News Blast Hub

Stay updated with the latest news and insights.

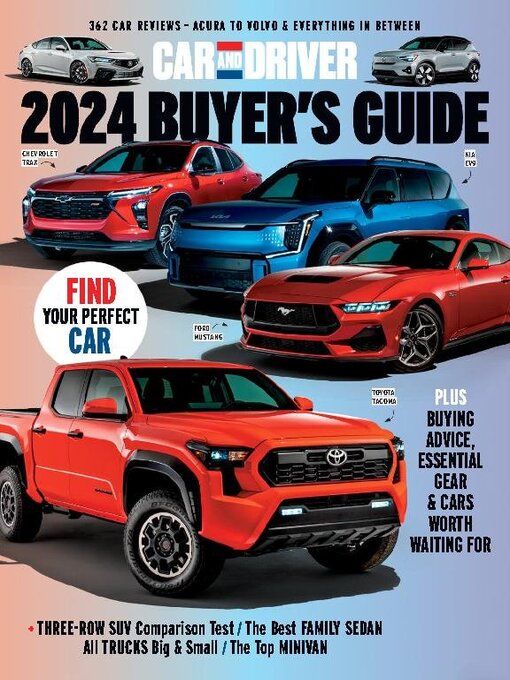

Rev Up Your Car Buying Skills

Master the art of car buying with expert tips! Unlock unbeatable deals and drive away with confidence today. Don't miss out!

Top 10 Tips for Negotiating Your Car Price Like a Pro

When it comes to negotiating your car price, preparation is key. Start by researching the market value of the vehicle you’re interested in, using resources like Kelley Blue Book or Edmunds to gauge a fair price. Create a list of comparable vehicles in your area to have solid evidence backing your offer. Additionally, consider the timing of your purchase; buying at the end of the month or towards the end of the year can put you in a stronger negotiating position, as dealers may be eager to meet sales quotas.

Once you're at the dealership, remember to maintain a confident demeanor throughout the negotiation process. Start the discussion by presenting your research and an initial offer that is lower than your target price. Be prepared to counter any objections with facts and remain patient, as negotiation often involves some back-and-forth. Utilizing strategies such as asking for additional perks or services—like free oil changes or extended warranties—can also be beneficial. Keep these top tips for negotiating your car price in mind to ensure you secure the best deal possible.

Understanding the True Cost of Car Ownership: What You Need to Know

Understanding the true cost of car ownership involves more than just the sticker price. While many potential car buyers focus solely on monthly payments or the initial purchase cost, it's essential to consider a range of additional expenses that accumulate over time.Insurance, fuel, maintenance, and depreciation are just a few factors that can significantly affect your overall budget. To give you a clearer picture, here are some typical costs to keep in mind:

- Insurance: Varies widely based on vehicle type, driving history, and coverage options.

- Fuel: Fluctuating gas prices and fuel efficiency impact overall expenses.

- Maintenance: Regular servicing, tire replacements, and unexpected repairs can add up.

- Depreciation: Your car’s value decreases over time, affecting its resale worth.

When assessing the true cost of car ownership, it's also crucial to factor in financing options and any innovations like roadside assistance plans that can bring peace of mind. You should take the time to perform a comprehensive assessment of all possible expenses and decide which budget aspects are more essential for your financial situation. Additionally, remember that the decision to own a car involves personal priorities; for some, the freedom and mobility a car provides may outweigh the financial implications. An informed choice will ultimately lead to greater satisfaction and financial stability.

Is Now the Right Time to Buy a Car? Factors to Consider Before You Decide

Deciding whether now is the right time to buy a car involves weighing several critical factors. First, consider the current car market conditions. With fluctuating interest rates and vehicle availability, it's essential to assess whether prices are likely to increase or decrease in the near future. Additionally, take into account any promotions or incentives offered by dealerships, as these can significantly impact your purchasing decision. Consulting automotive pricing trends and local dealership offers can provide valuable insights into the best time for your investment.

Another aspect to consider is your personal financial situation. Before committing to a purchase, evaluate your budget and determine how much you can afford without straining your finances. It's also advisable to check your credit score, as this will influence the financing options available to you. If you're considering trading in your current vehicle, research its current market value. Balancing market conditions and your financial readiness will help you decide if now is the right time to buy a car.