News Blast: Your Daily Dose of Insight

Stay updated with the latest news and insightful articles.

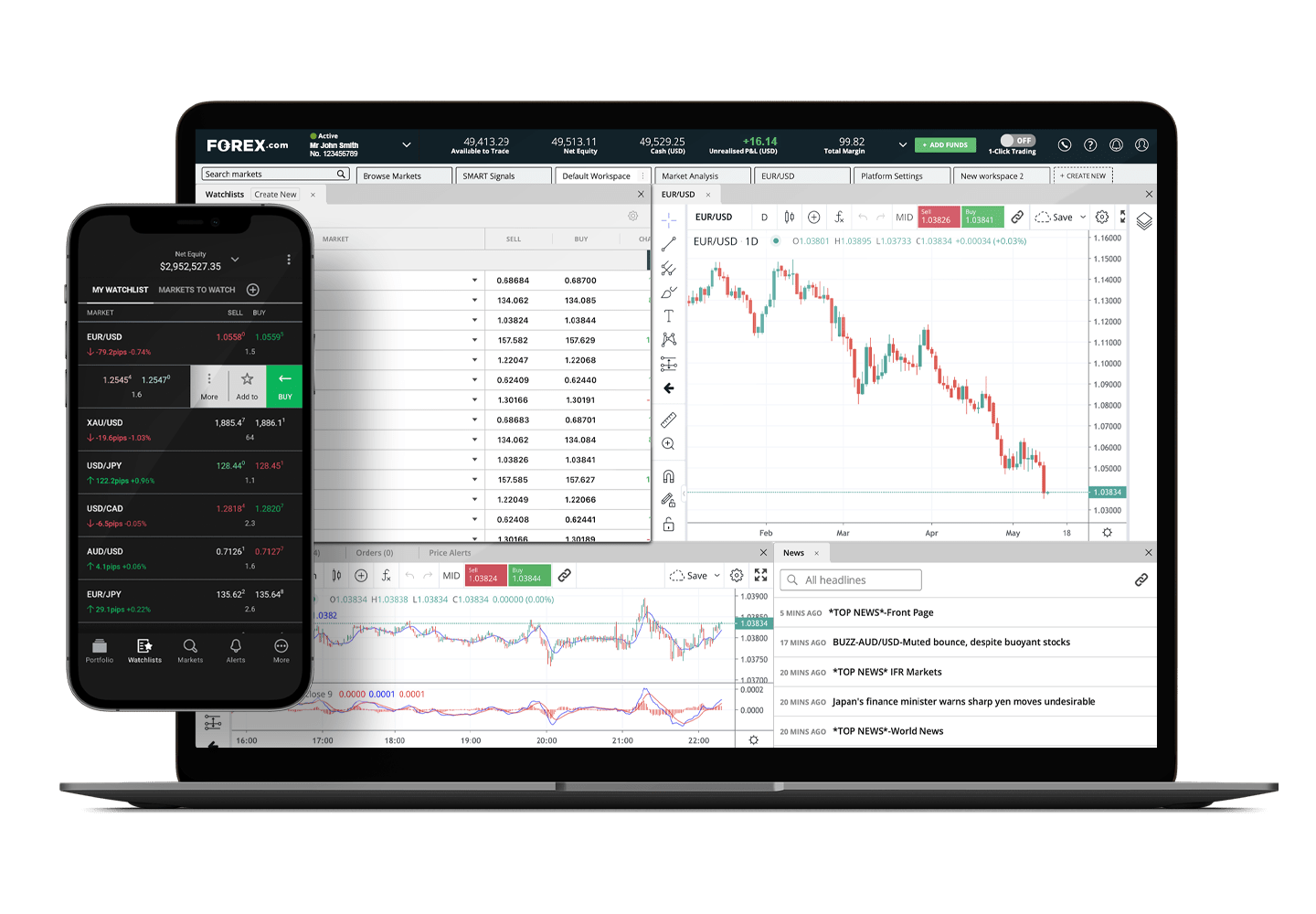

Pip Dreams: Chasing Currency Riches

Unlock the secrets to wealth! Dive into Pip Dreams and discover how to chase currency riches like a pro!

Understanding Pip Values: The Key to Currency Trading Success

In the world of currency trading, understanding pip values is crucial for traders aiming to maximize their success. A 'pip', or 'percentage in point', represents the smallest price movement in a currency pair and is typically measured as the fourth decimal place for most pairs, except for those involving the Japanese yen where it's the second decimal place. Mastering pip values allows traders to calculate their potential profits and losses with precision, thereby making more informed trading decisions and enhancing overall strategy.

For instance, if a trader buys the EUR/USD currency pair at 1.1200 and sells it at 1.1250, the price movement is 50 pips. Understanding this fluctuation is fundamental as it directly impacts your trading account. To effectively manage your risk, consider creating a pip value calculator so you can easily assess how much each pip is worth based on your trade size. This knowledge is not only key for maximizing profits but also essential for implementing effective risk management strategies in your trading endeavors.

Top Strategies for Maximizing Your Forex Gains

Maximizing your Forex gains requires a strategic approach that encompasses several key principles. Firstly, it's essential to establish a well-defined trading plan. This plan should include clear entry and exit points, risk management tactics, and profit targets. To optimize your outcomes, consider implementing a risk-reward ratio of at least 1:2, which ensures that for every unit of risk, you have the potential to gain two units. By adhering to this structure, traders can improve their chances of consistent profitability amidst the market's inherent volatility.

Moreover, keeping abreast of market trends and analyses is vital for leveraging new opportunities. Utilizing tools such as technical analysis can significantly enhance your decision-making process. Traders should also engage in fundamental analysis to understand economic indicators that may affect currency values. By staying informed and flexible, traders can adapt their strategies to align with shifting market dynamics, thereby positioning themselves for greater success and sustained gains in the Forex market.

Is Forex Trading Right for You? A Deep Dive into the Risk and Reward

Is Forex trading right for you? This question lies at the heart of the decisions that aspiring traders face. Forex, or foreign exchange trading, can be exhilarating, offering the potential for high returns in a short period. However, the risks are equally significant. Traders must navigate a complex landscape marked by volatility and unforeseen changes in market conditions. Before diving into Forex trading, it’s crucial to evaluate your financial goals, risk tolerance, and the time you can dedicate to developing crucial skills. Understanding whether you have the temperament to handle the emotional rollercoaster that comes with trading is vital.

When considering the risk and reward of Forex trading, remember that while the possibility of substantial profits exists, the potential for loss is omnipresent. Many successful traders emphasize the importance of a robust risk management strategy to safeguard their capital. Setting stop-loss orders, diversifying your trading portfolio, and continually educating yourself about market trends and economic indicators can significantly mitigate risks. Ultimately, the decision to engage in Forex trading should stem from a clear understanding of both the upside and downside, ensuring that you can navigate this high-stakes environment with greater confidence.