News Blast

Your daily source for breaking news and insightful articles.

Life Insurance: Because 'What If' Shouldn't Keep You Up at Night

Discover how life insurance can ease your worries about the future. Don’t let uncertainty keep you up at night—secure your peace of mind today!

Understanding the Basics of Life Insurance: Your Guide to Peace of Mind

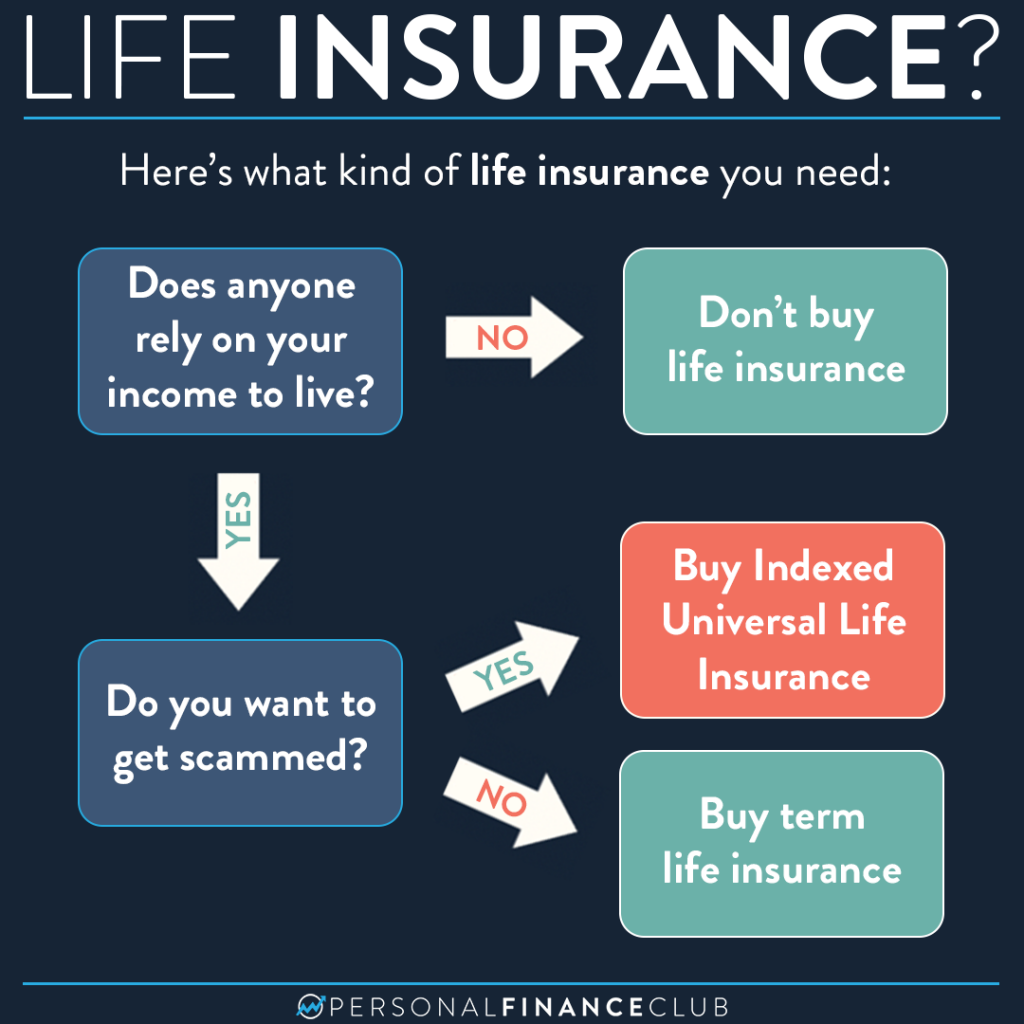

Life insurance is a crucial financial tool that provides peace of mind by ensuring the financial security of your loved ones in the event of your untimely passing. Understanding the basics of life insurance begins with knowing the two main types: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically 10, 20, or 30 years, while permanent life insurance provides lifelong coverage and includes a cash value component. Knowing these distinctions is essential to choosing the right policy for your needs.

When considering life insurance, it's imperative to assess your financial obligations and future needs. Here are some key factors to evaluate:

- Dependents: Consider who relies on your income.

- Debt: Account for loans or mortgages that would need to be paid off.

- Final expenses: Factor in costs related to funerals and other end-of-life expenses.

- Long-term goals: Think about funding education for children or other future plans.

By understanding these components, you can select a policy that not only safeguards your family’s future but also promotes your overall financial well-being.

Top 5 Reasons Why Life Insurance is a Smart Investment for Your Family

Life insurance is often overlooked, but it serves as a crucial safety net for your loved ones. One of the top reasons why life insurance is a smart investment for your family is the financial security it provides. In the unfortunate event of your passing, life insurance ensures that your family is not burdened with financial hardships. This includes covering essential expenses such as mortgage payments, daily living costs, and children's education. By investing in life insurance, you can ensure that your loved ones maintain their quality of life, even in your absence.

Another compelling reason to consider life insurance is its role in estate planning. Many families want to leave behind a legacy or ensure that debts are settled without putting strain on their heirs. Life insurance can help cover estate taxes and any outstanding debts, allowing your family to inherit your assets without the accompanying financial stress. Additionally, with various policies available, you can tailor the coverage to meet your family's unique needs. Overall, investing in life insurance is a proactive step towards safeguarding your family's future, making it a fundamentally wise choice.

What Happens When You Don’t Have Life Insurance? Exploring the Consequences

Life insurance serves as a financial safety net for your loved ones, providing them with the necessary support in the event of your untimely demise. Without it, the consequences can be dire. Family members may find themselves grappling with not only the emotional fallout of your loss but also significant financial burdens. From covering debts such as mortgages and car loans to managing everyday living expenses, the absence of life insurance can place immense strain on your loved ones. They could be left to make difficult decisions regarding their lifestyle and future, all while navigating their grief.

Furthermore, the lack of life insurance may force your family to rely on savings or go into debt to maintain their standard of living. Without a financial cushion, they could face the threat of foreclosure on their home, difficulty in funding education for children, or even having to make sacrifices on essential needs. This financial instability can ripple through generations, affecting not only the immediate family but also future descendants who may not be able to afford the life choices you envisioned for them. As such, the importance of securing life insurance cannot be understated—it is a proactive measure to safeguard the financial future of your loved ones.