News Blast: Your Daily Update

Stay informed with the latest news and trends.

Insurance Showdown: Picking the Best Policy Without Losing Your Mind

Navigate the insurance maze effortlessly! Discover how to choose the best policy without the stress in our ultimate showdown.

The Essentials of Insurance: Key Factors to Consider When Choosing Your Policy

When it comes to selecting the right insurance policy, understanding the essentials of insurance is crucial. Different types of insurance, such as health, auto, and home insurance, come with unique features and coverage options. Before making a decision, consider the following key factors:

- Coverage Needs: Assess what you need to protect and choose a policy that offers adequate coverage for those specific needs.

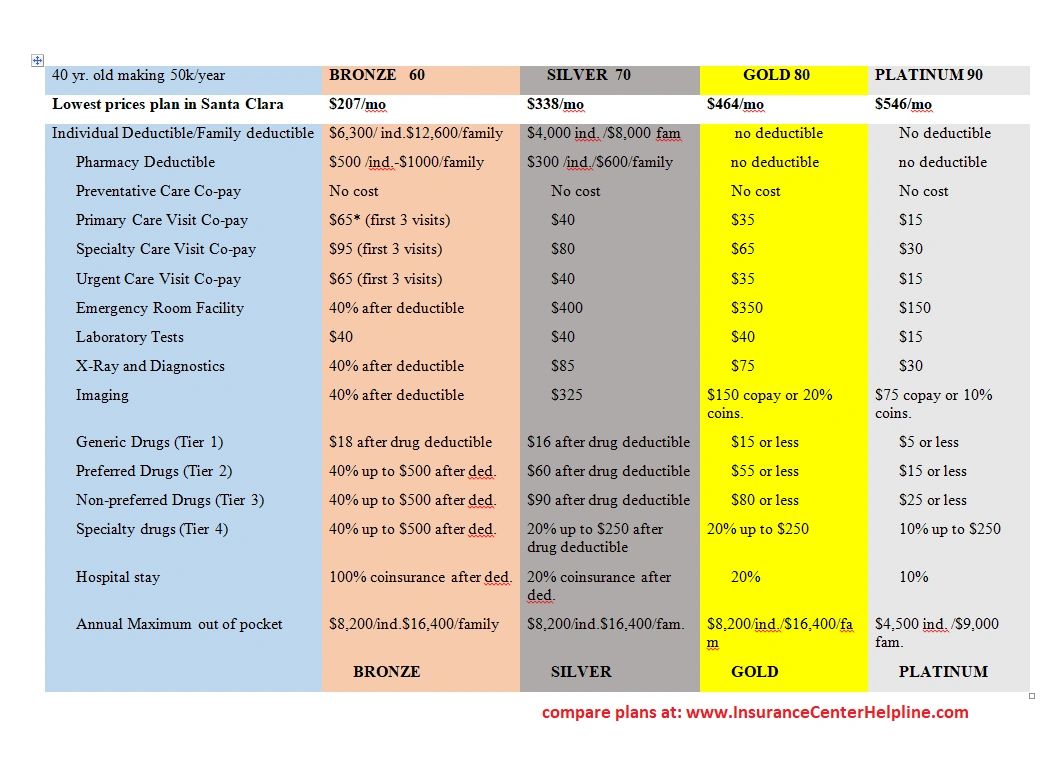

- Premium Costs: Evaluate your budget and compare premium costs among different providers to find a balance between affordability and adequate coverage.

- Deductibles: Higher deductibles typically mean lower premiums, but they can lead to out-of-pocket expenses during a claim. Ensure the deductible aligns with your financial situation.

Another important aspect of choosing your insurance policy is the provider's reputation and customer service record. Research reviews and ratings to gauge their responsiveness in handling claims and how they assist customers during their policy period. Additionally, policy exclusions should not be overlooked; read the fine print to understand what is not covered under your plan. Taking these essentials into account when selecting your insurance can help you secure the protection you need without unnecessary costs or stress.

Insurance Myths Debunked: What You Really Need to Know Before Buying

When considering insurance, it's crucial to separate fact from fiction. One common myth is that insurance is always a waste of money. In reality, purchasing the right policy can provide invaluable financial protection in times of need. Whether it's health, auto, or homeowner's insurance, having coverage can save you from significant out-of-pocket expenses. Debunking this myth can help individuals understand that insurance is an investment in peace of mind, not just an additional monthly expense.

Another prevalent misconception is that insurance policies are all the same and that shopping around doesn't matter. In truth, insurance products vary widely in terms of coverage, deductibles, and premiums. Before buying, it's essential to research different options to find the best fit for your needs. Consider using a checklist to compare policies based on key factors such as coverage limits, exclusions, and customer service ratings.

How to Compare Insurance Policies: A Step-by-Step Guide to Finding the Perfect Fit

When it comes to comparing insurance policies, the first step is to identify your specific needs. Make a list of what you want to cover, whether it's auto, home, health, or life insurance. Prioritize your requirements and consider factors like your budget, coverage limits, and any specific conditions that might affect you. Once you have a clear set of criteria, you can start gathering quotes from different insurance providers to see how their offerings align with your needs.

Next, it's essential to compare the details of each policy. Look beyond the premium prices and analyze the coverage options, deductibles, and exclusions. Create a comparison chart to easily visualize the differences among the policies, focusing on factors that are most important to you. Don't forget to read customer reviews and claim settlement ratios of the insurers, as these insights can provide valuable context that goes a long way in helping you choose the perfect fit for your insurance needs.