News Blast

Your daily source for the latest news and insights.

Term Life Insurance: Buy It, Just in Case Your Plans Go Awry

Discover why term life insurance is your safety net when life takes unexpected turns. Protect your loved ones today!

Understanding Term Life Insurance: Why It's Essential for Your Family's Security

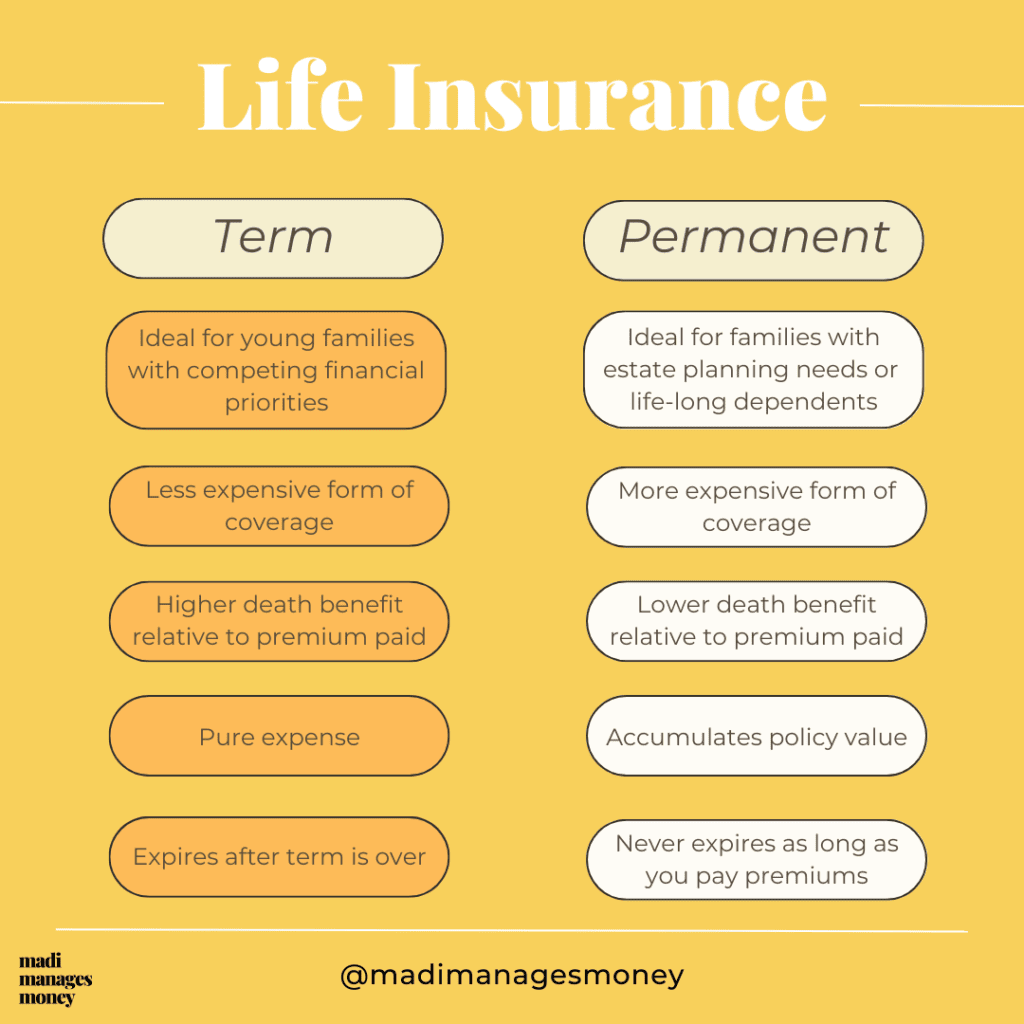

Understanding Term Life Insurance is crucial for ensuring your family's financial stability in the face of unexpected events. This type of insurance offers coverage for a specific period, typically ranging from 10 to 30 years, which makes it an affordable option for many. Parents with young children, in particular, can benefit from a term life policy as it secures the household's financial future during critical years. In the event of a policyholder's untimely passing, the beneficiaries receive a lump sum payment, allowing them to cover essential expenses such as mortgages, education, and daily living costs.

One of the greatest advantages of term life insurance is its simplicity and affordability compared to permanent life insurance options. With lower premiums, families can obtain substantial coverage without straining their budget. It's important to assess your family's needs and choose a policy that provides adequate coverage for your specific situation. As you evaluate different policies, consider factors such as the total amount of coverage needed, the length of the term, and how this decision impacts your family's security in the long run. Making informed choices about life insurance is a vital step in safeguarding your loved ones' financial future.

Top 5 Reasons to Consider Term Life Insurance Today

When it comes to protecting your loved ones financially, term life insurance stands out as a cost-effective and straightforward option. One of the top reasons to consider it today is its affordability; compared to whole life policies, term life insurance provides significant coverage at a fraction of the cost. This makes it accessible for young families or individuals looking to secure a financial safety net without breaking the bank. The ease of understanding and managing a term policy further adds to its appeal, allowing you to focus on life rather than financial worries.

Another compelling reason to explore term life insurance is the flexibility it offers. With various term lengths available, such as 10, 20, or even 30 years, you can tailor the policy to fit your specific needs and financial goals. This allows you to ensure that your loved ones are protected during critical life stages, such as raising children or paying off a mortgage. Additionally, many policies offer the option to convert to permanent insurance in the future, giving you peace of mind as your circumstances evolve.

What Happens to Your Loved Ones Without Term Life Insurance?

Without term life insurance, your loved ones may face significant financial hardships in the event of your untimely passing. The absence of a safety net can lead to overwhelming expenses including mortgage payments, education costs, and everyday living expenses. In fact, a sudden loss can result in your family struggling to maintain their current lifestyle, leading them to make tough decisions regarding their future.

Moreover, the emotional burden of losing a loved one is often compounded by financial strain. Term life insurance can provide a necessary cushion that allows your family to mourn without the added stress of mounting bills. Failure to secure this protection can result in your loved ones facing debt or even losing their home. In essence, having a term life policy is not just about financial support; it's about ensuring peace of mind for your family during their most vulnerable moments.