News Blast

Your daily source for the latest news and insights.

Why Life Insurance is Like a Safety Net for Your Dreams

Discover how life insurance protects your dreams and secures your future. Explore the ultimate safety net for a worry-free life!

How Life Insurance Protects Your Aspirations and Goals

Life insurance is not just a financial product; it serves as a crucial safety net that enhances your peace of mind while pursuing your aspirations and goals. Whether dreaming of a new home, a child’s education, or a comfortable retirement, life insurance ensures that the financial burden does not derail these ambitions. In the event of an unforeseen tragedy, the coverage provides essential financial support, allowing your loved ones to continue their journey without the added stress of financial instability.

Moreover, life insurance can also act as a strategic tool for wealth accumulation and legacy planning. With policies like whole life or universal life, you can build cash value over time, which can be borrowed against for significant life events, such as starting a business or funding higher education. By securing adequate life insurance, you are not only protecting your current goals but also planting the seeds for future aspirations, ensuring your dreams live on even in challenging times.

Exploring the Safety Net: Why Life Insurance is Essential for Your Future

Exploring the Safety Net: Life insurance is a cornerstone of financial security, providing a vital safety net for individuals and their families. In an unpredictable world, having a comprehensive life insurance policy ensures that your loved ones are protected from financial burdens in the event of an untimely death. This essential coverage helps cover expenses such as funeral costs, outstanding debts, and even future living expenses, which can alleviate the stress during difficult times. Without this safety net, families may face overwhelming challenges that could compromise their financial stability.

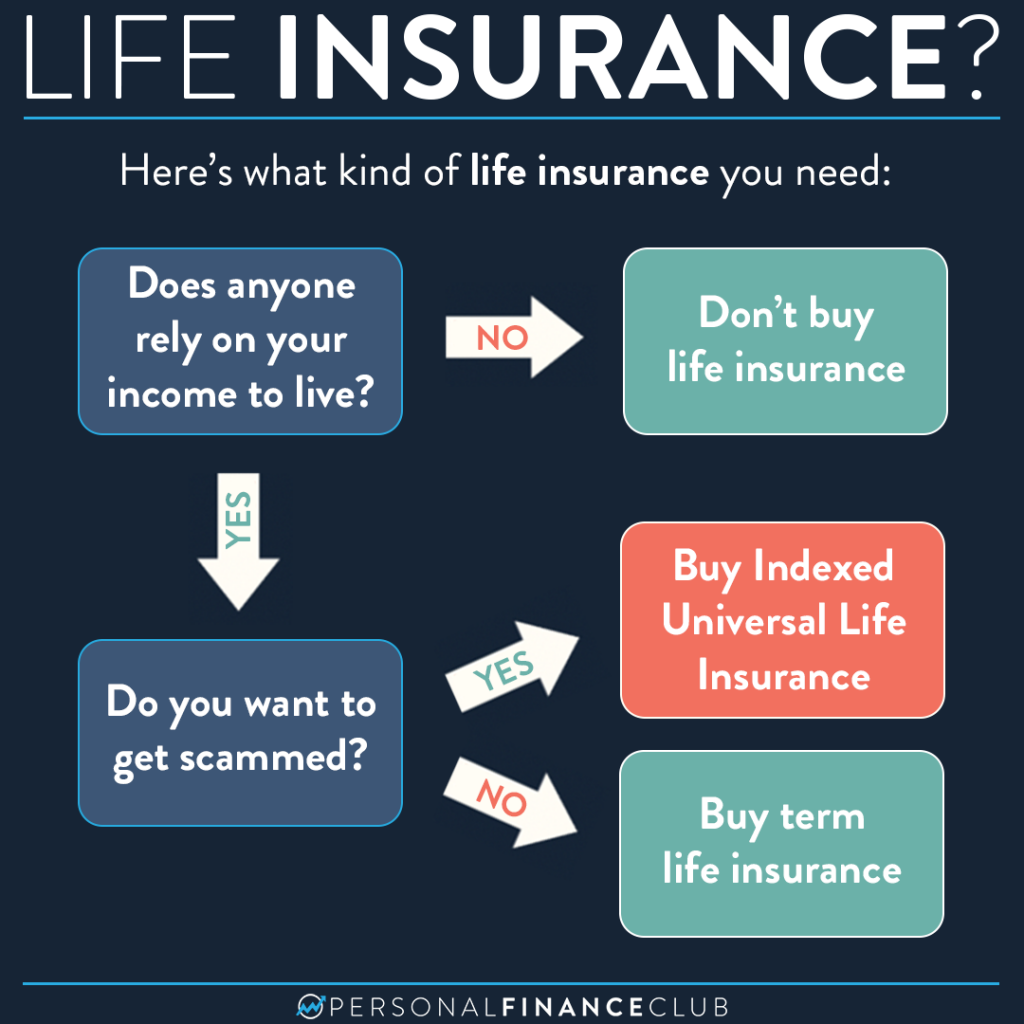

Moreover, investing in life insurance can also serve as a strategic part of your financial planning. It not only offers a sense of security but can also complement retirement planning and serve as a tax-efficient asset for your beneficiaries. Many modern policies provide flexible options that cater to various needs, like whole life insurance or term life insurance. Ultimately, the peace of mind gained from knowing your family will be financially secure cannot be overstated, making life insurance an essential component of a well-rounded financial strategy.

Is Life Insurance the Key to Safeguarding Your Dreams?

When it comes to ensuring the future of your loved ones and safeguarding the dreams you've built together, life insurance serves as a critical pillar of financial planning. It not only provides peace of mind but also acts as a safety net that protects against unforeseen circumstances. Consider the event of a sudden loss; without a solid financial foundation, your family could face overwhelming challenges. With a suitable life insurance policy, you can ensure that your dreams for their education, home ownership, and overall quality of life remain intact, even in your absence.

Moreover, life insurance is not just about providing for your family; it can also serve as a strategic component of wealth management. Many insurance policies come with savings or investment components, allowing you to build cash value over time. This dual benefit means that by securing a life insurance policy, you are actively working towards fulfilling both your immediate goals and long-term aspirations. Whether it’s funding a child’s college education or creating a legacy that continues beyond your lifetime, life insurance can be the key to turning these dreams into reality.