News Blast: Your Daily Update

Stay informed with the latest news and trends.

When Life Throws You a Curveball, Is Your Income Protected?

Discover how to safeguard your income when life surprises you. Don't let curveballs catch you off guard—learn to protect your financial future now!

How to Safeguard Your Income When Life Takes an Unexpected Turn

Life is full of unpredictable events, and they can significantly impact your financial stability. To , start by building an emergency fund that can cover three to six months' worth of expenses. This financial cushion will offer you peace of mind during turbulent times and allow you to navigate unexpected situations without sacrificing your essential needs. Furthermore, consider diversifying your income streams; this could involve taking on freelance work, investing in rental properties, or finding passive income opportunities that can help supplement your earnings, even when your primary source of income is at risk.

Additionally, it’s essential to regularly review your financial plan and set realistic goals. Establishing a budget that aligns with your income allows you to track your spending and save effectively. As you refine your financial habits, utilize tools and apps that can help you monitor your progress and adapt to changes in your situation. Remember, the key to safeguarding your income is being proactive rather than reactive. Keep your skills sharp and stay informed about market trends, as this can increase your employability and keep your earning potential intact, even when faced with challenges.

The Importance of Income Protection: What You Need to Know

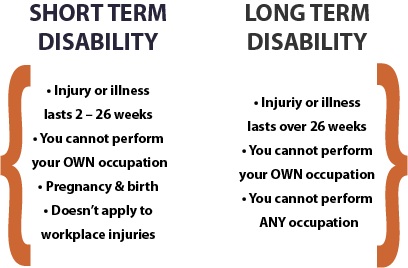

Income protection is a vital component of financial planning that often goes overlooked. It provides a safety net for individuals who may face unforeseen circumstances like illness or injury that could render them unable to work. Without income protection, you risk facing significant financial strain during difficult times, as your regular paycheck could disappear overnight. Consequently, investing in this type of insurance can mean the difference between maintaining your current lifestyle or spiraling into debt when faced with an unexpected event.

Understanding income protection is crucial for anyone who relies on their salary to cover living expenses. Policies can vary significantly, so it's essential to choose one that aligns with your unique financial situation and needs. Here are a few key considerations to keep in mind when evaluating your options:

- Determine the percentage of your income you want to be covered.

- Assess the waiting period before benefits kick in.

- Understand the duration of the payout period.

Being well-informed allows you to make choices that protect not only your income but also your future financial stability.

Are You Prepared for Life's Surprises? Tips for Protecting Your Financial Future

Life is full of unexpected twists and turns, making financial preparedness more critical than ever. From sudden medical emergencies to unexpected job losses, unforeseen events can disrupt your financial stability in an instant. To safeguard your financial future, it's essential to develop a robust plan that includes emergency savings and comprehensive insurance coverage. Start by setting aside a portion of your income each month into a dedicated emergency fund. Aim for three to six months' worth of living expenses to cushion you during tough times.

In addition to saving, consider diversifying your investments to create a more resilient financial portfolio. This could include a mix of stocks, bonds, and other assets that can withstand market fluctuations. It's also wise to regularly review and adjust your financial plan in light of life's surprises. Keep in mind the following tips:

- Establish an emergency fund.

- Invest in comprehensive insurance policies.

- Diversify your investment portfolio.

- Review your financial plan annually.

By taking these proactive steps, you can enhance your financial security and better navigate whatever life throws your way.