News Blast: Your Daily Dose of Information

Stay updated with the latest happenings across the globe.

Insurance Policies That Won't Break the Bank

Discover affordable insurance policies that fit your budget! Save big without compromising on coverage. Start your savings journey today!

Top 5 Affordable Insurance Policies You Should Consider

When it comes to protecting yourself and your assets, finding the right insurance policy is crucial. Here are the Top 5 Affordable Insurance Policies you should consider to ensure you have the coverage you need without breaking the bank:

- Health Insurance: A basic health insurance plan can save you from exorbitant medical bills. Look for policies that offer essential coverage while maintaining a reasonable premium.

- Auto Insurance: It's mandatory in most states, but that doesn't mean you have to pay a fortune. Shop around for policies that offer comprehensive coverage at competitive rates.

- Homeowners Insurance: Protect your home and personal property from unexpected disasters without overspending. Many companies provide customizable plans to fit your needs.

- renter's Insurance: If you rent your living space, this affordable option safeguards your belongings from theft or damage, often at a low cost.

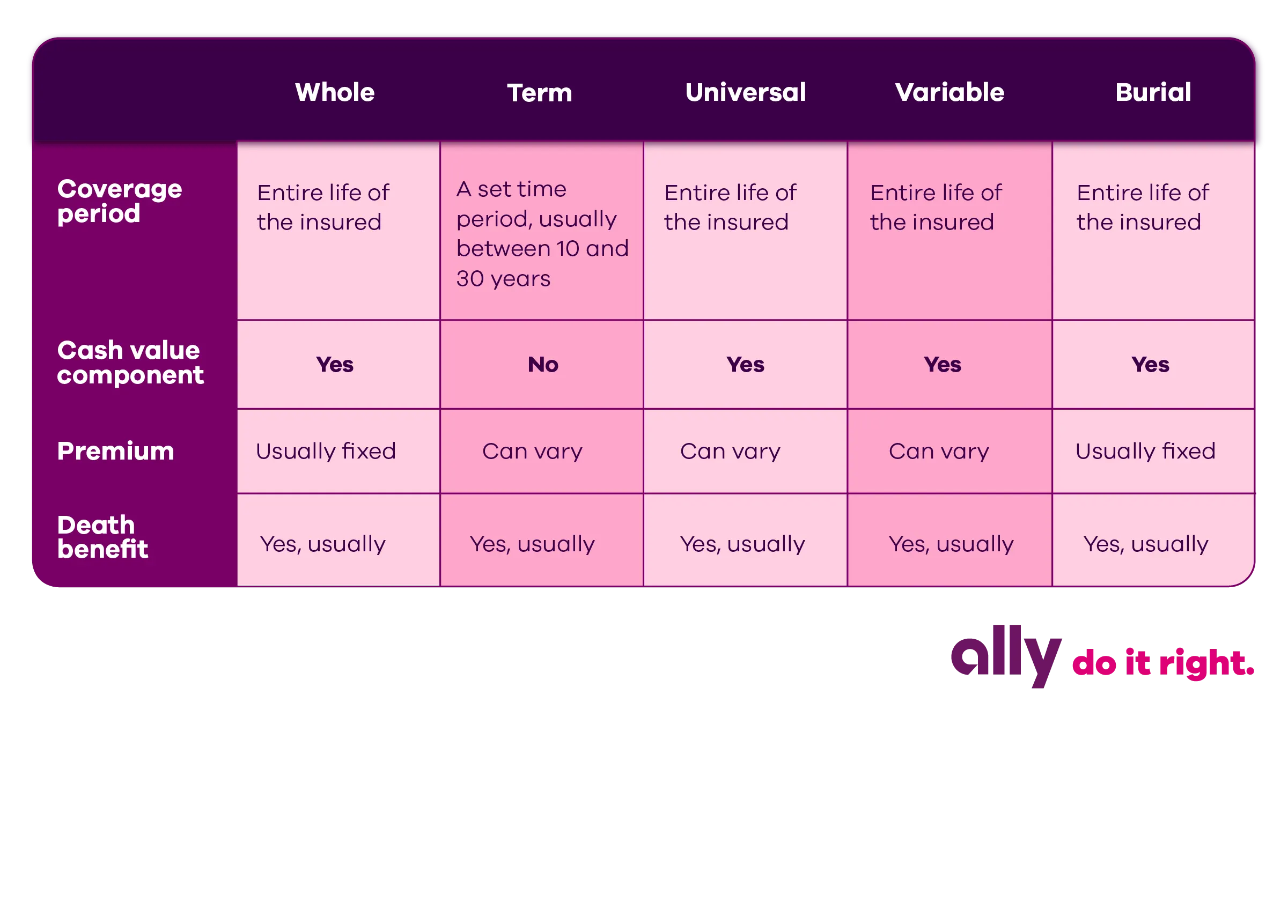

- Life Insurance: Even on a budget, life insurance is a vital consideration. Look for term life policies that offer substantial coverage without high premiums.

How to Choose Budget-Friendly Insurance Without Sacrificing Coverage

When it comes to finding budget-friendly insurance, the first step is to evaluate your specific needs. Start by assessing what coverage is essential for your situation. For instance, if you need car insurance, consider the minimum required coverage in your state versus additional protections you might want, such as collision or comprehensive coverage. Additionally, it's wise to compare multiple insurance companies and their offerings, as rates can vary significantly. Use online comparison tools to get quotes side-by-side. This approach not only helps you find affordable options but also ensures that you're not compromising on crucial coverage.

Another vital aspect of selecting budget-friendly insurance is to take advantage of available discounts. Many insurers offer savings for bundling policies, installing safety features in your home or vehicle, or maintaining a clean driving record. Don't hesitate to ask your insurance agent about all the possible discounts that you might qualify for. Additionally, consider adjusting your deductible; a higher deductible often results in lower premiums. However, be sure to set a deductible that you can comfortably manage in the event of a claim. Ultimately, making informed decisions by weighing your options can lead to significant savings without sacrificing quality coverage.

Common Myths About Cheap Insurance Policies Debunked

When it comes to insurance, cheap policies often attract attention due to their apparent affordability. However, many people fall prey to the myth that cheap insurance policies provide inadequate coverage. In reality, the affordability of a policy does not directly correlate with its level of protection. Numerous reputable insurers offer competitive rates without compromising on coverage. Often, these policies may simply exclude add-ons or have higher deductibles, yet still provide essential protection for policyholders.

Another common misconception is that cheap insurance policies are only suitable for low-risk individuals. Conversely, many providers cater to various demographics, ensuring that everyone—regardless of risk profile—can access budget-friendly options. While it’s true that certain factors, such as driving history or credit score, influence rates, many insurers offer discounts and incentives that can make cheap insurance policies a viable choice for a wider audience. By debunking these myths, consumers can better navigate their options and make informed decisions about their insurance needs.