News Blast: Your Daily Dose of Updates

Stay informed with the latest news and insights.

Is Pet Insurance Worth It or Just a Well-Fed Myth?

Discover the truth behind pet insurance: is it a lifesaver for your furry friend or just a clever myth? Uncover the facts now!

Debunking the Myths: Is Pet Insurance a Smart Investment?

When considering whether pet insurance is a smart investment, many pet owners fall prey to common misconceptions. One prevalent myth is that pet insurance is unnecessary if you can afford to pay for veterinary bills out-of-pocket. While having the funds to cover an emergency is a great advantage, unpredictable health issues can lead to exorbitant costs that might strain even the most prepared budgets. For instance, treatments for severe conditions like cancer or emergency surgeries can quickly escalate into thousands of dollars. Thus, opting for pet insurance can provide peace of mind, knowing that the financial burden of unexpected medical expenses is mitigated.

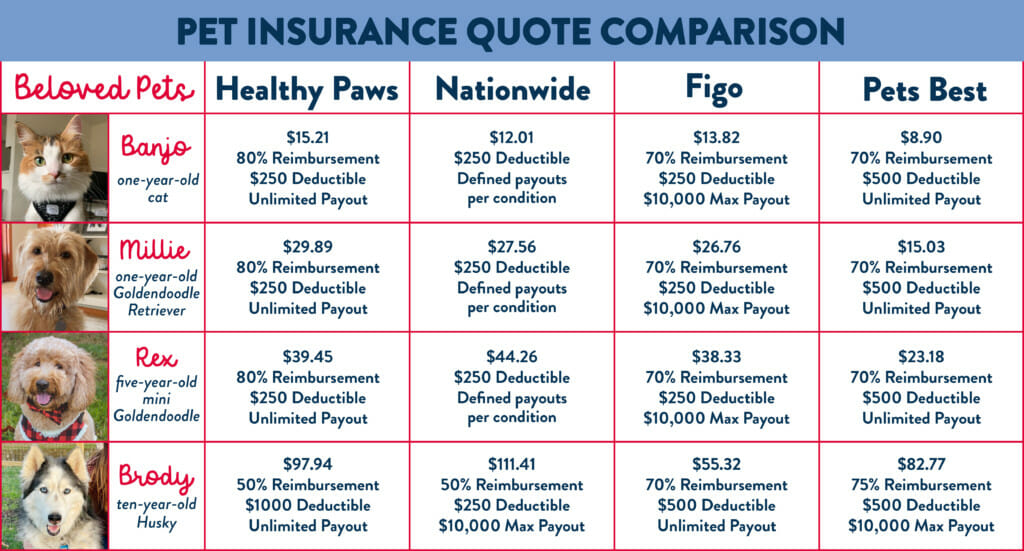

Another myth is that all pet insurance policies are the same or that they don’t cover anything significant. In reality, there is a wide range of policies with varying coverage options tailored to different needs and budgets. Many plans offer comprehensive coverage that includes not only accidents and illnesses but also routine care, behavioral therapy, and even prescription medications. It's crucial for pet owners to research and compare different offerings to find a plan that suits their pet’s unique health requirements. By doing so, they can make a more informed decision about whether pet insurance is truly a smart investment for their furry family member.

The True Cost of Pet Ownership: Is Insurance Worth It?

Owning a pet brings immense joy, but it also comes with financial responsibilities that can be surprising. From food and grooming to regular veterinary check-ups, the expenses can add up quickly. For instance, the average annual cost of pet ownership can reach $1,000 or more, depending on the type of pet and its specific needs. This figure doesn't even include unexpected emergencies that can lead to sudden, large vet bills. Therefore, many pet owners find themselves asking: Is pet insurance worth it?

Pet insurance can act as a financial safety net, helping to cover unexpected medical expenses and potentially saving pet owners thousands of dollars over time. Generally, pet insurance plans cover a range of services, including emergency care, surgeries, and even prescription medications. However, it's essential to consider the premium costs, deductibles, and coverage limits of different plans. Ultimately, determining whether pet insurance is worth it depends on various factors, including your pet's health, age, and lifestyle. Weighing the true cost of pet ownership against the peace of mind that insurance provides can help you make an informed decision.

Navigating Pet Insurance: Questions to Ask Before You Buy

Before purchasing pet insurance, it's crucial to ask yourself several key questions. Start with understanding what types of coverage are offered. Does the policy cover only accidents, or does it also include illnesses and routine care? Additionally, inquire about the exclusions. Some policies might not cover pre-existing conditions, behavioral issues, or specific breeds. Make sure you are fully aware of any limitations to avoid unexpected out-of-pocket expenses down the line.

Another important factor to consider is the policy's cost structure. Compare premium rates and check if there are deductibles, copayments, or maximum payout limits. Ask yourself whether you can afford the monthly payments while also considering potential out-of-pocket costs. Don't forget to read the fine print regarding claim submission and reimbursement timelines, as these can greatly affect your experience. Ultimately, taking the time to ask these critical questions will lead you to a more informed and satisfactory choice.