News Blast: Your Daily Dose of Information

Stay updated with the latest happenings across the globe.

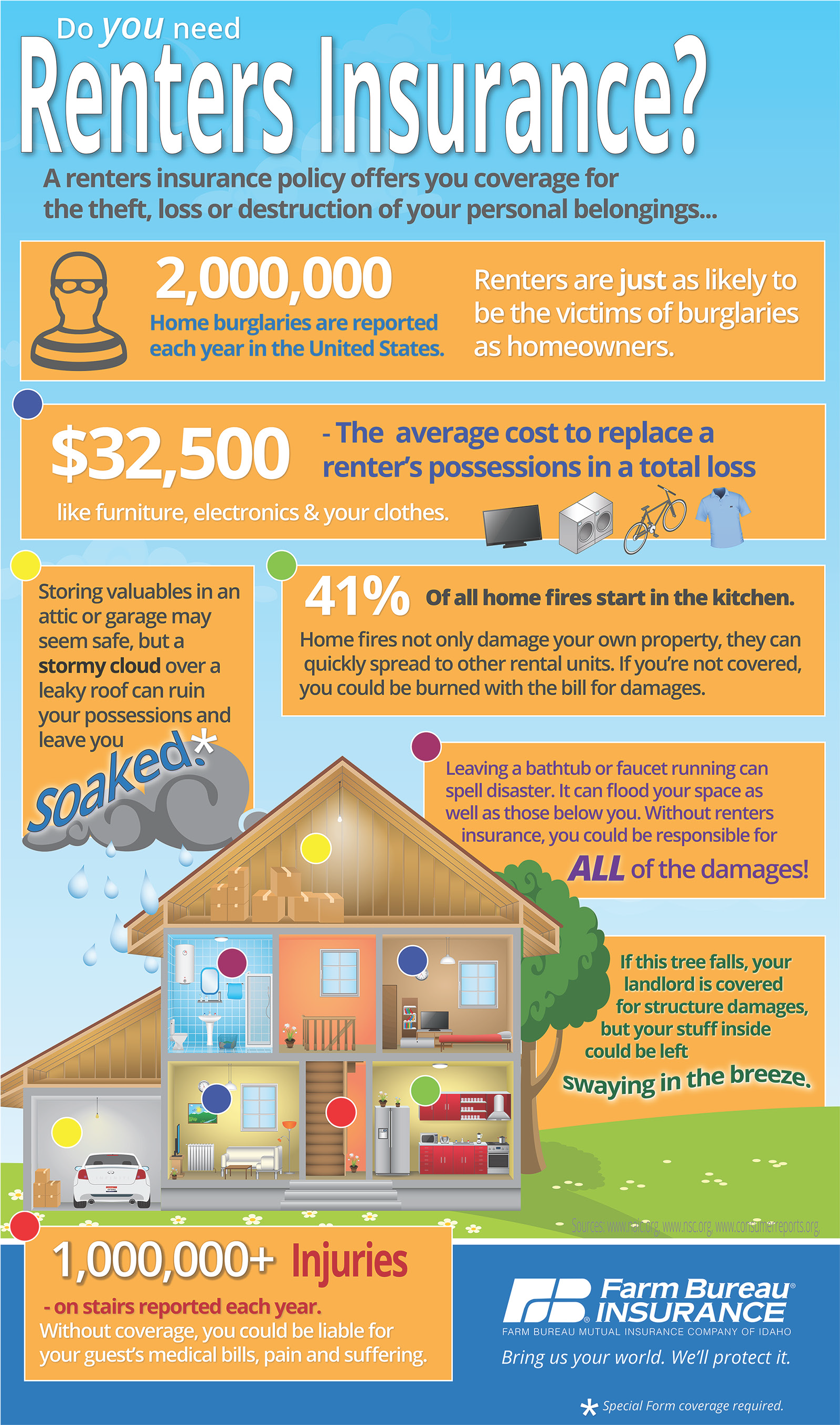

Renters Insurance: Because Your Last Apartment Stunt Shouldn't Cost You

Protect your belongings and your wallet! Discover why renters insurance is a must—because past apartment mishaps shouldn't break the bank.

What Does Renters Insurance Actually Cover?

Renters insurance is a vital policy that protects tenants from financial losses due to unexpected events. Generally, it covers personal property, liability, and additional living expenses. Personal property coverage, for instance, safeguards belongings like furniture, electronics, and clothing if they are damaged or stolen. This part of the policy can vary significantly, so it’s crucial for tenants to understand their coverage limits and the specific events (like fire, theft, or vandalism) that are included.

Beyond personal property, renters insurance typically includes liability coverage, which protects against legal claims for injury or property damage that you might accidentally cause to others. For example, if a guest is injured in your apartment, this coverage can help with legal fees and medical expenses. Additionally, many policies offer coverage for additional living expenses (ALE) if your rental becomes uninhabitable due to a covered loss. This means that your policy can help cover hotel or temporary housing costs while repairs are being made.

5 Reasons Why You Need Renters Insurance Before Moving In

Renters insurance is an essential safeguard for anyone moving into a new rental property. First and foremost, it provides financial protection for your personal belongings. Whether it’s a theft, fire, or natural disaster, having renters insurance ensures that you can recover the cost of your possessions without facing a significant financial burden.

Secondly, renters insurance can cover liability costs. In the unfortunate event that someone is injured in your rental home, having this insurance can protect you from hefty legal fees and medical expenses. Thirdly, most landlords require tenants to have renters insurance before moving in, making it a crucial part of your move-in checklist. Finally, obtaining renters insurance is typically affordable, providing peace of mind without breaking the bank. After all, it’s always better to be safe than sorry!

How to Choose the Right Renters Insurance for Your Needs

When it comes to choosing the right renters insurance, the first step is to assess your personal needs and the value of your belongings. Consider creating a detailed inventory of your possessions, listing out their estimated values. This can help you determine how much coverage you require. Look for a policy that offers a balance between affordable premiums and sufficient coverage. It's also wise to evaluate the specific risks associated with your area, such as natural disasters or theft, which might necessitate higher coverage limits.

Next, shop around and compare different renters insurance policies. Look for key features such as liability coverage, replacement cost vs. actual cash value, and any additional endorsements that may apply to your situation. Reading customer reviews and understanding the claims process are also crucial aspects of making an informed decision. By taking the time to research and assess your options, you can confidently choose a renters insurance policy that meets your needs and provides you with peace of mind.