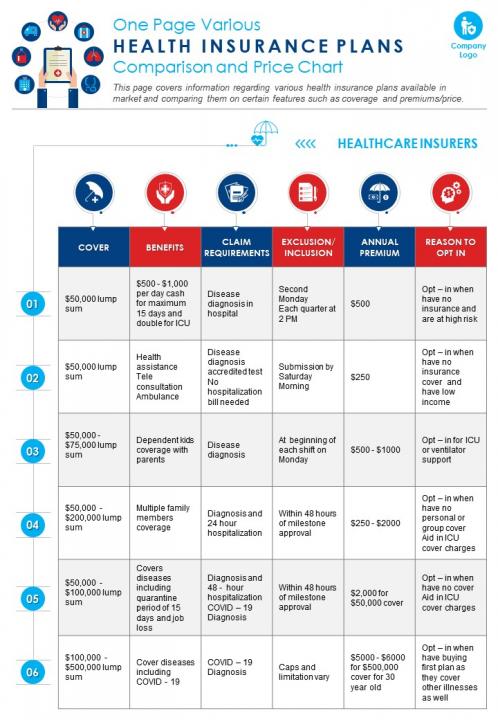

Insurance Face-Off: Which Plan Packs the Biggest Punch?

Discover which insurance plan delivers the ultimate protection! Uncover the surprising truths and make the best choice for your future!

Understanding the Key Differences Between Health Insurance Plans

When navigating the complex world of health insurance, it's essential to understand the key differences between various health insurance plans. The two primary types are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically require members to choose a primary care physician and obtain referrals to see specialists, which can result in lower premiums but less flexibility in choosing healthcare providers. On the other hand, PPOs offer greater flexibility by allowing members to visit any doctor or specialist without a referral, albeit usually at a higher cost. Understanding these distinctions can significantly impact your healthcare choices and overall expenses.

In addition to HMO and PPO distinctions, there are also High Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs) to consider. HDHPs come with lower premiums and higher deductibles, making them suitable for individuals who are generally healthy and do not require frequent medical care. In contrast, HSAs allow you to save money tax-free to cover qualifying medical expenses. This combination provides a pathway for consumers to manage their healthcare costs effectively. Recognizing these key differences among health insurance plans enables you to make informed decisions that align with your healthcare needs and financial situation.

Maximizing Your Coverage: What to Look for in an Insurance Plan

When it comes to maximizing your coverage, understanding the various types of insurance plans available is crucial. Start by assessing your specific needs and what you want the insurance to protect. This may include health insurance, auto insurance, or homeowner's insurance. It’s important to consider factors such as your budget, potential risks, and the level of coverage each plan offers. Additionally, comparing multiple providers can help you identify which plan gives you the best value for your money.

Another key aspect of maximizing your coverage is evaluating the policy's terms and conditions. Look for options that provide comprehensive coverage without hidden exclusions. Here are some essential elements to examine:

- Deductibles: Understand how much you’ll need to pay out-of-pocket before coverage kicks in.

- Limits: Check the maximum amount your insurer will pay for various claims.

- Premiums: Assess your monthly costs against the value of coverage received.

By paying attention to these factors and ensuring that your selected plan aligns with your needs, you can achieve a well-rounded insurance strategy that offers peace of mind.

Health Insurance Showdown: Which Plan is Best for Your Needs?

Choosing the right health insurance plan can be overwhelming, but understanding your specific needs is the key to making the best decision. First, evaluate your healthcare requirements, including any chronic conditions, medications, and anticipated medical services. You can categorize plans based on their premiums, deductibles, copayments, and networks of doctors. For example, consider factors like:

- Premiums: Monthly fees you pay for coverage.

- Deductibles: Amount you pay before insurance kicks in.

- Co-pays: Fixed fees for specific services.

- Out-of-pocket maximums: The limit on what you spend annually.

Once you have a grasp of your financial situation and health needs, it’s time to compare different plans. Look for network coverage to ensure your preferred doctors and hospitals are included. Additionally, assess whether you need a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA) for future expenses or a more traditional plan with lower out-of-pocket costs. Ultimately, the best plan for you will align with your budget while providing the necessary access to healthcare services that you require. Remember, the choice is personal, so weigh the options carefully to find a plan that suits your lifestyle.