News Blast: Your Daily Update

Stay informed with the latest news and trends.

Whole Life Insurance: The Policy That Never Sleeps

Unlock financial peace with Whole Life Insurance – a policy that protects you today and forever! Discover why it’s the ultimate safety net!

Understanding Whole Life Insurance: How It Works and Its Benefits

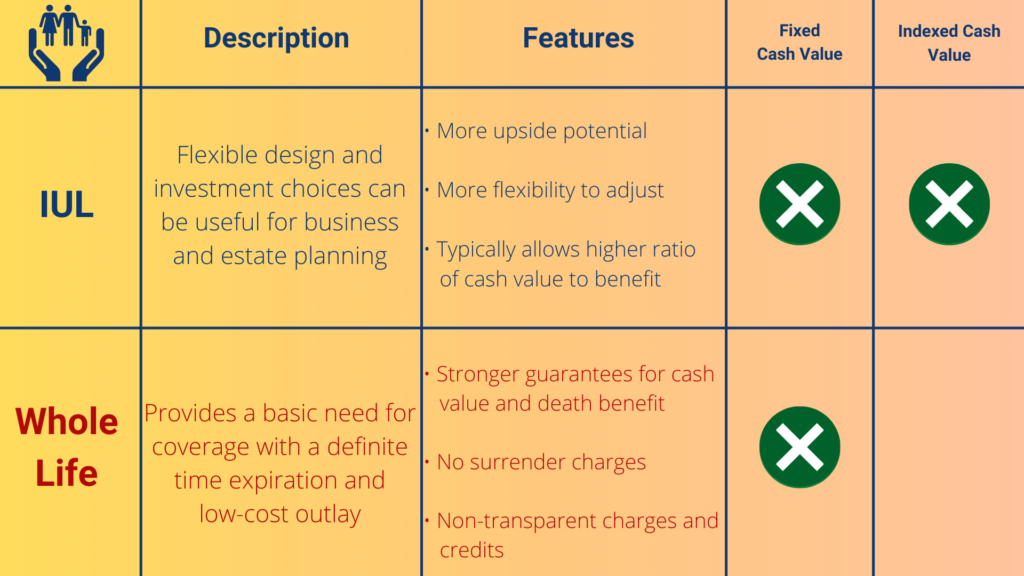

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. Unlike term life insurance, which only offers coverage for a specified period, whole life insurance accumulates cash value over time. This cash value grows at a guaranteed rate and can be borrowed against, offering policyholders financial flexibility. To understand how whole life insurance works, it's important to recognize its dual components: the death benefit and the cash value accumulation. The death benefit is the amount paid to beneficiaries upon the insured's passing, while the cash value component allows individuals to build wealth that can be accessed during their lifetime.

The benefits of whole life insurance are numerous, making it an appealing option for those seeking long-term financial security. First and foremost, it provides lifelong coverage, ensuring that your loved ones are protected no matter when you pass away. Additionally, the tax-deferred growth of the cash value can serve as a valuable financial resource, providing funds for emergencies, retirement, or other significant expenses. Moreover, whole life insurance policies often come with a guaranteed minimum return on the cash value, offering a stable investment option in an unpredictable market. Overall, whole life insurance not only serves as protection for your family but also functions as a strategic financial tool in your overall estate planning.

Is Whole Life Insurance Right for You? Key Factors to Consider

When considering whole life insurance, it's essential to first assess your financial goals and circumstances. This type of insurance not only provides a death benefit but also accumulates a cash value over time. Ask yourself these key questions:

- What are your long-term financial objectives?

- Do you have dependents who rely on your income?

- Are you prepared for the higher premiums associated with whole life policies?

Another crucial factor to contemplate is your overall health and age. Whole life insurance is generally more beneficial for younger individuals in good health, as premiums are lower and the cash value has more time to grow. Additionally, consider your investment strategy; if you're looking for growth and security, whole life could be a solid choice. However, if your primary focus is on maximizing returns and you're comfortable with risk, a term policy or other investment vehicles might suit you better.

The Lifelong Security of Whole Life Insurance: What You Need to Know

Whole life insurance offers a unique advantage in the realm of financial planning: it provides lifelong security. Unlike term life insurance, which only covers you for a specified period, whole life policies remain in force as long as premiums are paid. This guarantees that your loved ones will be financially protected, no matter when the policyholder passes away. Additionally, whole life insurance accumulates cash value over time, making it not only a safety net but also a potential source of savings and investment. This dual benefit enhances the appeal of whole life insurance as a stable financial product.

When considering whole life insurance, it's essential to recognize its benefits and costs. First, the premiums are typically higher than those of term policies, reflecting the coverage duration and cash value accumulation. However, this investment can translate into significant long-term benefits. Here's what you need to know:

- The cash value grows at a guaranteed rate.

- Policyholders may borrow against the cash value or withdraw it, providing liquidity if needed.

- Whole life insurance can positively influence your estate planning strategies.