News Blast

Your daily dose of trending news and updates.

Term Life Insurance: Because Life is Unpredictable

Protect your loved ones with term life insurance—your safety net for life's surprises. Discover how to secure their future today!

Understanding Term Life Insurance: Key Features and Benefits

Term life insurance is a straightforward and affordable option for individuals seeking financial security for their loved ones. This type of policy provides coverage for a specified period, typically ranging from 10 to 30 years. If the insured person passes away during this term, the policy pays out a death benefit to the beneficiaries, ensuring that they are financially supported during a challenging time. Unlike whole life insurance, which builds cash value over time, term life insurance focuses solely on providing financial protection, making it an ideal choice for those who need short-term coverage or are on a limited budget.

Some key features and benefits of term life insurance include its low cost compared to permanent policies, flexible term lengths, and straightforward application process. Additionally, many policies offer options to convert to a permanent policy or renew the coverage at the end of the term. This flexibility allows policyholders to adjust their coverage as their financial needs evolve. Ultimately, term life insurance serves as a valuable tool for individuals looking to safeguard their family’s financial future without the higher premiums associated with lifelong coverage.

How Much Term Life Insurance Do You Really Need?

Determining how much term life insurance you really need involves careful consideration of various factors, including your financial obligations, dependents, and long-term goals. Start by evaluating your current debts, such as mortgages, student loans, and credit card balances, as these will need to be settled in the event of your passing. Additionally, consider the income your family relies on; a common rule of thumb is to have insurance coverage that is 10 to 15 times your annual salary. This way, you can ensure that your loved ones maintain their quality of life and have adequate funds for future expenses like education and retirement.

Another important aspect to consider when calculating how much term life insurance you need is the duration of coverage. Typically, term life insurance is available in lengths of 10, 20, or 30 years. Choosing the right term is crucial; it should ideally align with your financial responsibilities, such as the duration until your children become financially independent or until your mortgage is paid off. Additionally, regularly reassess your life insurance needs as your financial situation evolves due to factors like promotions, family changes, or increased living expenses. By staying proactive, you can ensure that your term life insurance policy adequately reflects your current needs.

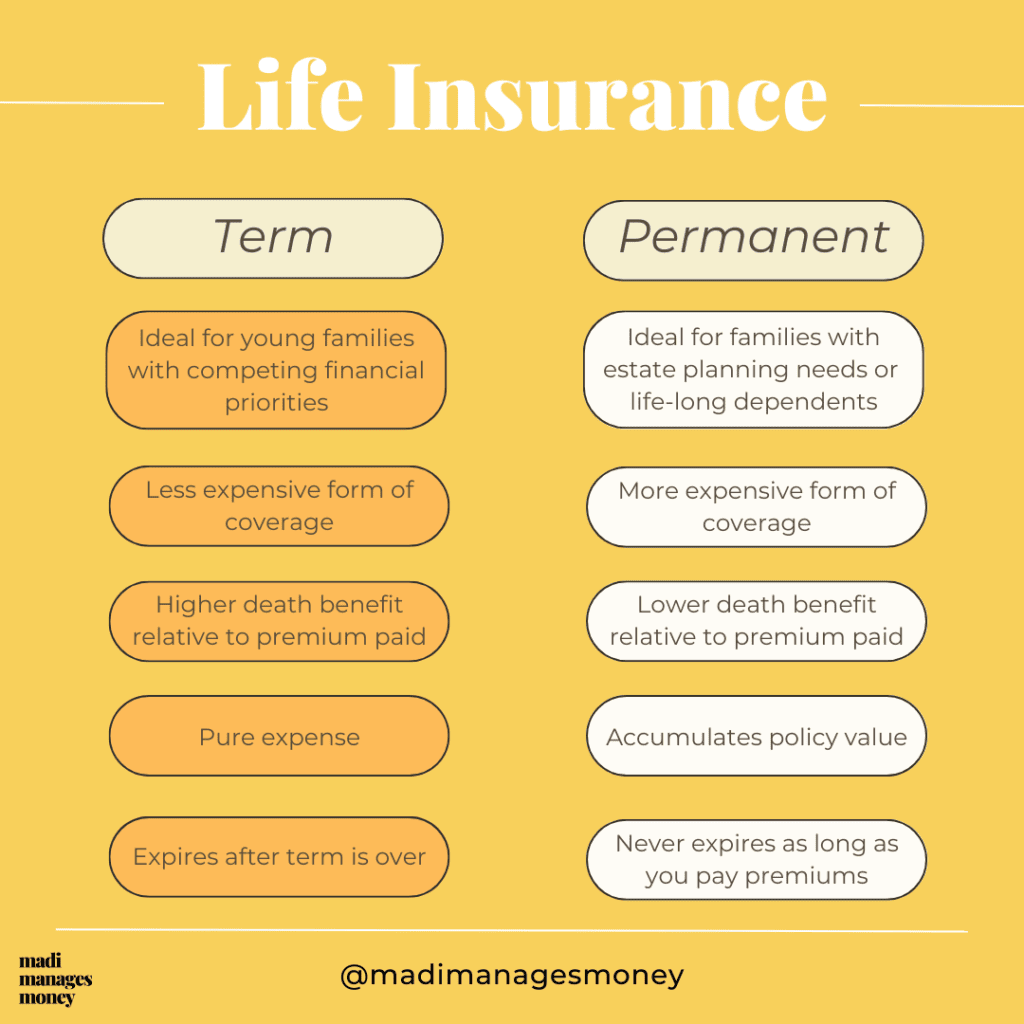

Term Life Insurance vs. Whole Life Insurance: Which is Right for You?

Term life insurance and whole life insurance are two popular types of life insurance policies, each catering to different financial needs and goals. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an affordable option for those seeking temporary financial protection. This type of insurance guarantees a death benefit to the beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance offers lifelong coverage, combining both a death benefit and a cash value component that grows over time, providing policyholders with a savings element in addition to life insurance.

When deciding between term life and whole life insurance, consider factors such as your budget, financial objectives, and the needs of your dependents. If affordable premiums and temporary coverage align with your goals, then term life insurance may be the best choice. Conversely, if you are looking for a permanent solution that includes a cash value accumulation feature, you might lean towards whole life insurance. Ultimately, understanding the differences between these two types of policies is crucial in making an informed decision that best suits your financial landscape.