News Blast

Your daily source for the latest news and insights.

Why Cyber Liability Insurance is the New Must-Have Accessory

Discover why cyber liability insurance is the hottest trend for businesses today. Protect your brand and assets—don't be left unprotected!

The Rising Importance of Cyber Liability Insurance: What You Need to Know

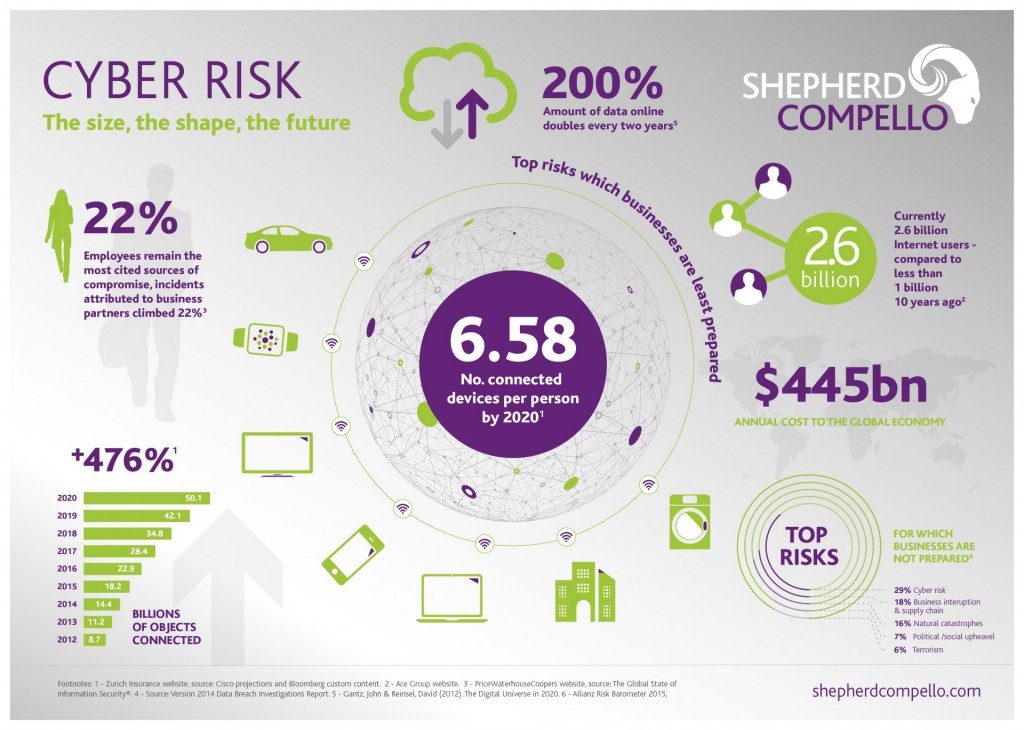

The digital landscape is evolving rapidly, and with it comes an increase in cyber threats capable of compromising sensitive information. Cyber liability insurance has emerged as a crucial safeguard for businesses, offering coverage against data breaches, network failures, and other cyber-related incidents. As companies rely more on technology and online operations, the potential financial repercussions of a cyberattack can be devastating. Hence, understanding the importance of this insurance is no longer optional but a fundamental aspect of modern business risk management.

In today's interconnected world, the implications of a cyber incident extend beyond immediate financial losses. With legal repercussions and damage to reputation at stake, having robust cyber liability insurance can provide peace of mind and financial protection during challenging times. Key aspects to consider when evaluating a policy include coverage limits, type of incidents covered, and any exclusions that may apply. Businesses of all sizes, from startups to multinational corporations, must prioritize this insurance to mitigate risks and ensure resilience in the face of growing cyber threats.

Is Your Business Actually Protected? Exploring the Benefits of Cyber Liability Insurance

In today's digital age, the question Is Your Business Actually Protected? is more pertinent than ever. With cyber threats becoming increasingly sophisticated, businesses of all sizes are vulnerable to data breaches and cyberattacks. Cyber liability insurance serves as a crucial safety net, providing coverage for various incidents including data breaches, business interruption, and even legal fees. It not only helps mitigate financial losses but also aids in managing the reputational damage that could arise from such incidents, ensuring that businesses can recover more swiftly.

Investing in cyber liability insurance offers numerous benefits that are essential for any modern business. These include:

- Financial Protection: It helps cover the costs associated with a data breach, including notification expenses and credit monitoring for affected customers.

- Legal Support: In the event of a lawsuit due to a data breach, this insurance can provide legal defense coverage, thus protecting your bottom line.

- Peace of Mind: Knowing that your business is protected from unexpected cyber incidents allows you to focus on growth and innovation, rather than worrying about potential losses.

Why Cyber Liability Insurance is Essential for Today's Digital Landscape

In today's rapidly evolving digital landscape, the necessity of Cyber Liability Insurance has never been more apparent. As businesses increasingly rely on technology to operate, they also expose themselves to a myriad of cyber risks, including data breaches, ransomware attacks, and identity theft. According to various studies, over 60% of small businesses experience a cyber attack each year, highlighting the urgent need for robust protective measures. Without adequate insurance coverage, organizations can face crippling financial losses, legal penalties, and a damaged reputation that can take years to rebuild.

Moreover, Cyber Liability Insurance not only provides financial protection but also offers businesses a support system in navigating the complex aftermath of a cyber incident. With coverage typically encompassing costs related to data recovery, legal fees, and public relations efforts, companies are better equipped to handle the fallout of a breach. In a world where data is considered the new currency, investing in cyber liability coverage is essential for maintaining consumer trust and ensuring long-term viability in the digital market.