News Blast

Your daily source for the latest news and insights.

Insurance Quotes: How to Make Sure You're Not Overpaying

Unlock savings on your insurance! Discover tips to avoid overpaying and find the best quotes tailored for you. Get more for less today!

5 Tips to Avoid Overpaying for Insurance Quotes

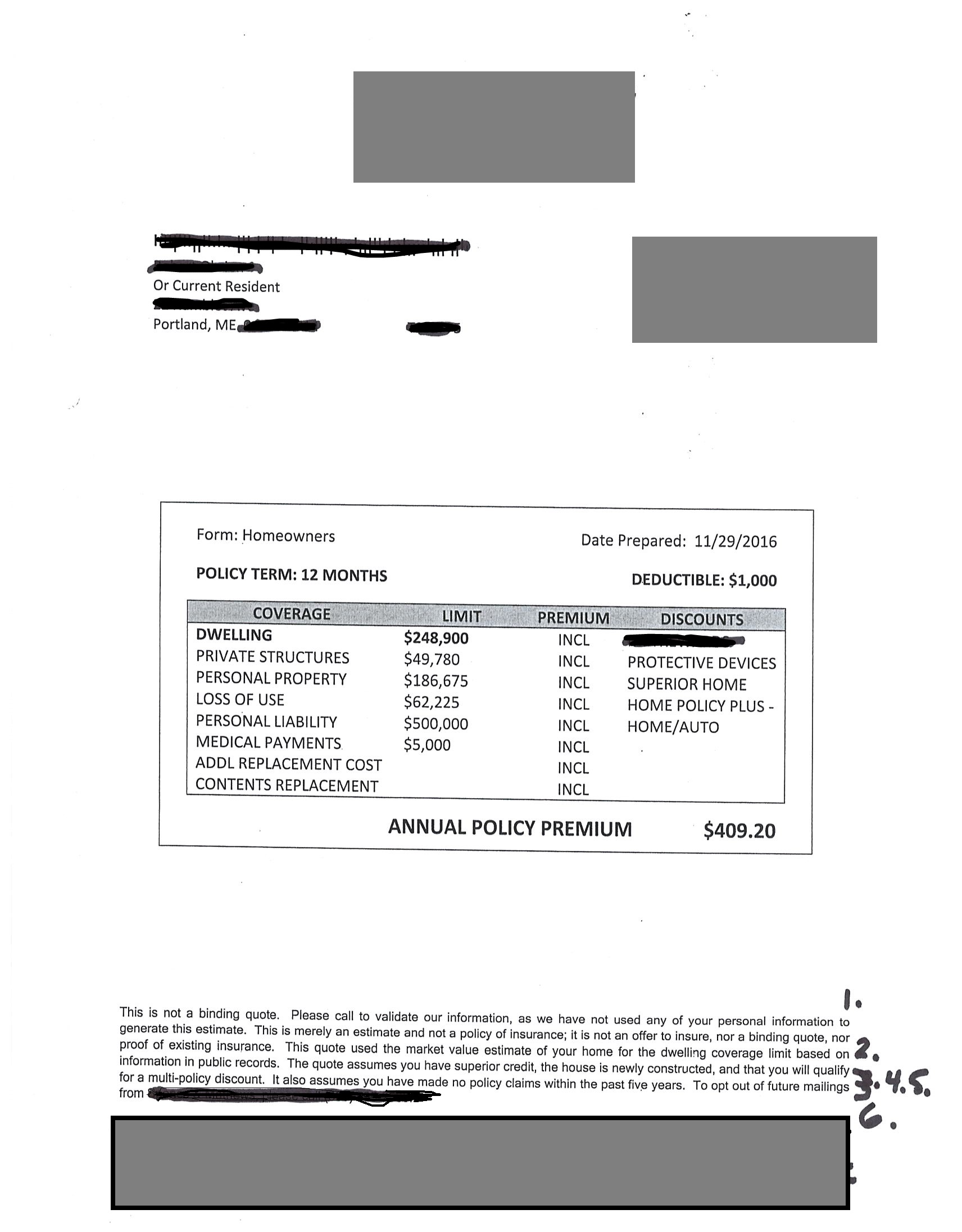

When shopping for insurance, avoiding overpaying for insurance quotes requires a strategic approach. Start by comparing quotes from multiple providers; don't settle for the first one you receive. Make sure to utilize online comparison tools, which can help you see different rates based on your specific needs. Additionally, consider your coverage requirements carefully—opting for only the necessary coverage can significantly reduce your premiums. Remember, just because a quote seems low, it doesn’t mean it’s the best value.

Another effective tip is to maintain a good credit score, as insurance companies often factor this into their pricing models. A higher score can lead to lower premiums, so take steps to improve your credit if necessary. Lastly, don't hesitate to negotiate with your insurance provider. They may be willing to offer discounts or reduce rates if you ask. Following these steps can help ensure that you're getting the best possible deal and truly avoiding overpaying for insurance quotes.

Understanding Insurance Terminology: Key Terms to Help You Save

Understanding insurance terminology is essential for anyone looking to navigate the complexities of different insurance policies effectively. From premiums to d deductibles, familiarizing yourself with these terms can empower you to make informed decisions that ultimately save you money. Below are some key terms you should know:

- Premium: The amount you pay for your insurance coverage, usually on a monthly or annual basis.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for specific services, typically at the time of service.

- Exclusion: Specific situations or circumstances that are not covered by your insurance policy.

Mastering insurance terminology not only aids in selecting the right coverage but also helps in avoiding costly surprises down the road. For instance, understanding the term coverage limit—the maximum amount your insurance will reimburse you for a covered loss—can prevent underinsurance. Consider these additional vital terms to enhance your understanding:

- Underwriting: The process by which insurers evaluate risk to decide whether to accept an application for coverage.

- Rider: An add-on to an insurance policy that provides additional benefits or coverage options.

- Broker: A licensed individual or company that sells insurance policies on behalf of one or multiple insurers.

Are You Getting the Best Deal? Questions to Ask When Comparing Insurance Quotes

When you're on the hunt for the best deal on insurance, it's crucial to ask the right questions when comparing quotes. Start by focusing on the coverage options each provider offers. Are there specific policies tailored to your needs? Create a list of priorities that includes essential coverages such as liability, collision, and comprehensive plans. Don't forget to inquire about deductibles and how they affect your premium. For example, a lower deductible typically means a higher premium but could save you from larger out-of-pocket expenses in the event of a claim.

Next, consider asking about discounts and incentives that might be available. Many insurance companies offer reductions for bundling policies, safe driving records, or even completing defensive driving courses. It's also a good idea to probe into the claims process; understanding how straightforward it is to file a claim can greatly influence your overall satisfaction. Lastly, don't shy away from reaching out to customer service to gauge their responsiveness before making a commitment. This could be a key factor in ensuring you are truly getting the best deal on your insurance.