News Blast: Your Daily Update

Stay informed with the latest news and trends.

Why Term Life Insurance is Like a Safety Net for Your Loved Ones

Discover how term life insurance acts as a vital safety net, securing your loved ones' future when they need it most!

Understanding the Benefits of Term Life Insurance for Family Security

Term life insurance is a critical financial tool that provides families with peace of mind and security in the face of unexpected events. By purchasing a term life insurance policy, you ensure your loved ones are financially protected during your absence. This type of insurance offers a death benefit to your beneficiaries if the policyholder passes away within the specified term, typically ranging from 10 to 30 years. The affordability of term life premiums makes it an attractive option for young families seeking to secure their financial future without breaking the bank.

Moreover, term life insurance can serve as a strategic component of a comprehensive financial plan. Families can use the payout from a policy to cover essential expenses such as mortgage payments, education costs, or everyday living expenses in the event of a tragedy. This financial support can help loved ones maintain their quality of life and focus on healing rather than worrying about finances. Additionally, many term policies offer options to convert to permanent life insurance, allowing families to adapt their coverage as their needs evolve over time.

How Term Life Insurance Acts as a Financial Safety Net: A Complete Guide

Term life insurance serves as a crucial financial safety net for families and dependents, ensuring that they remain financially secure in the event of an untimely death of the insured. This type of policy typically provides coverage for a specified term, usually ranging from 10 to 30 years, during which premium payments are made. If the policyholder passes away within this period, the designated beneficiaries receive a death benefit that can be used to cover everyday expenses, debts, or future financial needs like education for children. By securing term life insurance, individuals can have peace of mind, knowing that their loved ones are protected from financial burdens.

In addition to providing a death benefit, term life insurance can also play a strategic role in long-term financial planning. Many financial experts recommend using the coverage to replace lost income, ensuring that families can maintain their standard of living. Moreover, since term policies are generally more affordable than permanent life insurance, policyholders can allocate their savings towards investments or other financial goals. It's essential to evaluate your individual needs and circumstances to determine the appropriate term length and coverage amount, allowing you to create a robust financial plan backed by the protective shield of term life insurance.

Is Term Life Insurance Worth It? Answers to Your Most Pressing Questions

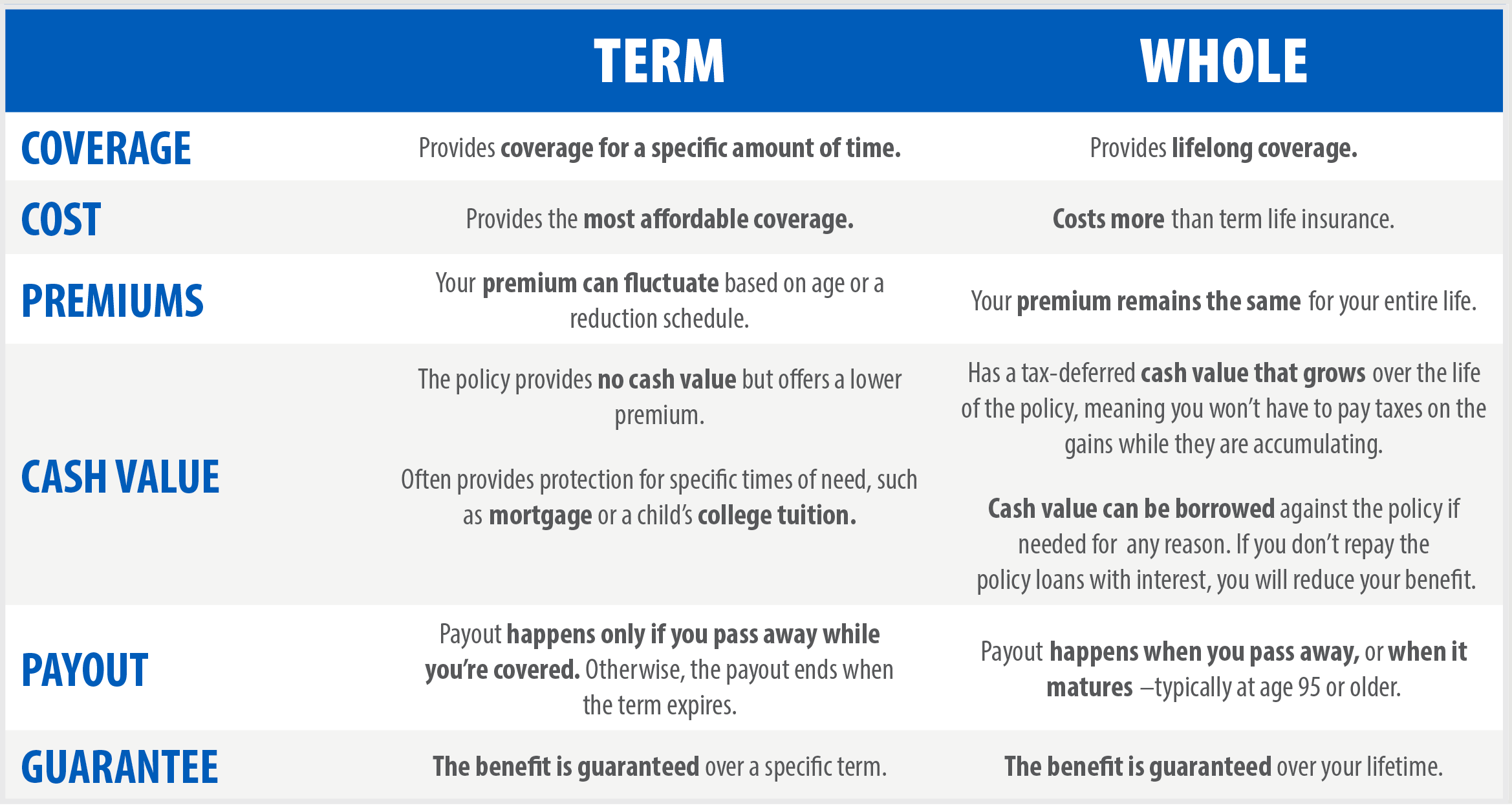

When considering term life insurance, many individuals find themselves grappling with the question: Is it really worth the investment? Term life insurance provides a death benefit to your beneficiaries if you pass away within a specified term, typically ranging from 10 to 30 years. This type of policy is generally more affordable than whole life insurance, making it an attractive option for those seeking financial security for their loved ones without breaking the bank. Term life insurance can be particularly valuable for young families with dependents, as it ensures that their financial needs are met in the event of an untimely death.

However, it's essential to consider various factors before deciding if term life insurance is the right choice for you. Here are some key questions to ask yourself:

- Do you have dependents who rely on your income?

- What are your long-term financial goals?

- Do you have existing savings or investments that could support your family?