News Blast: Your Daily Dose of Information

Stay updated with the latest happenings across the globe.

Insurance Policies: A Love-Hate Relationship You Never Knew You Had

Discover why your insurance policies might have a secret hold on you—it's a love-hate saga that could change your financial future!

Understanding the Benefits and Drawbacks of Different Insurance Policies

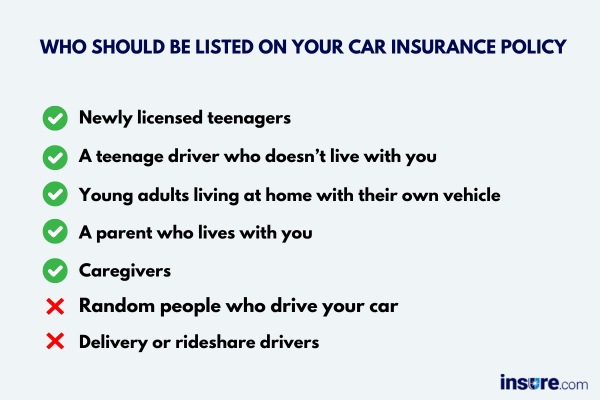

When navigating the world of insurance policies, it is essential to understand the various options available and their respective benefits and drawbacks. Health insurance, for instance, can provide crucial financial support during medical emergencies, shielding individuals from high medical costs. Additionally, life insurance ensures that your loved ones are financially secure in the event of your untimely demise. Other types, such as auto insurance and homeowner's insurance, protect against loss or damage to property. However, one must consider the trade-offs; higher premiums may lead to greater coverage, but logging into complicated policy terms can be a daunting task for many.

On the flip side, various insurance policies come with inherent drawbacks that can lead to confusion and financial strain. For example, while deductibles can lower monthly premiums, they may also result in higher out-of-pocket costs when you need to make a claim. Moreover, some policies feature exclusions and limitations that policyholders may not fully understand until it's too late. To summarize, getting a solid grasp on the benefits and drawbacks of different insurance types not only aids in making informed decisions but also ensures that you select a policy that best aligns with your needs and financial situation.

Is Your Insurance Policy Truly Working for You? Key Questions to Ask

Understanding whether your insurance policy is truly working for you involves asking the right questions. Start by evaluating your coverage limits: are they sufficient to protect your assets adequately? It's crucial to assess whether your current policy aligns with your needs and lifestyle changes, such as a new job, marriage, or the purchase of valuable items. Additionally, consider the deductibles: could you comfortably pay these out-of-pocket in the event of a claim? By identifying these key areas, you can gain insight into the effectiveness of your insurance policy.

Next, review your insurer's claims process by asking: How easy is it to file a claim? A cumbersome claims process can make your policy less effective when you need it most. Look for customer reviews and testimonials to gauge the insurer's reliability and responsiveness. Finally, inquire whether your policy includes any hidden exclusions that could surprise you later. By addressing these vital questions, you ensure that your insurance policy is not just a financial tool, but a safety net that supports you when it's needed the most.

Navigating the Complexities of Insurance: How to Make Peace with Your Policy

Navigating the complexities of insurance can often feel overwhelming, with a myriad of options and jargon that can leave anyone confused. To make peace with your policy, it's crucial to start by understanding the basic components. Types of insurance such as health, auto, and home can vary significantly in coverage and terms. Begin by creating a list of your needs and priorities, which will help you filter through policies that truly align with your lifestyle. Additionally, an organized approach to comparing quotes can unveil potential savings and help you determine which policies may offer the best value.

Once you have chosen an insurance policy, the next step is to thoroughly read your contract. Take note of key elements such as deductibles, premium costs, and coverage limits. Consider highlighting sections that are particularly significant, as this will aid in future reference when filing claims or discussing terms with your provider. Don't hesitate to reach out for clarification on terminology you don't understand; most insurance agents are more than willing to assist. Embracing the learning process can transform your relationship with your insurance policy from one of trepidation to confidence.